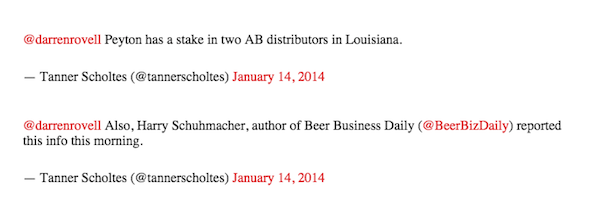

Apparently, he owns an interest in two Bud distributorships.

Following the Broncos’ super bowl win, when asked what he’d do next, Peyton Manning, in two different discussions, said he’d go kiss his wife and children, then go drink a whole lot of Budweiser.

He pulled this shit in the AFC championship win too. It just went under the radar, due to the obscurity of his degenerate favoritism towards swill.

Following the Broncos’ 24-17 AFC divisional playoff victory over the Chargers in 2014, Manning was asked if retirement was weighing on his mind.

“It’s really not,” he responded. “What’s really weighing on my mind is how soon I can get a Bud Light in my mouth after this win.”

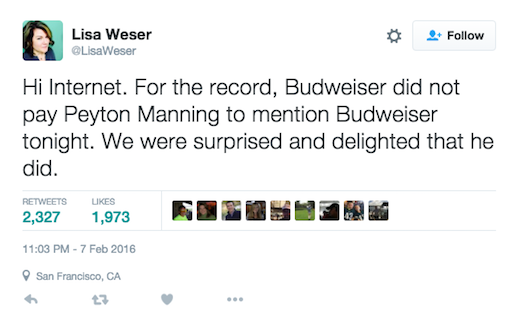

A Budweiser spokeswoman said the company did not pay Peyton to promote the brand, but were delighted by it nonetheless.