So many people love to visit cesspools around the world, in order to “take in” the depravity of a savage populous. Raise your hands if you’ve ever visited Thailand, Africa or any country east of Germany?

Precisely.

Whether you know it or not, you visited these indigenous countries in order to see how the savage comports himself. You visited his towns and devoured his disgusting food. Your mind tricked you into believing that you were enjoying your stay, when in fact, deep down, you were wholly disgusted by the ordeal.

The same goes with the stock market. If you’ve ever invested overseas, not including the civilized countries of England, France and Germany, I am sure you can recall a moment that you’ve questioned your own sanity for being long an inferior civilization. One should not trust the stocks of an inferior people’s. Sure, when times are good, their novelty is interesting and somewhat entertaining. But when times are bad, like now, they will bite your face off–cannibals running through the jungles naked with scary masks atop their heads.

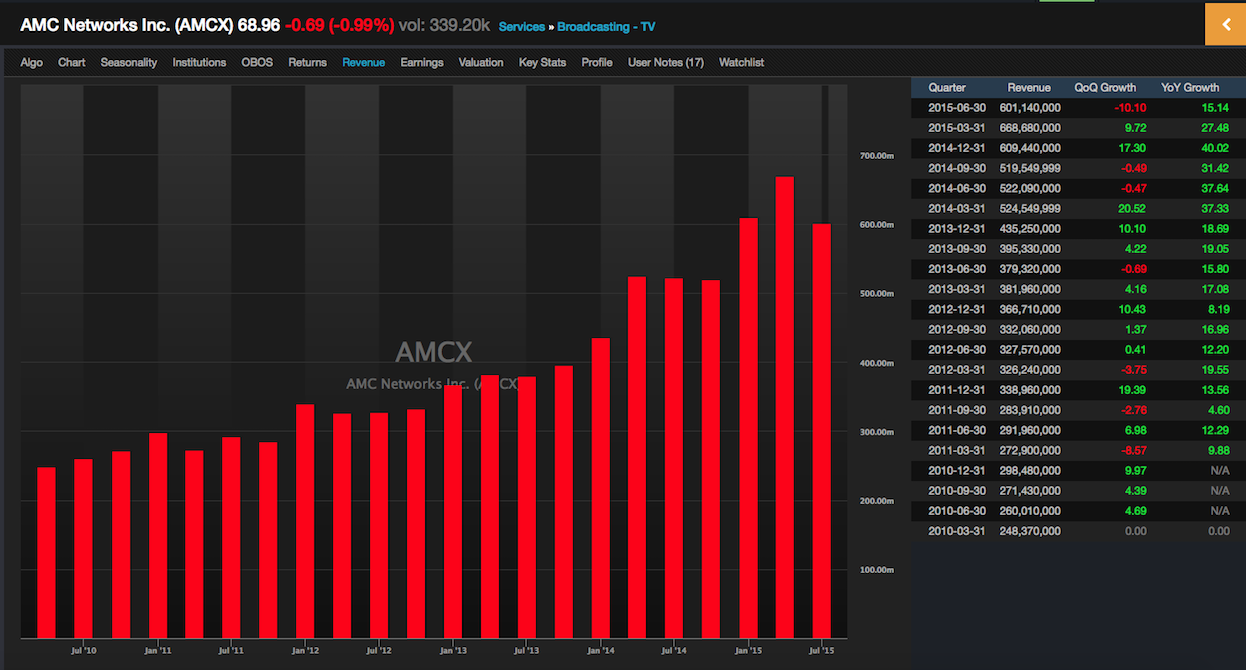

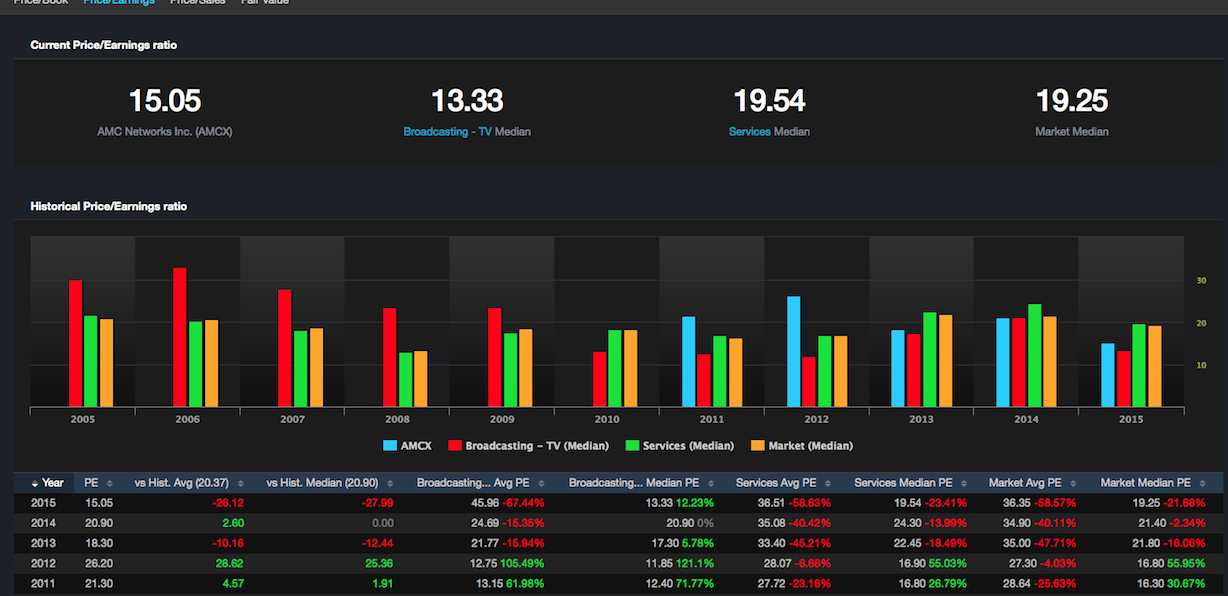

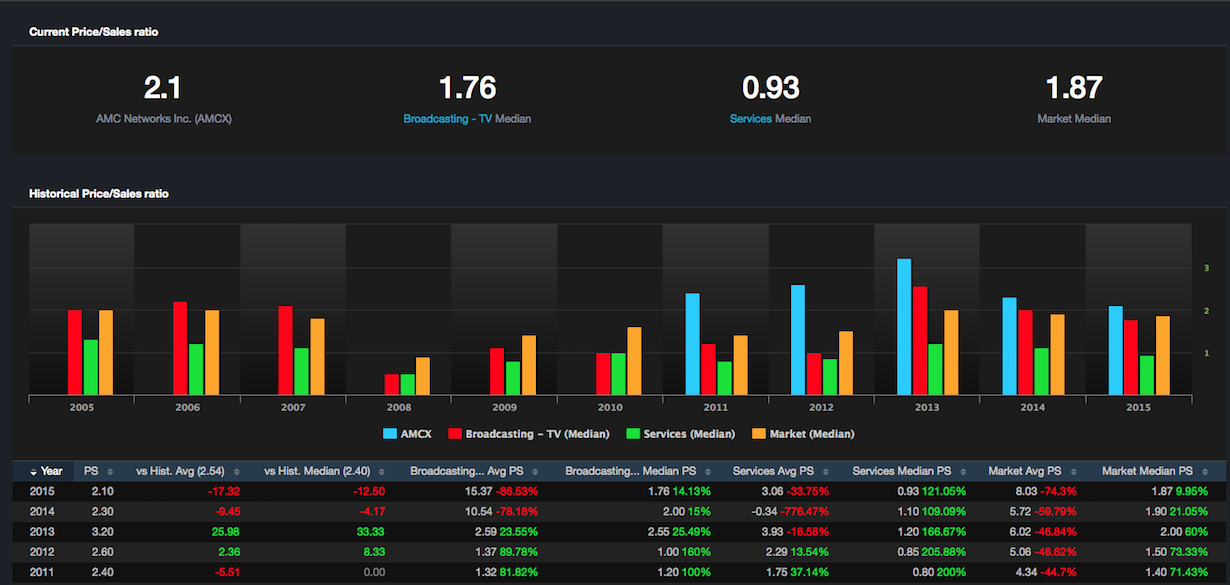

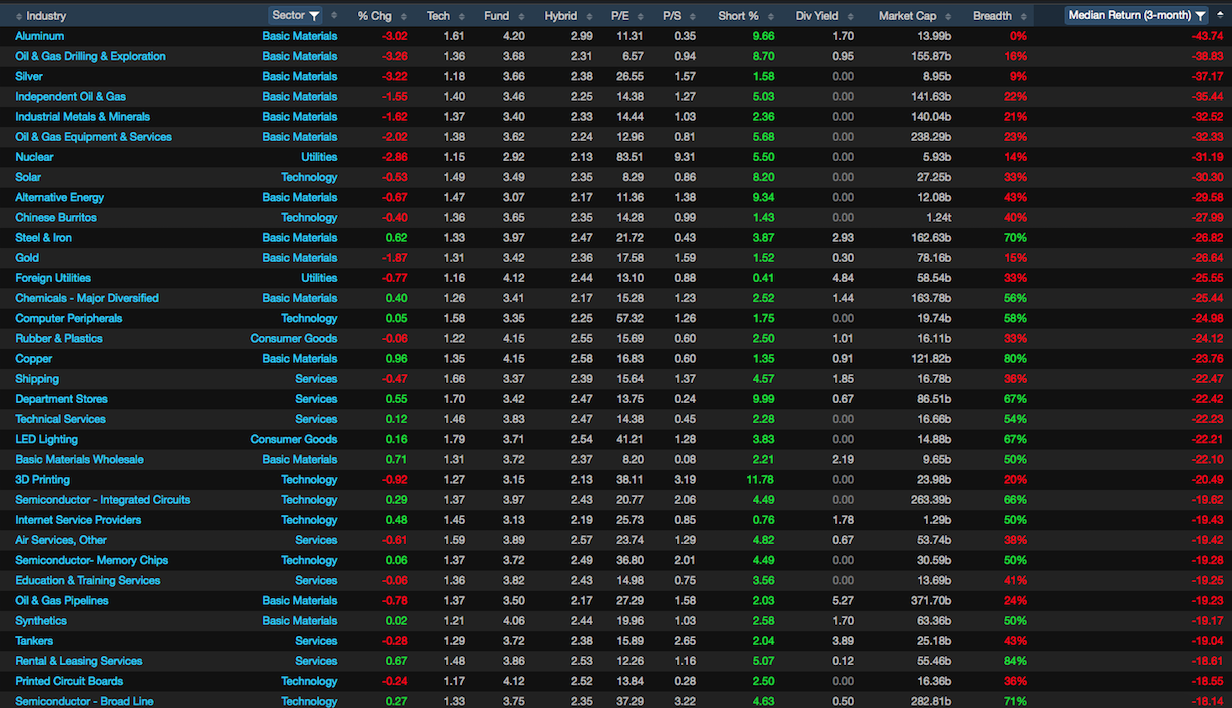

Regional banks like SBNY and BOFI interest me here, as well as my top pick AMCX. I am not enthused by today’s rally. It has a certain tenuous feel to it that makes me uneasy.

Comments »