As mentioned in my last blog, you have got to be pretty pumped over a free Exodus trial. Shoot, I know I am. But even better, you guys are getting an interactive look at it this Friday in After Hours with Option Addict. I am pretty sure I am going to open this up to anyone that wants a free peep show, but not 100% sure yet.

Also, NYC is right around the corner. We speak of this often, but stop procrastinating. For those that thought the VIP party last year was just wall-to-wall wang, we’ve taken steps to insure there will be more diversification between genders.

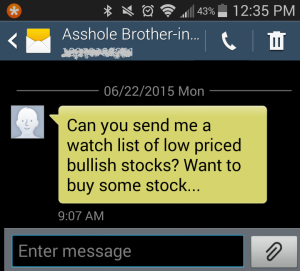

Ok enough of that. Before I forget…funny story, but check this out:

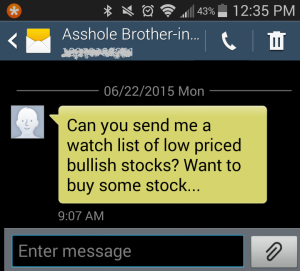

Notice the date.

Better yet, notice the time.

Now look at the NASDAQ.

If you haven’t heard my brother-in-law stories, you have totally missed out. This guy is uncanny, and he’s the best indicator I have. 100% accurate, much better than your hindenturd omen’s.

You’ve been warned.

OA

Comments »