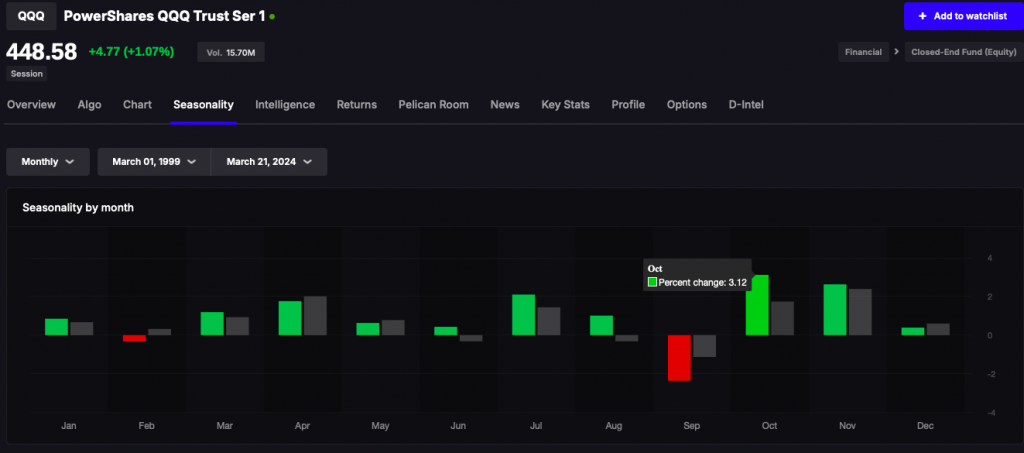

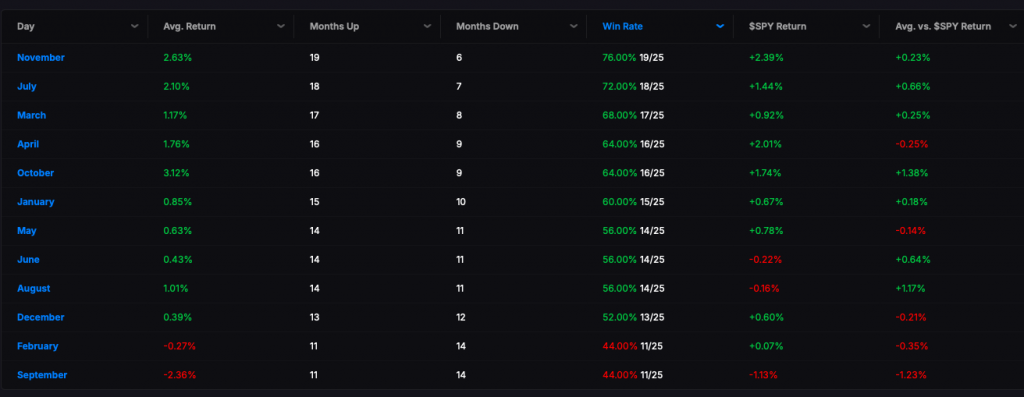

I want you to examine the monthly returns for the $QQQ since 1999.

You see that there are just two months out of the year when stocks trade lower.

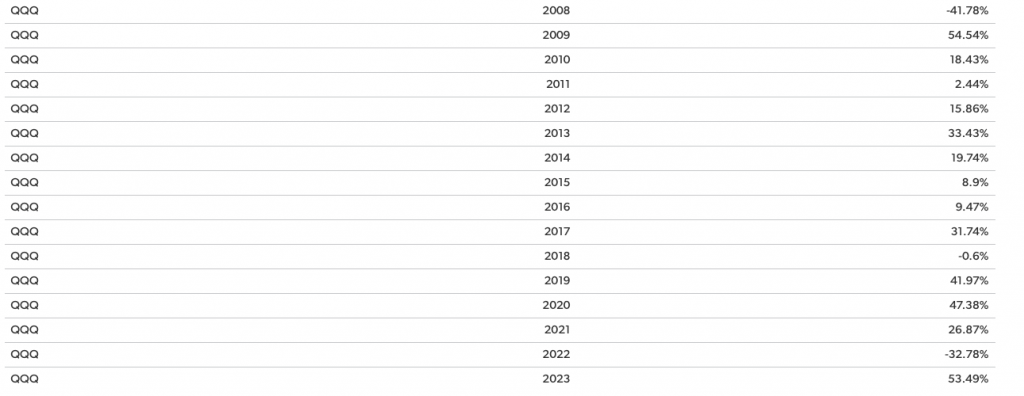

The NASDAQ went down just two times since 2008.

