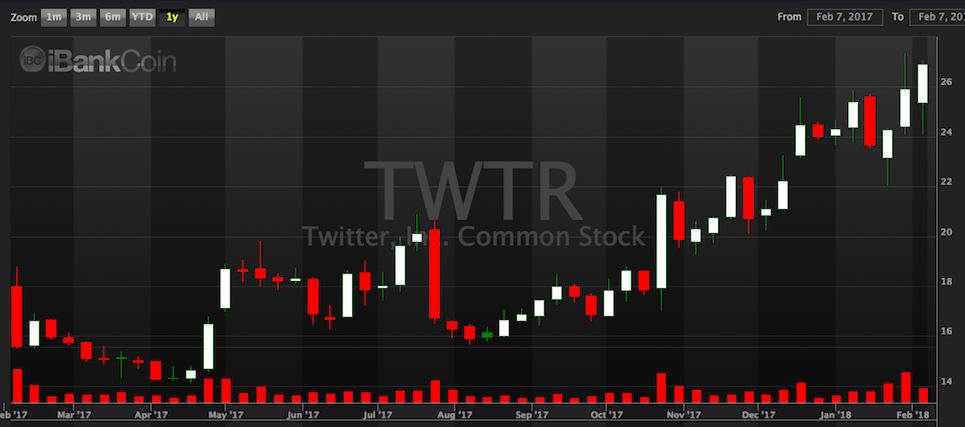

I think it’s fair to say Jack Dorsey has finally proven himself to be a fine CEO, running two companies at once and creating massive amounts of shareholder value for both.

Shares of TWTR are higher by 23% this morning, after reporting solid results — achieving GAAP profitability for the first time in company history.

Jack’s other company, Square, is up 384% over the past two years. After today’s jump in Twitter, that stock will be up more than 100% the past year.

Twitter beats by $0.05, beats on revs; Achieved GAAP profitability for first time ever (26.91)

Reports Q4 (Dec) earnings of $0.19 per share, excluding non-recurring items, $0.05 better than the Capital IQ Consensus of $0.14; revenues rose 2.0% year/year to $731.6 mln vs the $686.12 mln Capital IQ Consensus.

Advertising revenue totaled $644 million, an increase of 1% year-over-year.

O&O advertising revenue totaled $593 million, an increase of 7% year-over-year.

Data licensing and other revenue totaled $87 million, an increase of 10% year-over-year. o US revenue totaled $406 million, a decrease of 8% year-over-year.

International revenue totaled $326 million, an increase of 17% year-over-year.

Total ad engagements were up 75% year-over-year.

Cost per engagement (CPE) was down 42% year-over-year.Q4 adjusted EBITDA of $308 million, an increase of 43% year-over-year, representing an adjusted EBITDA margin of 42%, highest adjusted EBITDA margin to date and within long-term target range of 40-45%.

Users:

Average monthly active usage (MAU) was 330 million for Q4, an increase of 4% year-over-year and flat compared to the previous quarter.

Daily active usage grew 12% year-over-year.

Achieved GAAP profitability for the first time and delivered highest ever GAAP net income, adjusted EBITDA, and adjusted EBITDA margins in Q4. GAAP net income in Q4 reached $91 million with adjusted EBITDA of $308 million.Outlook

Q1:

Adjusted EBITDA to be between $185 million and $205 million;

Adjusted EBITDA margin to be between 33% and 34%;

Stock-based compensation expense to be in the range of $100 million to $110 million.

FY2018:

Stock-based compensation expense to be in the range of $350 million to $450 million;

Capital expenditures to be between $375 million and $450 million.

Conversely, shares of YELP are lower by 11% on disappointing earnings. However, more or less, the social networking space is on fire, especially after SNAP set the tone yesterday with a 46% jump on better than expected results.

If you enjoy the content at iBankCoin, please follow us on Twitter

Fly — you will be interested in this if you haven’t already read it.

http://www.cmlviz.com/cmld3b/index.php?number=11930&app=news&cml_article_id=20180206_the-astonishing-story-behind-what-really-happened-to-xiv

Trump is the best thing that ever happened to Twatter. Ban Trump and stock goes into the shitter. Why do ppl even click on those shitty ads is beyond me. All one needs can be found on pornhub.