I’m contemplating allocating some funds for Earnings Plays in stocks where there are open volume pockets. For next week, I started with a position in May $KMI calls.

My philosophy on these are simply P3…

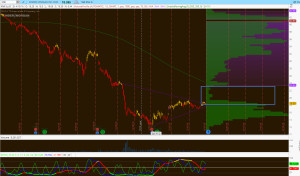

- Pattern – Good consolidation

- Profile – Good open profile above

- Premium – Recent contraction in option premiums.

I’m making a list for this earnings season. I want to try maybe 4-6 plays, so that I might happen across a win or two to pay for any losses.

OA

If you enjoy the content at iBankCoin, please follow us on Twitter

All premium at risk or do you bet enuff that you would salvage premium if wrong? TY for your time.

I always bet premium.

Jeff what’s your stock target price for May on KMI? Thanks in advance.

In my experience, earnings plays are an ‘all or nothing’ YOLO-type gamble. When you are wrong, premium is gone!

HAVE to play UA. I’m willing to bet their winter season was monstrous. Plus that weekend sale where the huge warehouse was CLEANED out in hours and it was all old seasons styles. Last time it fell it was because an “analyst” said they have too much inventory sitting. Well no more

Plus Steph got 73.

That company has so much going for it (growing by the minute in Maryland) that it wouldnt be too far gone to put 20% of my LT account in it and just let it ride

Never traded an option in my life. Any recommendation on a simple strategy if I want to give one a shot? I’ve done a little reading on the subject but still pretty much ignorant.

Risk the type of money you’d risk at a game of roulette.

Be careful! My 2nd or 3rd trade was a 10 bagger in 2 hours on $X. (Bought the close with a 1-2 day expiry as I recall). They’re not all that easy, but it gets you addicted.

Position size and manage risk – if you can’t afford to lose the money, then don’t play options. I started off with positions that were way too big and ended up getting wrecked in 2014 – I don’t recommend going that

Now I am more judicious (usually)

Same here. I am usually pretty careful and in general risk averse but a few years ago I opened up a “fun” account. Every position was 10% of the acct. Scored huge on the first two and then blew up the whole account in a matter of months. I think I still have the screenshot of the account on the day of expiry of those options just to remind myself of what “fun” can mean.

Never had a 10% option trade on before. That would go quickly.

I did a 4% trade on TWTR once – it went to 0 lesson learned

AAPL just got hammered on low iPhone sales news. Quite interesting to watch – took a chunk out of the indices.

correction, low iPhone production

Am I missing something? KMI hasnt scheduled their report yet I don’t think.

Bloomberg says 4/20

YUM looks interesting in terms of a solid volume profile above and consolidation. Reports after the close on Wednesday April 20 (please insert stoner Taco Bell joke here). All wisecracks aside, a price target at $85 seems reasonable with the air above it. Plus, it’s consolidating in an attractive manner.

Ehhhh never mind, premium is pretty expensive

As far as option plays before earnings, the best bet is arguably a strangle – betting both sides – smaller on the side you think will not happen. I can’t tell you how many times I was convinced the stock was going to move in a certain direction but to be safe I also bet the other side small and came away a good winner or a big winner. Most recent biggest example – GOOGL this past summer. I was pretty convinced that although moving up big before earnings, the stock would disappoint on earnings. When I saw the strength the day of earnings – before earnings – I went a little more on the call side then I had planned but still had the put side since of course I thought the stock would probably disappoint. Result? 5000 percent.

Or – to use the roulette analogy – if a stock looks like it will go big one way or the other – you can bet both red and black but you have a good chance of coming up a winner since the payout will most likely be much more than a double on either side.

Of course – master of the obvious statement – it might not really move at all and both sides lose which therefore – as Jeff said – it is best to bet that which someone realizes they might lose completely without much damage to their overall capital.