Take a look at the lower time frame of the market here, particularly the Russell. The RUT ripped off the open this morning while the Nasdaq plummeted in the first hour.

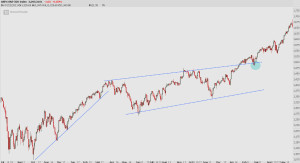

I’ve been watching the lower time frame of the market here, and the charts took me back to late 2011-2012. Here’s a quick comparison of what’s happening on the lower time frame.

I’m mixing time frames here, but patterns like this are applicable on any time frame as you know. But in both instances the market rallied sharply after trauma. Then, the angle of the trend changed and got slower. Many view this as a sign of weakness, but notice in 2012 where we traded outside the channel, a simple retest was bought, and that created a steeper trend, similar to the initial thrust off the low.

If we are near the LOD here, and breadth does not hit an extreme, be cautious of getting lured in here. Wait as long as you can to see this play out first.

OA

If you enjoy the content at iBankCoin, please follow us on Twitter

Looks like 10-15% of guaranteed upside (i joke i joke)

Wow. OA, you are the man! I almost pee in my pants before I read your post.

I am sure there is a medication for that.

Haha. What a shakeout!

“be cautious of being lured in here” – by that you mean be cautious of going short here?

Yup. Squeeze!

OA thoughts on KMI heading into earnings? I know you plan to hold but when there’s strength ahead of the event I always get nervous of a sell the news situation. Does the ramp affect your decision to hold? Thanks as always

MK, same thoughts. Last two days validated my suspicions about this stock as a candidate. Strong demand, no overhead supply.

I know you guys are looking for 10 bags. I usually sell before earning then buy back after earning if it is good. It still have plenty of room to run if the earning is good.

that depends on your style.

unloading $FB weeklies into this rally this afternoon then or holding a little longer? looks like $112 is resistance on 15min chart

I doubled down this morning for 44 cents

Of course I ended up buying SDRL after it popped today. Got long at $4.01 even though I watched it at $3.70 for a few days. I am keeping risk small on this as its risky as shit but highly leveraged to the price of oil. If oil goes to $50 this can go to $8-9.

I sold out of BIIB today at a small gain at around $273 primarily because I got spooked by the amount of concentration in revenues they have to those MS drugs. I probably ended up selling too soon but I’m trying to keep focused on the ones that offer more upside like NM / etc that I posted about yesterday. With PBR and FCX I’ve slowly transitioned to an energy trader which scares the shit out of me.

Hope you guys are having a good day. It’s been a helluva run.

This MTCH is only of the weirdest trading stocks I’ve ever seen. So much volatility intraday. I’m still holding it from under $11 and hoping for a move to $16. I think Tinder standalone is worth the entire company and am looking forward to when they release the feature that lets people see who is single nearby (ie in bars), which is something Barry Diller talked about last year. That will be revolutionary in terms of creepiness.

*is one of the weirdest*

Jeff, thoughts on AAPL weeklies here?

Lower lows are only bullish if a wedge develops here. Not a strong read here, sorry.

Which timeframe are you looking at? I was thinking higher lows developing, potential cup and handle play.

Does anyone follow the fundamental story for PACB closely? I know ILMN fairly well being in San Diego and I know a lot of traders are assuming the ILMN miss is due in part to PACB making inroads into their market. Just wondering how valid this is. The low to mid $8’s area looks like a good spot for a long.

OA…back to the under $10 stocks from yesterday, how about EMES…..other sand names breaking out HCLP & SLCA

Man i snoozed on SLCA.

yup

SLCA…. watched it from 19 to 14 to 25. Terrible front row seats

geez – I had wanted to watch that one after the Fly had caught that initial move up…..I forgot…

So….you’re saying no bodies will be hitting the floor today as a result?

volume picking up in KMI – looks like some large block trades going through. Volume profile looks similar to February

I am still holding GPRO – wish I had bought shorter dated calls so getting out last week would have been an easy call to make. Still like the setup here though.

risk stocks don’t looks that great. hopefully russell starts to turn

picked up some KERX today, (sub $10), expecting a move soon.

Thoughts on PAH ?

I get asked about that stock once a week. I’d short it at $10 because too many are interested in it.

Found a place for some volume profile charts and it doesnt have that volume pocket like you talk about above.

OA- you think we are setting up for a sell in May and go away type summer

I hope everyone goes away this summer.

Maybe if that happens the 387546 headline stories per day I sift through to find your blog will slow down.

bookmark this instead

http://ibankcoin.com/option_addict/

and save your sanity!

+1

Just bookmark his blog… much easier… or better yet, join his Trading Addicts… you wouldn’t be disappointed.

Been quietly and patiently waiting for my pitch…took a few swings on the close and bought BIS and FAZ.

Based on the way stocks are trading post-earnings, I am sensing an environment that priced for perfection and wondering if anyone is left to buy after the breathtaking rip from Feb lows.

Color me bearish — I might start buying up below-face value tickets for the Ark for resale during a panic.

Surprised you are tuning bearish now.

How do you join trading addicts? Does it come with the exodus subscription?

FEYE looks like crap, but bounced off the 50 day MA – may be the false breakdown (or a real one…) Either way, I am still holding May 20 calls.

Still crap

lol – I do agree – article came out on Seeking Apple praising the company, trashing the stock.

http://finance.yahoo.com/news/bulls-target-kinder-morgan-report-170809850.html

apparently others are betting on KMI

Move in FIT should be sold / faded….I would be a seller of any BAC calls that I bet the house with a few weeks ago.

Market is not buyable — only group worth consideration is precious metals. Moving IRA accounts into cash on the close today.

What’s your reasoning for turning bearish?

Price action, calendar, VIX levels and excessive call buying

Kid,

What’s your time frame on your short position?

Bought more FAZ

shorted ZTS with tight stop.