Futures are off by 230, Nasdaq -45. WTI is -0.3%, gold +0.3%. Bitcoin is pulling in, now at $7,700, which coincidentally is in sync with the dive in the futures market. The ramifications of the XIV blow up, but more importantly, the OTC shadow volatility market, hasn’t been realized yet.

We’ve already heard of several hedge funds closing down, one of which is under the umbrella of Man Group PLC.

One of Man Group Plc’s main funds plunged on Monday as market trends suddenly reversed, according to a person with knowledge of the matter. Option Solutions LLC, a hedge-fund that trades equity options, lost as much as 65 percent after it was forced to sell holdings overnight.

“Traders who were short volatility just had to puke,” said Tobias Hekster, co-chief investment officer at True Partner Advisor, who was speaking in general ahead of trade opening in the U.S. on Tuesday. “And our expectation is we’re not done yet.”

The CBOE Volatility Index had its biggest ever rally on Monday, hurting investors who had piled into products betting on low volatility after central bank policy helped it to record lows last year. U.S. wage data issued last Friday pointed to quickening inflation causing bond yields to soar and global stocks to tumble.

Hekster’s relative value volatility hedge fund surged 14 percent in two days through Tuesday as turmoil roiled the stock market, he said, profiting from price movements between indexes in the U.S., Korea, Taiwan and Japan. The fund purchases volatility equity-index options that it thinks are underpriced and sells those that it believes are overvalued.

Man AHL Diversified Futures plunged about 4.6 percent on Monday, leaving the fund flat for the year. Shares of Man Group, the world’s biggest publicly traded hedge fund firm, slid as much as 7.9 percent on Tuesday, the most in almost 11 months. A spokeswoman for the London-based firm declined to comment.

‘Very Bad Day’

The strategy “had a very bad day yesterday, that’s not a surprise,” said David McCann, an analyst at Numis Securities Ltd. “That’s in the context of some very good performance year-to-date.”

“Yesterday’s move has certainly generated a lot of damage for all implicit short volatility strategies, including trend followers,” said Nicolas Roth, head of alternative assets at Geneva-based Reyl & Cie. “Most systems are designed somehow to capture trends and this selloff appeared out of nowhere for a quantitative system.”

The $362 million systematic global macro Lynx fund lost 6.6 percent yesterday and is down 8.8 percent this month after gaining 8.6 percent in January, according to their website. A spokesman declined to comment.

Option Solutions faced a tough day.

“The market became completely illiquid as volatility increased far in excess of the market movement,” Paolo Compagno, a partner at the London-based firm, said in an email to investors seen by Bloomberg News. “We were forced to liquidate throughout the night and morning.”

The firm and fund remain in business and will waive its incentive fee, or slice of profits, for new investors until the fund returns to its high watermark, he said in an interview. The firm had managed about 65 million euros ($80 million) before the losses, he said.

The return of volatility was a long time coming for True Partner, which oversees about $325 million and acts as a hedge against greater levels of turbulence in global financial markets. Last year the flagship fund was down 5.6 percent, and up 0.4 percent in 2016. The fund had gained about 17 percent in 2015, benefiting from the flash crash that year.

That was the “last interesting day for us,” Hekster said.

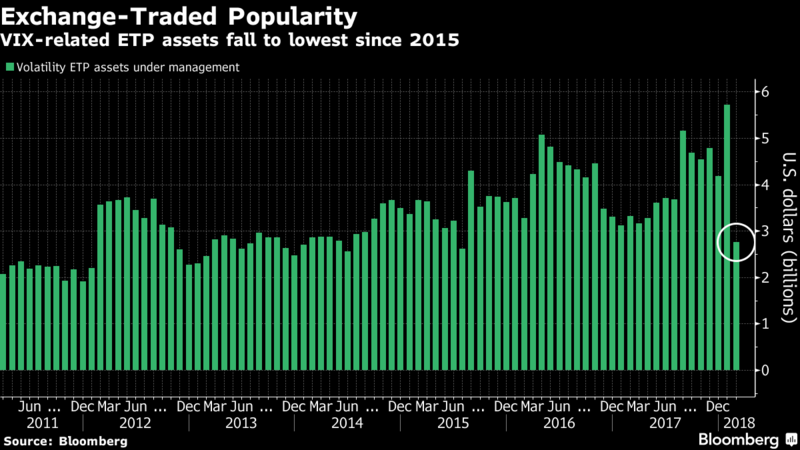

Before the collapse of XIV, total exposure to volatility was roughly $2 trillion, the highest ever. It was so fucking easy — even a retard could do it.

Now all of that has ended, spawning a new crisis for us to worry about and create melodramas about end of the world scenarios playing out. For now, I remain apocalyptic, but will smile every so often when stocks revert back to rigged upwards charging.

If you enjoy the content at iBankCoin, please follow us on Twitter

-230 = plunge? That is so January.

Damn right it is

Rest of sure, we are going higher tomorrow motherfuckers

Regards

Chuck Bennett

WRONG

Chuck is a lot of things. That motherfucker is not wrong

Up

Regards

Chuck Bennett

Nobody knows. If you, personally, controlled interest rates, banking, debt, oversight agencies, government and printed your own currency in which everything is denominated through the back door, you could and would make the market go any which way you’d want…up, down, sideway. Instead, we’re just guessing and betting.

Rest of sure?

Regards,

Pedant

ill leave the x i v thing for now

much exoneration

how(fucking)ever

These decentralized cloud storage guys have to get it together.

Storj has the best looking best laid out and documented site. Easy Windows/Mac ways to share your storage. No collateral requirements to do so. They also take Visa. But might not be as private as Sia?

