Happy Fourth of July lads. As much of a shitposter as I can be I want you to know I do love this country and so does Elder Raul. He came here when he was twelve with the suit on his back to live with his older sister and he hustled his butt off and now he takes it easy on some remote patch of sand up north in the woods. My clan has accumulated more resources in our 50 years in this country than many americans have done in 100s of years. This would not be possible in any other country and I just want to say thanks.

I have been working so dang good hard since February and at times it has made me a real surly some-bitch. Thank you for bearing with me in this challenging times.

A few more weeks of moving rocks and sanding walls and it looks like I will be able to breathe again. Go back to swimming and pumping iron and taking lots of naps. Again. This country is great.

Once a man liberates himself from the many traps set up by insurance companies, mortgage companies, employers, debt and other webs of insanity spun up by corporate goons this country is a real gem. Vagabonding around and accumulating wealth and resources and in-general doing whatever the heck you want….as long as you don’t want to trade leverage in crypto.

Nope can’t do that…

One of the greatest american pastimes is finding ways to break its laws. Tom Brady managed to buy FTT tokens which speaks volumes to how wonderful america is.

So have an appled pie. Blow off some explosives and gobble down lots of fire roasted animal flesh. Warsh it all down with some cheap swill from Anhisur bush and listen to some Lana Del Rey.

Happy fourth from your dear pal RAUL.

Raul Santos, July 4th 2021

And now the 345th edition of Strategy Session. Enjoy:

Stocklabs Strategy Session: 07/05/21 – 07/09/21

I. Executive Summary

Raul’s bias score 3.63, medium bull*. Strong rally throughout holiday-shortened week. Watch for FOMC minutes Wednesday afternoon to accelerate price action.

U.S. markets will be closed Monday, July 5th in observation of Independence Day

II. RECAP OF THE ACTION

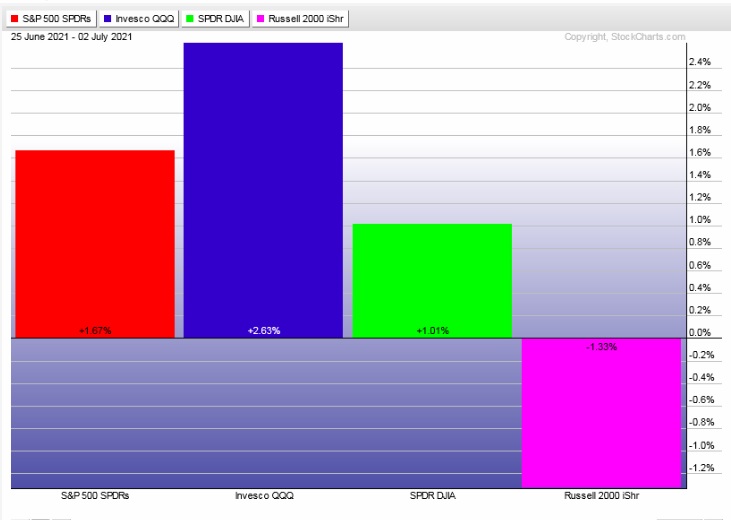

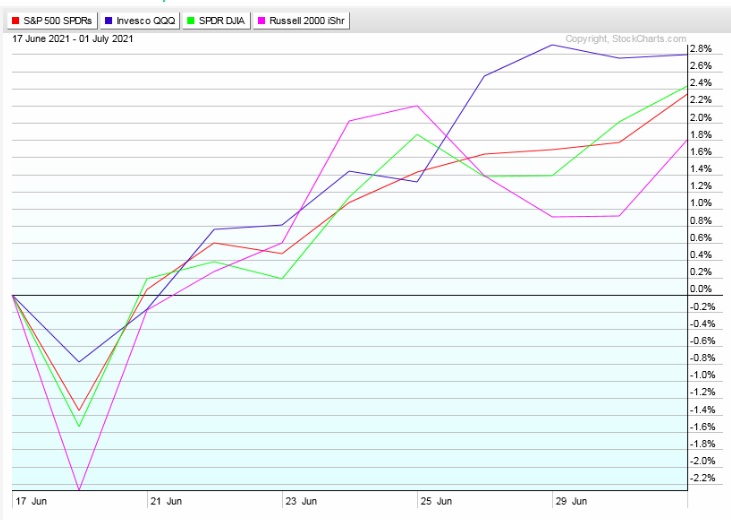

Strong buyers early Monday squeezed prices higher, then we drifted for much of the week before accenting with a rally Friday. All week the Russell 2000 lagged.

