There is no website that I hate more than Reddit. It is the epitome of bad — bad design, information, bad people. I used to cavort there and was even an admin on WallStreetBets for awhile — but was quickly infuriated by the brand of person who travels there. They are the very worst people in the world, pathetic even. The CEO is a liberal cock-sucking piece of shit and I really do hope the stock CRESCENDOS to ZERO — bankrupting all involved.

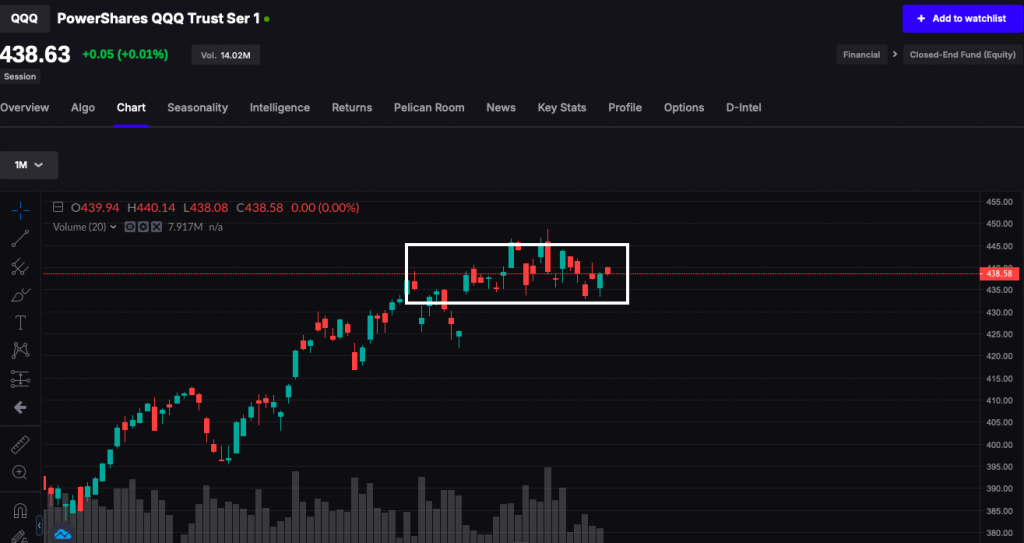

I was ENTREATED to early gains of 170bps and like a son of a bitch gave 90bps back, closing the day +80bps. I am hedged with a 12% SOXS position because fuck the semiconductors — but I really don’t have a strong bias for downside action.

I would hope, in a poetically romantic way, the IPO of Reddit ushers in the apocalypse — broken elevator pin action with accounts spiraling to zero and lower into the sub-basements of negative equity — squatters from Mexico taking over houses in America — supported by neoliberal laws that give them the right to do so.

Not a single person will do anything about — rather opting for supporting foreign wars in a distant land for their agenda.

I’d wish you good luck but I really couldn’t care less. Don’t be cross, as I don’t give a fuck if I make grandiose returns either — would prefer to bear witness to a catastrophic irreversible collapse rather than see this tape print another record high.

Comments »