Sia has the coolest OS for Raspberry Pi but sharing out your storage actually costs you at this point. It’s not worth it. So it doesn’t seem like it’s very encouraging to be part of the nodes to get this off the ground? Although it appears more private. Also penalizes you if you don’t have great uptime. And if you don’t re-up those Siacoins, your data is literally deleted from the cloud.

Some really really neat ideas. It’s just so immature I don’t see anybody but real hardcore people using this stuff. Nobody is bailing from Amazon, Microsoft, Dropbox, Sync for this. Not yet anyway. Maybe they’ll get bought up and the technology (privacy aspects) could be used by a bigger corporation?

I’m still thinking no major corp wants to have decentralized nodes with no clue what’s on them and no way if served with a warrant to unlock it. Just seems like any reputable company would steer clear.

But the underlying tech is so cool!

#HODL

No doubt the tech has potential but a metric shit ton of these ideas will crash and burn. We need faster computers and faster internet first. Not happening any time soon with intel and isp monopolies.

This market makes me want to write again. Just like the good ole days of 07 and 08 when ibc led the cds implosion for months with cutting edge insight and mad technical skills. And bear markets are great for traffic!

Fuck Trump.

Fuck this market.

CANNOT WAIT to see a 10% crash when Mueller et al. grand-jury that motherfucker and his klan.

Please hold your breath while you wait. It’s much better that way when it all happens.

It’s the total detachment from reality that is reflected in uniformed opinions like this, that tells me we’re in deep trouble.

It does not bode well for what should be an informed electorate.

Go jack off to Fox News and go to bed, grandpa.

rofl you seriously thing still mueller is working on indicting trump ??? ROFLLLLLLLLLLLLL . really

I suppose the xiv debacle will suffice for a left shoulder on what will be a yuuggge topping head. Bring it on

Govt screw up. 50 cent guy. Bitcoin futures and etfs? Why did they need to exist? It was unregulated for a reason. Notice right when those retard futures came out bitcoin got stomped. Hit its high the same day cme launched futures trading. go figure.

Lolz

Market will close green. The opening doesn’t matter anymore.

isn’t this the exact time to buy $VXX puts with everyone blowing up?

Now is a good time to Stop trading volatility products and leveraged ETFs. Be patient and wait for a good trade.

So we have a few speed bumps. It seems like the market wants to trend higher.

Big deal we have $6 spreads on VIX options. These ETFs/ETNs like $XIV are legally allowed to steal even the professionals money.

Oil is strange, though.

Fly, I am willing to make a concession. Not knowing about XIV extinction level is unforgivable. There’s a sub section of vol traders on Twitter that have been screaming about it for years. Check it out some time.

But…what NO ONE saw coming is VIX futures moving to a beta of 1 relative to VIX cash. It’s usually about 0.4. Extinction should have required about a 170% VIX spike. Even for people the most familiar with this space, no one imagined it’d only take a spike of 100%. That’s the true Black swan here.

I highly doubt no one imagined it. Not a single person thought all it would take is a 100% spike. Everyone is a fucking idiot apparently.

What was the cause of the spike? Nobody wants to talk about that? If people knew this could happen, they could profit from it, right?

If you know of someone that thought VIX futures beta could go to 1 feel free to point us in that direction. Standard models predicted ~170% spike would cause an 80% XIV drawdown. Predicting something orders of magnitude beyond anything that has ever happened is not something humans are very good at.

Just one of the many ZeroHedge articles about the danger with XIV:

https://www.zerohedge.com/news/2017-07-10/retail-investors-are-piling-most-dangerous-trade-world

Honestly, the stock market is so momentum driven nowadays, and big move in anything is multiplied. The lack of volatilty is more of a black swan (statistically speaking) than the volatiltiy spike. How many professional traders would have taken the under in predicting the VIX would stay below 20 in the 2017 after Trump got elected?

Lots of people said it would happen eventually. Me included. The article you linked to mentions nothing about a change in VIX futures beta. It just vaguely states “when vix and vix futures double.”

There has never been an instance where VIX futures went up the same amount as VIX cash.

“We think it’s especially interesting that there is now more XIV trading than VXX, perhaps pointing to the growing interest in shorting volatility among retail [investors] and others who are not specialists in volatility trading,..One big thing that we’ve been highlighting is that this product can actually go to zero…Right now the VIX is around 12 — just think of a scenario that takes the VIX from 12 to 20-plus in a single day. It’s not impossible. In that case the XIV could easily go to zero”

– Pravit Chintawongvanich, head of derivatives strategy at Macro Risk Advisors

(from the ZeroHedge Article)

Short YM from 24800 on up. Easy money right here.

Took 50 points of profit and calling it a night.

i do feel bad for those who jumped in near the end of the trading day, expecting things to subside significantly when cooler heads prevailed and the Vix shot down overnight and into the next day. Only to see their money disappear after hours. serious flaw there. But little pity for ‘professional managers” who buy vxx and inverse etfs and etns, or leveraged oil or inverse oil plays, as long term hold with little knowledge of contango, backward action, and premium erosion. Hold UNG for 5 years and if nat gas was at 3 when you bought it, and is at 3 5 years later, you will shockingly not be anywhere near your buy price more likely 60% down. These are all 1,2 or 3 day trades, with known enormous risks. So no tears for reckless idiot “money managers” front-running your readers into crypto black jack or low cap momentum names. Your money managing abilities have escaped you or you are just throwing dice.

$xiv could be a good DAY trade , that day before 2 20 , keep an eye open

lack of liquidity / volatility / compressed trade range , means also a lot of easy speculative plays .. on products that are not heavy liquidity managed. that will repeat soon .

the major corraction points are ( very easy…) qqq 150 , 132 , 125.

don’t know if it goes there tomorrow or 2019 , more likely later then soon , but it goes there

lot of money to be made on it and recoup

econmy is apeak , big tech earnings friday gave some signal ………..