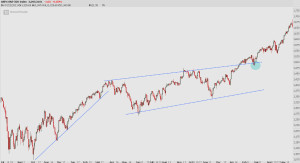

Stocks are ordered to trade higher on this national day of all things “high.”

Since the latest discussions have been pointed towards all stocks that are perversely risk in nature, I will focus on getting high in Mary Jane stocks today.

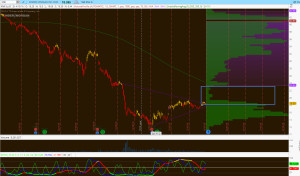

I already own $TRTC, $CANV, $HEMP and $CBIS.

Last night we looked at $DIGP, $ZYNE, $PMCB and $MSRT.

I know you must have one or two of these on your radar, and since there’s too many to list….which ones if any do you like?

OA

Comments »