Lululemon is not a mall based story. Their nonsense is in the streets, with the rest of the normal retail stores. Macy’s is in the mall and they’re getting hammered. Express is in the mall and their stock just died.

Although not a very large cap name, this is a big deal for retail. Anyone who ventures out into shopping malls knows that there’s an Express in almost every single one of them. It is the barometer for the layman, semi-retarded, consumer–in search of stylish wares at reasonable prices. I once made the mistake of buying denim from there and ended up looking like an actual clown when I wore it.

In the conference call, the company cited (courtesy of Briefing.com):

1) challenging store traffic

2) an increased assortment of merchandise that resulted in a lack of clarity and skewed too young.

Co is adjusted merchandising target and looking to resonate better with consumers

Traffic will remain a headwind

Mens outperformed but womens but both were negative

Co has ~550 stores and just under 100 outlets (targeting 140-150 outlets in a few years)

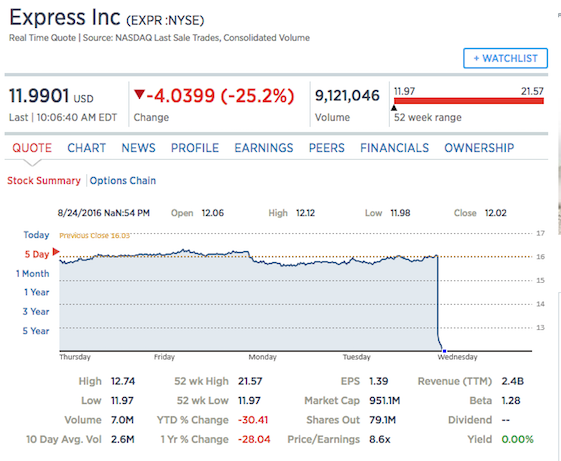

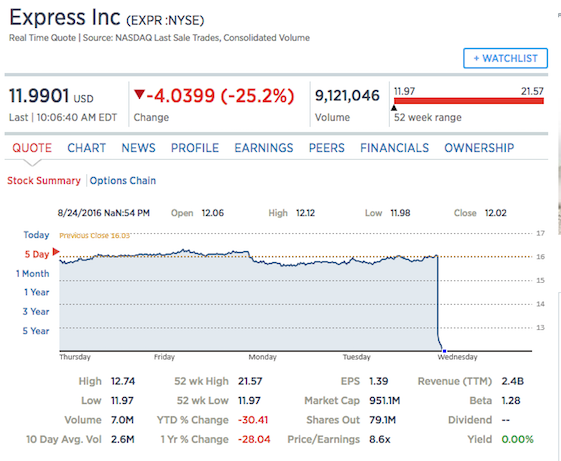

Look at these fucking numbers.

Reports Q2 (Jul) earnings of $0.13 per share, $0.04 worse than the Capital IQ Consensus of $0.17; revenues fell 5.8% year/year to $504.8 mln vs the $520.81 mln Capital IQ Consensus.

Comparable sales (including e-commerce sales) decreased 8% vs. guidance for a mid single digit decline, compared to a 7% increase in the second quarter of 2015. E-commerce sales declined 7% to $70.1 million.

Total inventory was down 6% with retail inventory down 9%.

Merchandise margin declined by 200 basis points driven by increased markdowns on clearance items as we focused on positioning our inventory for the fall season. Buying and occupancy as a percentage of net sales rose by 120 basis points. In combination, this resulted in a 320 basis point decline in gross margin, representing 29.9% of net sales compared to 33.1% in last year’s second quarter.

Co issues downside guidance for Q3, sees EPS of $0.09-0.15 vs. $0.32 Capital IQ Consensus; comps negative high single to low double digits.

Co issues downside guidance for FY17, lowers EPS to $1.00-1.14 from $1.41-1.54, excluding non-recurring items, vs. $1.46 Capital IQ Consensus; lowers comps to negative high single digits from low to mid single digits.

“I am disappointed with our second quarter performance as sales and earnings were below our guidance, reflecting challenging store traffic. This was compounded by a lack of clarity across the assortment. We believe we have identified the necessary actions to position Express to regain momentum and we are moving on them. Our fall assortment is more cohesive across our wearing occasions, clearly identifying the important trends, and we are aggressively pursuing several marketing initiatives focused on driving new customer acquisition and retention. In addition, we are pleased with our overall inventory position as we begin the fall season.”

Shares are being shattered this morning, off by 25%.

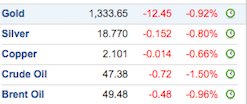

Other mall based retailers are heading lower too, namely GES and ANF.

Comments »