I want the world to end, just like the next guy. But that doesn’t mean it’s going to happen tomorrow. Like a fine wine, good things get better with age. The longer we delay the apocalypse, the greater its spectacle will be.

That being said, stocks were hammered by 1% today, throwing the long only camp into a fury, unable to deal with the minor set back. Commodity related stocks were poleaxed by 5% and David Einhorn told you the commodity super cycle was over.

On the plus side were discount, carnivale type stores, whereby goods are bargained off for less than $1. Also, gold and bonds fared well. Let’s not forget department stores, such as M, DDS and even SHLD were all higher.

It’s entirely possible that the top has been reached and everyone here who is long will commence a period of draw-down that can only be described as dreadful. But, it’s also possible that you are reading too much into this and that stocks aren’t done pressing higher. The wall of worry is very tall indeed, which effectively makes it all the more alluring to climb.

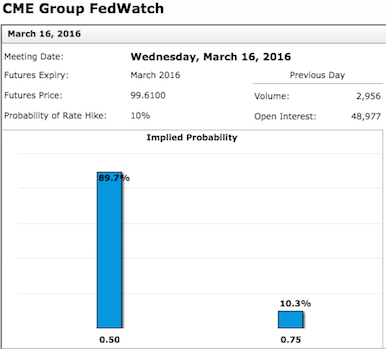

Even though I’ve embarked on a campaign to do away with equity exposure until the next Exodus oversold signal, I am not bearish enough to consider short positions, at least not now. The time for betting against stocks was in January and will come again in May. There will be a period of time when your only hopes will be for a Federal Reserve emergency meeting to take place on a warm summer night. But the weather is still cool and the Federal Reserve isn’t done inflicting their damage upon the global economies.

Don’t forget that tonight is the 2nd part of Jeff Macke’s boot camp. Our investor camp last through Friday. Don’t worry if you’ve signed up late. There are video archives available for late stragglers. The Option Addict is presenting on Wednesday and Thursday and finally RAUL on Friday.

Comments »