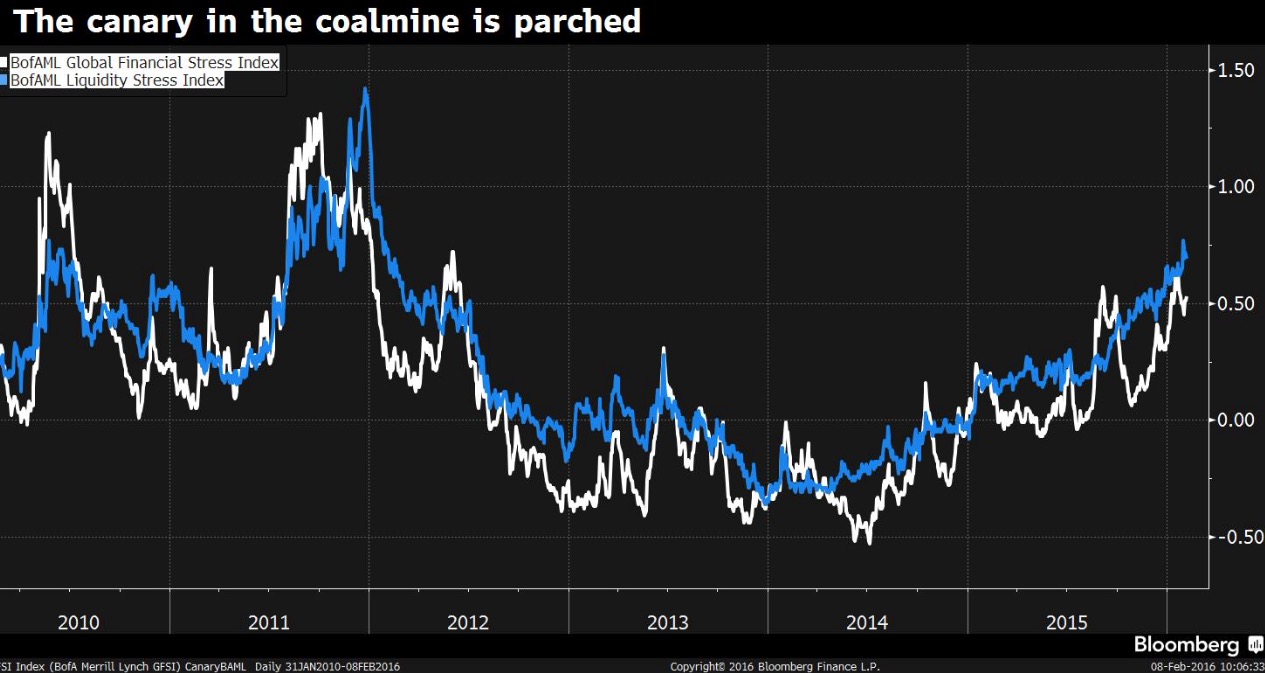

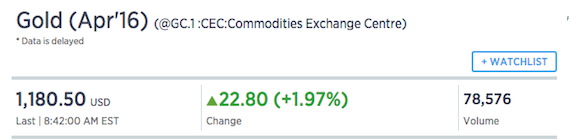

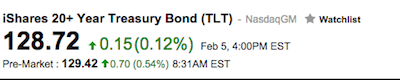

Finally, we’re getting to the crux of the matter: liquidity is drying up. The deflationary vortex has taken hold, sending all monies of substance into treasuries, racing away from risk.

Bank of America is out with a note pointing to the systemic nature of the liquidity crunch and how it’s at the heart of the recent tumult.

The index is a composite measure of market-based indicators of risk, demand for hedging, and risk appetite, while the liquidity subindex tracks a variety of funding spreads, such as Libor-OIS.

“Compared to the broader GFSI, liquidity stress has somewhat methodically and steadily risen over the past two years: while the GFSI has moved higher in fits and starts, liquidity stress has more persistently risen, only pausing its rise at times, before moving higher,” the strategists explained. “This persistence suggests to us that deteriorating liquidity is at the heart of and may be the primary driver of broader rising financial stress.”

Merrill Lynch chalks up the seemingly structural, unrelenting increase in liquidity stress to two factors:

New regulatory and capital requirements enacted since the financial crisis that restrict trading activity and limit the amount of balance sheet that banks are willing to dedicate to providing liquidity;

Building off the above, the collapse in commodity prices has sparked severe selloffs in the emerging markets and high-yield debt and led banks to jettison the provision of liquidity to challenged sectors in particular.

“The combination of these two factors has led to a somewhat vicious cycle and feedback loop, where poor liquidity is spreading, and liquidity problems appear to be turning into fundamental problems,” the pair wrote. “Moreover, tightening of monetary policy by the Fed, first through tapering and now through tightening, may have been necessary from an economic perspective, but the tightening appears to be adding fuel to the fire of liquidity deterioration.”

Can you say ‘negative feedback loop?’

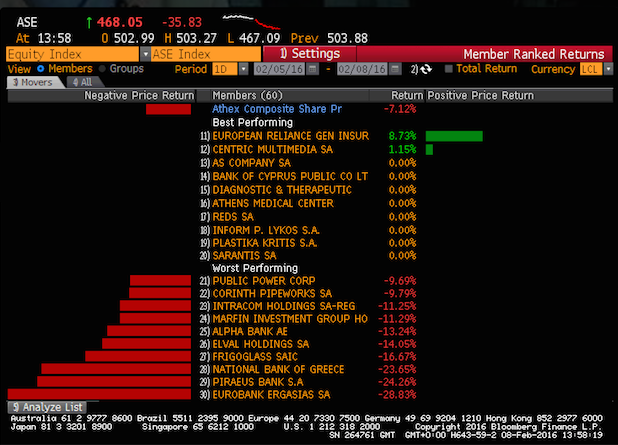

Bank stocks are getting clawhammered today, with 6%+ drops,in a number of major investment banks, including GS.

Comments »