Clinical studies have shown that men who cancel Stocklabs are in fact homosexual. I could not believe the data myself — but it’s true.

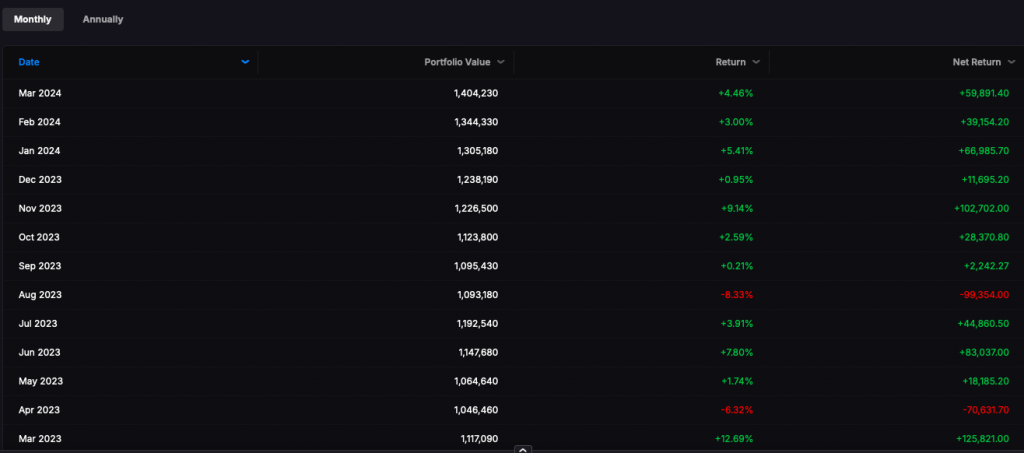

I closed the quarter of 2024 +13% for trading,+11% in Quant and +10.4% in strategic. Up against the NASDAQ’s gain of +8.5% and the $IWM’s +4.7%, I am pleased with myself — but I do realize I could be doing better.

I haven’t really applied myself in 2024 and will try to do better in Q2. All in all, markets are playing out exactly as they should, with no real big surprises other than a rapid breakout in $BTC and $GLD.

Allocations should be even and full, leaning into growth.

My trading returns the last 12 month indicate an aversion to risk and this is mostly true. I have been trading defensively for a number of reasons — chiefly the tape isn’t inspired. We have seen tera caps go up and the smaller/funner names underperform pretty consistently.

That’s not to discount the interesting movement in AI related stocks, especially $NVDA. Nonetheless, I feel like there is a dark cloud looming just above us and at any moment it’ll strike us all dead.

If I stopped being scared and only allocated long and increased the sizes of my positions, I’d likely be up 27% like some of the criminals inside the Pelican Room. However, I am a professional of the first order and like to comport myself with honor and dignity at all times.

Have a blessed extended weekend. See you catamites on Monday.

Comments »