In light of the ongoing conversation of dollar/precious metals, if I were to take a look at the long side of this, you cannot ignore what copper has been doing into all this weakness in the metals.

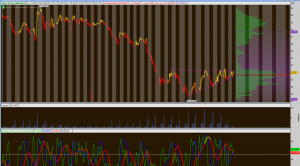

Here’s a look at a 10yr profile of Copper futures.

Copper has a similar chart as the metals, up until the puke phase. I’ve been a long term follower of Dr. Copper, using it as a daily indicator from 06-12. After that, it seemed to have lost its predictive value in terms of equity prices.

The relative strength in this is a thesis I am focused on going into next year. I’ve already placed long term money in FCX and SCCO. If I had to play metals, Copper interests me more here than Gold or Silver.

Just my humble opinion.

OA

Comments »