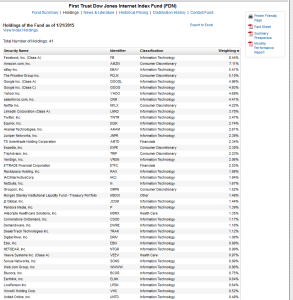

I’ve argued that risk stocks are setting up for a run that will lead to the last phase of this bull cycle. Hat tip to @coganj for the ticker, as its components are more in alignment with the stocks we’ve been tracking in After Hours with Option Addict.

Comments »TRYING TO BE OBJECTIVE

Honestly, the market feels as tentative here as I feel. I don’t know if there’s a clear cut read to this reaction yet.

The VIX has made it back down to the lower end of its range, which means that might be playable from here, unless the market no longer fears the outcome here and mindless chop is here to stay for the time being. Seeing the reaction to the ECB, it would seem like the appropriate compromise since the market always finds a way to stay propped up.

The USD/JPY isn’t totally confirming this all just yet, as it is propped right in the middle of its range. Bonds have rolled a little and stocks look like they might see the upper end of this range.

How to play this is a whole other can of worms. The volatility has throw off any risk-rotations, so rolling from one group to the next has been completely disrupted. Many market favorites, like FB, BIDU, AAPL, etc have been up for 3-4 days now. Hard to chase up.

The risk stock category flourished yesterday, which I think is an important signal, but I always think that. I can’t tell you how close I am to shifting around long term money to buy bullshit stocks like P, ANGI, MBLY, DDD, and logging out of my IRA for a year.

The best outcome here is a dying VIX. At least this calms the market and lets us slowly reengage the options market again.

More later,

OA

Comments »OPPORTUNITY FROM HERE IS EPIC

Regardless of directional bias, we should see no less than a 10% market move from these prices here. Not to mention, everything is still very coiled up for a big move later this week.

I’d take a moment to make some adjustments to free up some capital, and then start building your lists in terms of bullish, bearish, or breakout plays. If you’d prefer not to get lost in the stock selection process, simply start with a TNA/TZA position and build others after. Even if you have to chase a little, the next move out of the market will last weeks, if not months from here.

I don’t see myself anticipating too many movements in advance of ECB, but we did build out a pretty solid watchlist on Friday afternoon. To add anything else to that list, I’ll have to sit back and observe what the markets appetite for risk is this week, and which stocks respond the most to this weeks news flow.

Would love to hear what’s on your radar this week, post at will.

OA

Comments »DOWN WITH THE BEARS FROM DAY ONE

Yes, this chart right here illustrates the ongoing monthly conversation we have here. Easy to look at that chart and think… “Man, these internet trolls are right. I’ve been on the wrong damned side of this trend for the last several years. Why do I continue to fight this move that wants to go lower. Why don’t I listen to these anonymous experts that are so kind as to freely share and express their superior opinions on this matter?”

Yes, this chart right here illustrates the ongoing monthly conversation we have here. Easy to look at that chart and think… “Man, these internet trolls are right. I’ve been on the wrong damned side of this trend for the last several years. Why do I continue to fight this move that wants to go lower. Why don’t I listen to these anonymous experts that are so kind as to freely share and express their superior opinions on this matter?”

We’ve got an important week setting up, which will either confirm that volatility is here to stay, or whether the market releases last years pent up fear and anxiety. Recent headlines have me uneasy about the outcomes, but the charts still suggest this isn’t broken yet.

A “shout-out” to The PPT for signaling this move today. I’m still following this conviction day pattern in the Russell, which when tested, provides direction and clarity. Since October, conviction in the Russell, when tested, provides more conviction. When this pattern gives way, we’ll re-evaluate.

Wear a helmet next week. Bodies will be falling from buildings.

Wear a helmet next week. Bodies will be falling from buildings.

OA

Comments »WE GONNA BURN, BRO?

While the Nasdaq holds onto its lows, and the VIX is hanging near highs again, the biggest change in tone today was the deterioration in risk stocks. I’ve been holding that card close to the chest lately, as I felt it would be an important tell for how traders positioned into a volatile month, but I will quickly lose convictions if that trend continues.

If I look at the type of stocks down 4% or more today, its FEYE, QIHU, SPLK, LOCO, GPRO, MBLY, CYBR, DATA, TRUE, TWTR, and COUP.

While we toe the line again, the lack of downside follow through has a familiar feel to it. Especially going into EU QE next week. I’ve been trying to make more of the volatility environment by trading futures, and will do so til we get through next week.

The overall environment has been thrashed, which makes nothing look great here. Keep cash reserves high as something will start to make sense soon.

Top Pick: a fucking nap.

OA

Comments »AT THE GATES OF HELL

Here we are. Things are starting to slip. As it pertains to equities, the Russell and Nasdaq are at the gates. If the selling starts, it will get fast. Should you choose not to react, you wake up to a 2% gap down in addition to late day selling.

In terms of fear, naturally it is going first. The VIX has broken its range.

Despite buying off the open, it wasn’t met with the same conviction that last weeks rallies were. I thought we’d prolong this move until next week, but here’s the bulls last test to toe the line.

Financials look like absolute shit, which has the Dow and S&P leading lower. Start a plan now if things are to get fast. Don’t freeze.

I’ve booked positions in CDK and IG for gains and JRJC and VIP for losses. I’ll use the proceeds to get TZA if we slip, to provide a little relief while making adjustments.

More later,

OA

Comments »