The last week performance of each major index is shown below:

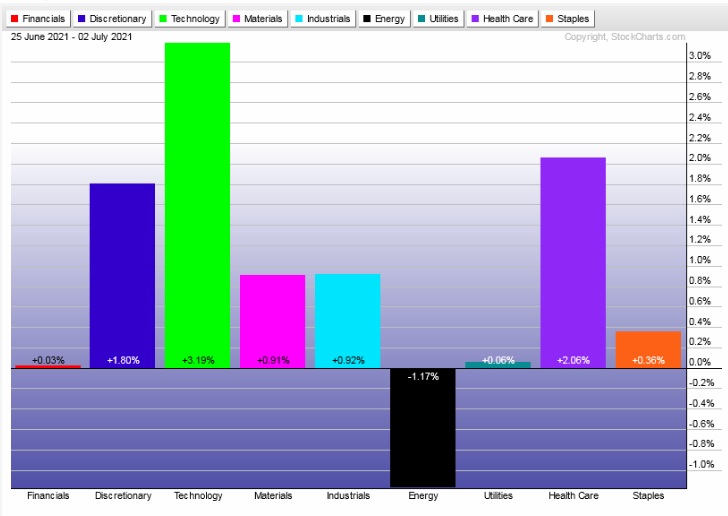

Rotational Report:

Tech leading the way. Flanked by discretionary and Health care.

bullish

For the week, the performance of each sector can be seen below:

Concentrated Money Flows:

Money flows skewed slightly bearish and the median return was negative on the week. This speaks to the nature of last week’s rally, with most of the upward action being contained to the best-of-the-best stocks like Apple and Alphabet.

It turns out volume delta is a useless data point for the Weekly Strategy Session. It is comparing the one day reading (in our analysis always Friday) with the average of the last 30 days. This is why it is pinned negative on this report, because Friday is lower volume than all the other days of the week.

I have requested a volume delta which compares the weekly volume to the average of the last 30 weeks. That would likely tell a story over time that would make our understanding of money flows much more valuable and actionable. Whether that data is available, we don’t know.

I looked through the entire list of data points available on the industries page and none of them are able to add value to the Weekly Strategy Session.

That said, partitioning the 1-week return the way we do still provides valuable insight. Whether we gain more relevant data is up to the Stocklabs development team.

Money flows are slightly bearish.

Here are this week’s results:

III. Stocklabs ACADEMY

Focus on executing the 6-month oversold signal

The 6-month oversold algo is proving to be a solid indicator to trade from. Consistent execution of this algo during 2021 has generated a solid return. It has been one of the only signals we’re seeing. I will be adding it to my toolkit going forward.

Note: The next two sections are auction theory.

What is The Market Trying To Do?

Week ended searching for sellers

IV. THE WEEK AHEAD

What is The Market Likely To Do from Here?

Weekly forecast:

Strong rally throughout holiday-shortened week. Watch for FOMC minutes Wednesday afternoon to accelerate price action.

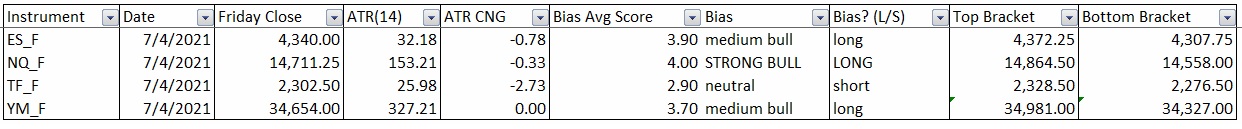

Bias Book:

Here are the bias trades and price levels for this week:

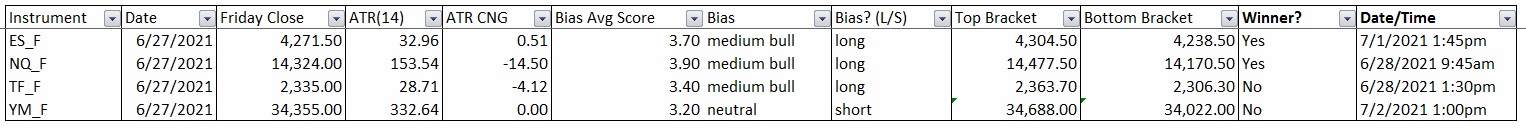

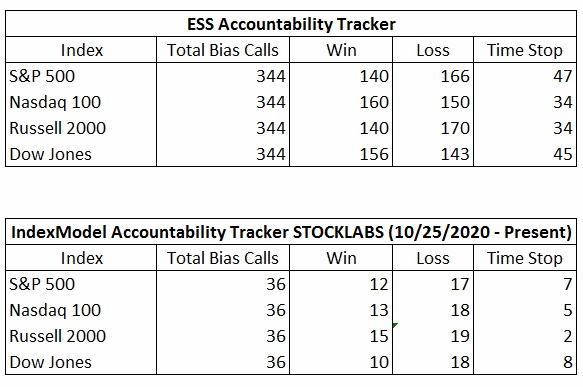

Here are last week’s bias trade results:

Bias Book Performance [11/17/2014-Present]:

Pivotal levels

Markets fluctuate between two states—balance and discovery. Discovery is an explosive directional move and can last for months. In theory, the longer the compression leading up to a break, the more order flow energy to push the discovery phase.

