I watched you smug bastards on the teevee declare “the bottom is in” to “head back into the shark infested waters” because the sharks like people who bought dips. Had I taken your advice, I’d be strewn across the pavement with vultures picking away at my carcass.

It’s not that simple. Bottoming out is a process and to buy this afternoon was the equivalent of buying into an 800 point melt up. No thanks.

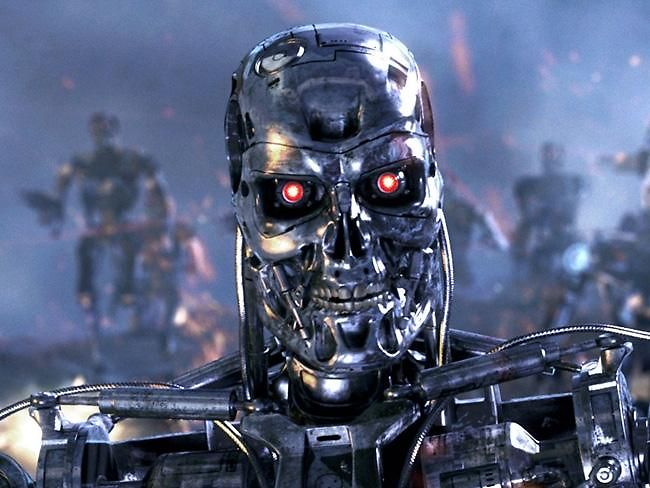

Now we descend into hell because that’s where China resides. We gave up our country a long time ago and transferred it to China. We enjoyed the frugality of cheap labor and goods. Now that cost savings will wreak havoc upon this nation for generations to come.

But don’t worry. The central bankers are owned, lock, stock and barrel. The syndicate of global oligarchs will pressure them to act, in order to reflate things again. You’ll have another shot at liquidating at reasonable levels, another shot at “playing the bounce”–because that’s what we are: “players” in a sordid game.

We’ve replaced human beings (cost savings) with the ability to think and react rationally to outsized moves for computers, prone to break and bust loose Armageddon on the capital markets every 5 years or so. We are reaping the seeds that we’ve sowed. I know this sounds awfully dramatic and the markets aren’t even down 15% from their highs. But we have 19 trillion in debt and the majority of our industrial output is done outside of our borders, exposed to fucked currency moves and the caprices of maniacal governments.

Regarding the markets: look towards China and Hong Kong this evening for signs of encouragement and get those handy-dandy (extra Blue’s Clues) buylists ready for a possible opening cascade tomorrow morning.

I closed the session with over 60% cash and I still got my brains blown out.

Comments »