This morning I made an effort to book some gains, to pay down and book a few losses, and scratched out of a position to get smaller quickly. The comments out of the Fed today are very odd, and very timely considering what we’ve discussed during After Hours with Option Addict.

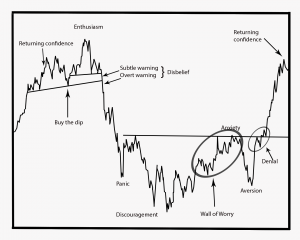

“This genre of stock is very vulnerable right now.” All stocks following sentiment cycle, WHICH HAPPEN TO INCLUDE SOCIAL MEDIA, BIOTECH, and SMALL CAPS, are vulnerable to fast moves here. How you view this message will help you immensely in the coming weeks.

To this point, I see only a handful of growth stocks (Yellen candidates) at the lower end of their multi-day ranges. All of them being supported and defended. Forget the broad market for a minute. Should they lose their ground, start to worry.

OA

Comments »