Futures are off by 230, Nasdaq -45. WTI is -0.3%, gold +0.3%. Bitcoin is pulling in, now at $7,700, which coincidentally is in sync with the dive in the futures market. The ramifications of the XIV blow up, but more importantly, the OTC shadow volatility market, hasn’t been realized yet.

We’ve already heard of several hedge funds closing down, one of which is under the umbrella of Man Group PLC.

One of Man Group Plc’s main funds plunged on Monday as market trends suddenly reversed, according to a person with knowledge of the matter. Option Solutions LLC, a hedge-fund that trades equity options, lost as much as 65 percent after it was forced to sell holdings overnight.

“Traders who were short volatility just had to puke,” said Tobias Hekster, co-chief investment officer at True Partner Advisor, who was speaking in general ahead of trade opening in the U.S. on Tuesday. “And our expectation is we’re not done yet.”

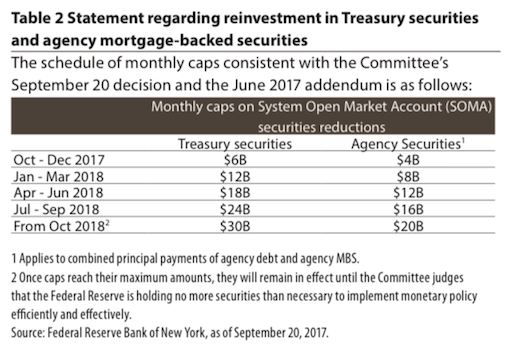

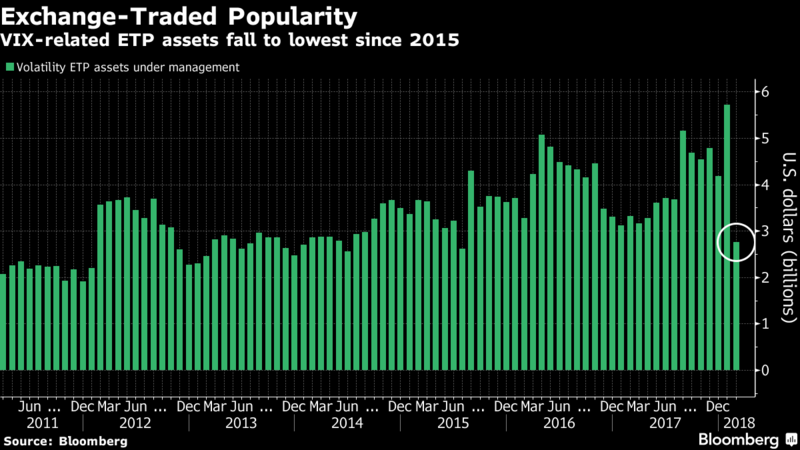

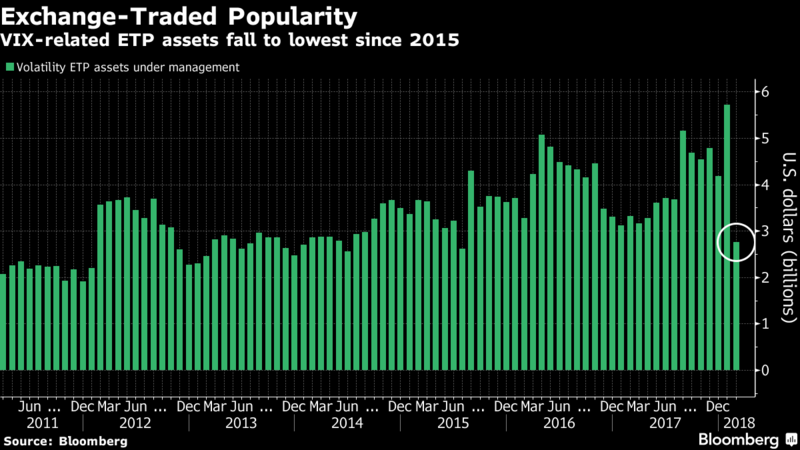

The CBOE Volatility Index had its biggest ever rally on Monday, hurting investors who had piled into products betting on low volatility after central bank policy helped it to record lows last year. U.S. wage data issued last Friday pointed to quickening inflation causing bond yields to soar and global stocks to tumble.

Hekster’s relative value volatility hedge fund surged 14 percent in two days through Tuesday as turmoil roiled the stock market, he said, profiting from price movements between indexes in the U.S., Korea, Taiwan and Japan. The fund purchases volatility equity-index options that it thinks are underpriced and sells those that it believes are overvalued.

Man AHL Diversified Futures plunged about 4.6 percent on Monday, leaving the fund flat for the year. Shares of Man Group, the world’s biggest publicly traded hedge fund firm, slid as much as 7.9 percent on Tuesday, the most in almost 11 months. A spokeswoman for the London-based firm declined to comment.

‘Very Bad Day’

The strategy “had a very bad day yesterday, that’s not a surprise,” said David McCann, an analyst at Numis Securities Ltd. “That’s in the context of some very good performance year-to-date.”

“Yesterday’s move has certainly generated a lot of damage for all implicit short volatility strategies, including trend followers,” said Nicolas Roth, head of alternative assets at Geneva-based Reyl & Cie. “Most systems are designed somehow to capture trends and this selloff appeared out of nowhere for a quantitative system.”

The $362 million systematic global macro Lynx fund lost 6.6 percent yesterday and is down 8.8 percent this month after gaining 8.6 percent in January, according to their website. A spokesman declined to comment.

Option Solutions faced a tough day.

“The market became completely illiquid as volatility increased far in excess of the market movement,” Paolo Compagno, a partner at the London-based firm, said in an email to investors seen by Bloomberg News. “We were forced to liquidate throughout the night and morning.”

The firm and fund remain in business and will waive its incentive fee, or slice of profits, for new investors until the fund returns to its high watermark, he said in an interview. The firm had managed about 65 million euros ($80 million) before the losses, he said.

The return of volatility was a long time coming for True Partner, which oversees about $325 million and acts as a hedge against greater levels of turbulence in global financial markets. Last year the flagship fund was down 5.6 percent, and up 0.4 percent in 2016. The fund had gained about 17 percent in 2015, benefiting from the flash crash that year.

That was the “last interesting day for us,” Hekster said.

Before the collapse of XIV, total exposure to volatility was roughly $2 trillion, the highest ever. It was so fucking easy — even a retard could do it.

Now all of that has ended, spawning a new crisis for us to worry about and create melodramas about end of the world scenarios playing out. For now, I remain apocalyptic, but will smile every so often when stocks revert back to rigged upwards charging.

Comments »