Fund managers are ‘enjoying’ elephantine redemption claims, many of which are emanating from the east. They set up wealth funds to prepare for a rainy day. According to the CEO of Aberdeen Investments, who endured $13.2 billion in redemption claims in the fourth quarter alone, sovereign wealth funds are under pressure due to oil and have been pulling money out of the market. Back in November, the head golfer in chief at Aberdeen, Martin Gilbert, said 2016 would be rough sledding if oil persisted in the $45-50 range. Now that oil is in the low $30’s, I am certain he wants to shoot himself out from a carnivale cannon.

“Sovereign wealth funds were set up for a rainy day and that rainy day has arrived,” Aberdeen CEO Martin Gilbert said on a conference call in January.

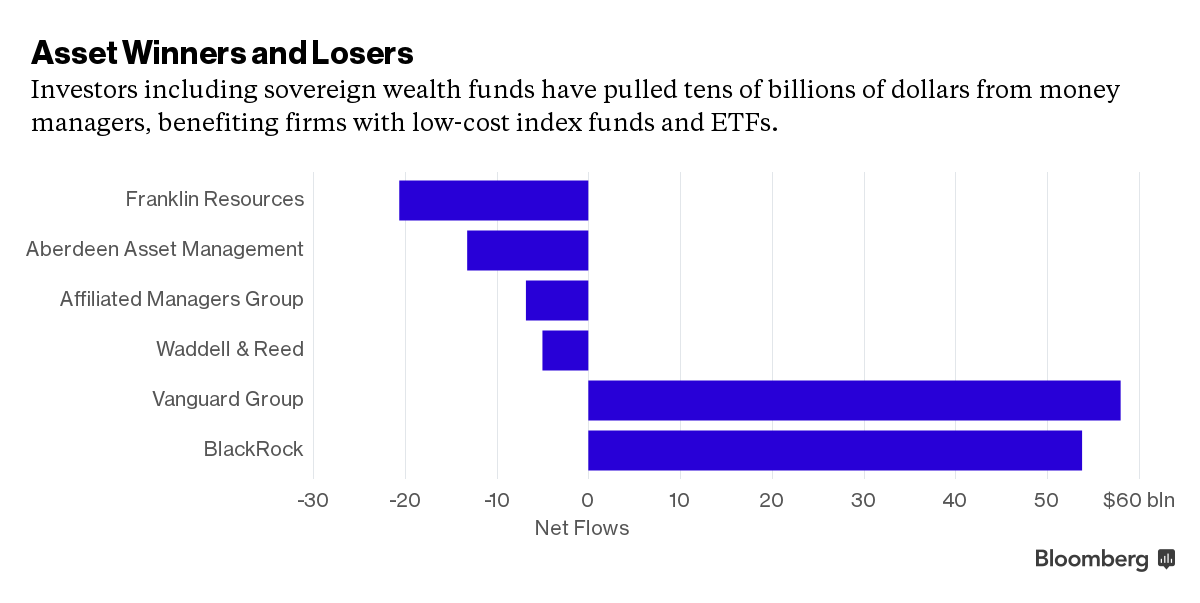

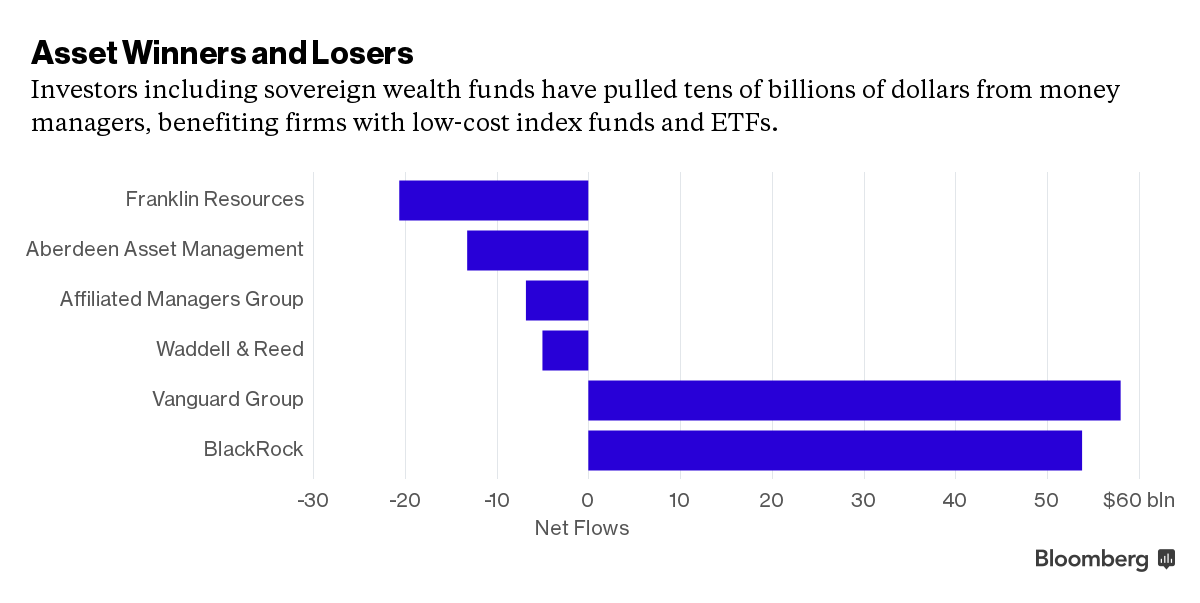

Franklin Resources were the biggest losers, shedding more than $20 billion in the fourth quarter (a new record, congrats assholes!), most of which were in passive funds–the sort of bullshit that loses people large swaths of cash when markets get tough.

The winners were Blackrock and Doubleline, adding an astounding $152 billion and $54 billion in 2015, respectively–both for totally different reasons. Blackrock has an array of ETFs and products that help investors hedge out or gain exposure to safe-haven products, whereas Doubleline is run by Jeffrey Gundlach, boss of all bosses, outspoken opponent of the retarded U.S. Federal Reserve.

Comments »