One of the more hawkish Fed heads just said the rate hikes will continue, while wringing her hands and bellowing out a witch-like, craven, laugh.

“While the actual path the fed funds rate follows will depend on the economic outlook, and thus, will be data dependent, my current view is that economic conditions will evolve in a way that will warrant rates moving up gradually over time to more normal levels,” Mester said, according to prepared remarks marks she was to deliver to a Market News International gathering in New York.

She acknowledged the decline in energy prices and net exports among other weakness in the economy. However, she also noted “solid labor market indicators, including strong payroll growth and healthy growth in real disposable income” that “suggest at underlying U.S. economic fundamentals remain sound.”

It’s all about those extra Target and Walmart jobs being added to the mix that’s making the Fed nervous about inflation.

“Until we see further evidence to the contrary, my expectation is that the U.S. economy will work through the latest episode of market turbulence and soft patch to regain its footing for moderate growth, even as the energy and manufacturing sectors remain challenged,” she added.

FML

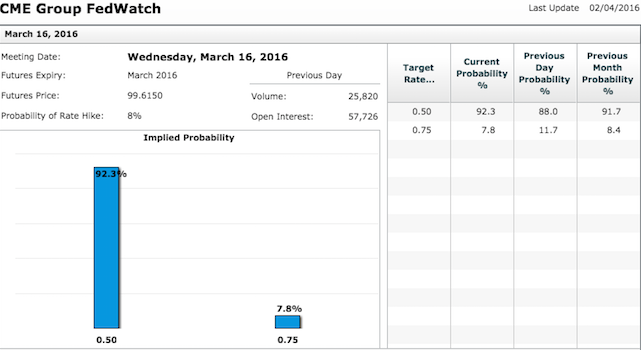

That’s funny, since the idiots who trade the Fed rate hike probabilities have eliminated the chance of another hike this year.

Can you say ‘downside surprise’? The Fed doesn’t give a shit about your portfolios.

Comments »Mester says financial market volatility is ‘not a rationale for making a monetary policy decision’