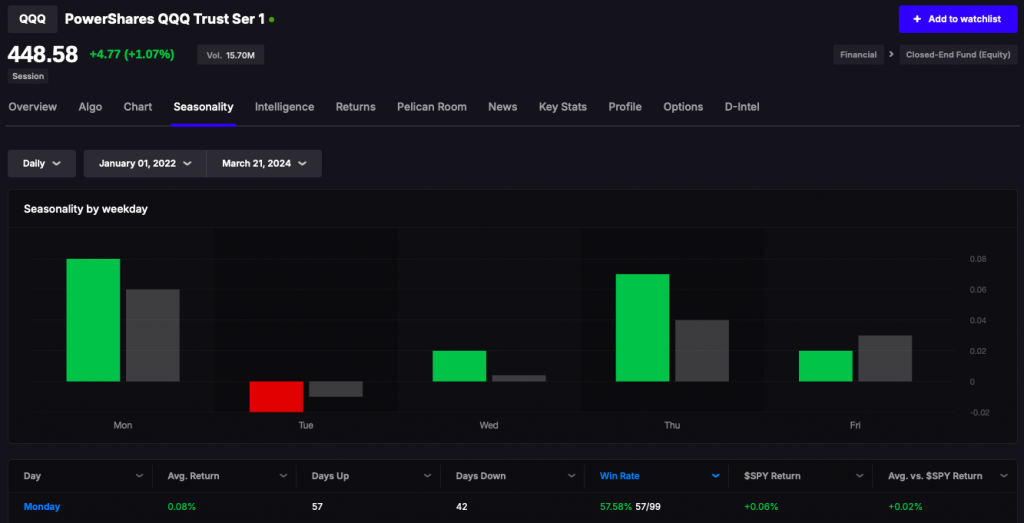

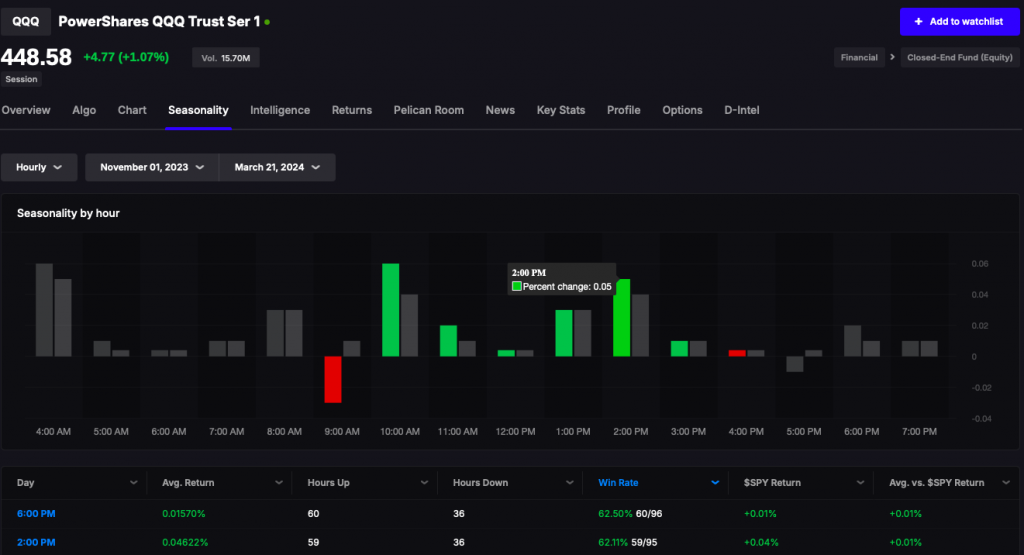

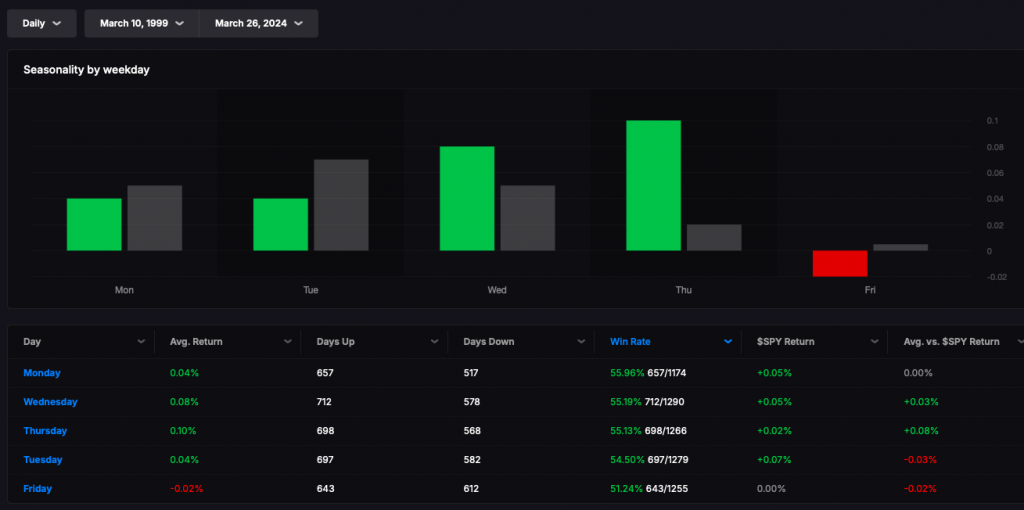

If you chose to invest in any day during the week, only Friday would be a bad time.

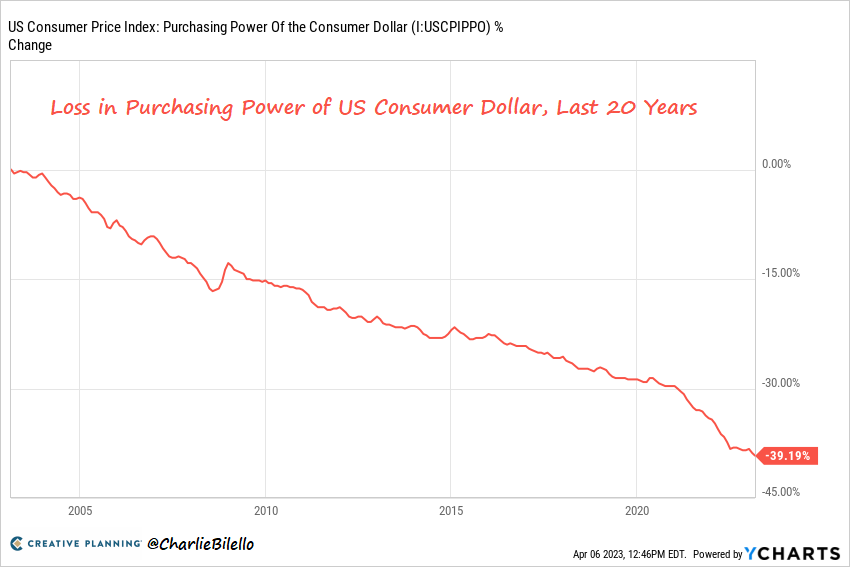

My point is — markets are RIGGED to go higher. The times it drops — it’s fairly predictable and if you’re paying close attention — you can avoid the bulk of the drawdown. This doesn’t have to be complicated. If you’re only focused on shorting the market, you are trading too emotionally. The numbers do not lie and the only way a person could’ve lost money in the tape since 2009 is if her was in stocks non-central to the greater economic schemes of the world. In other words, own companies that correlate to the economy and not outliers in the tech and biotech realm.

The question of “when to sell?” is an evergreen one, something myself have wrestled with intensely during my entire career. Since I trade a lot and am always fishing for new ideas — I often sell stocks that later run up to be great winners. I justify my actions by pointing to my returns being great and the idea that stocks are mere vehicles to an ultimate destination. You do not need to be fixed to one. HOWEVER, not everyone can trade as good as me or have the time necessary to keep in tune with trends. For those people I suggest a quarterly review and stringent dedication to allocation weightings.

I’ve said this many times before and I will repeat it now.

If you start a position in XYZ at 5% and it jumps to 9%, at your quarterly adjustment — pare it back down to 5% and if you have a down stock at 3%, increase it to 5%. We are assuming the long term fundamentals are still intact for the loser and nothing material has changed. If the loser missed earnings and lowered guidance and is counter-correlating its peer group — SELL IT and replace it with a company performing well.

Comments »