We are monitoring two instruments, the Nasdaq Transportation Index and the PHLX Semiconductor Index.

Transports might lose the low-end of range. More likely we see buyers rally up off of range lows.

See below:

Semiconductors are flagging along the top-end of range. This could result in a fresh leg of discovery up. This chart will be on one of my screens all week and providing key context to the overall market.

See below:

V. INDEX MODEL

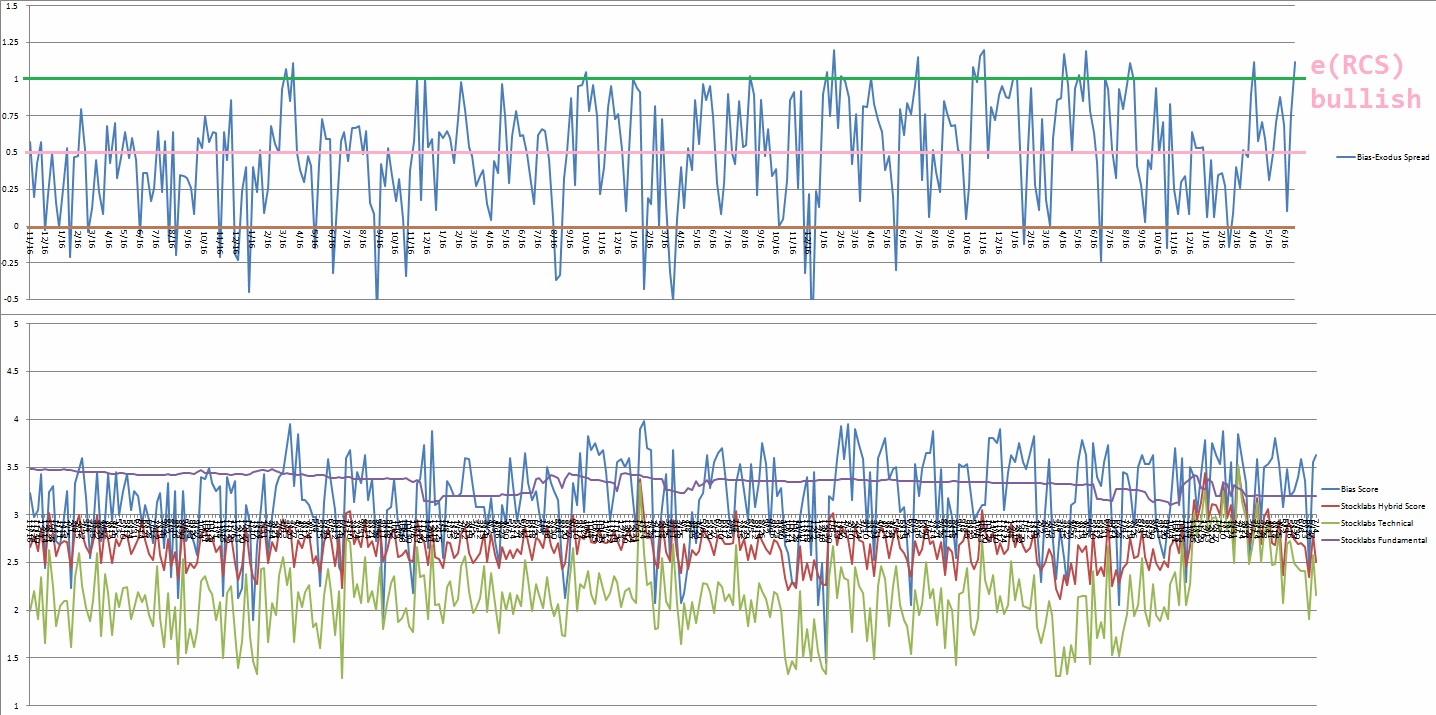

Bias model is extreme rose colored sunglasses bullish for a second week after being neutral two weeks back after being extreme Rose Colored Sunglasses bullish bias for three consecutive weeks after being neutral for the two weeks prior after being e[RCS] bullish eight weeks back and RCS bearish nine weeks prior.

We had a Bunker Buster eighteen weeks ago.

Extreme Rose Colored Sunglasses calls for a calm drift perhaps with a slight upward bias USUALLY but when the reading goes over +1 we expect a bit more strength/rally.

Here is the current spread:

VI. Stocklabs Hybrid Oversold (6-month)

On Thursday, June 17th Stocklabs went hybrid oversold on the six month algo. This bullish cycle runs through July 1st end of day. Here is the final performance of each major index.

VII. QUOTE OF THE WEEK:

“You might as well like yourself. Think about all the time you’re going to have to spend with you.” – Jerry Lewis

Trade simple, enjoy your duty

If you enjoy the content at iBankCoin, please follow us on Twitter