I’ve long advocated for lower rates — due to the lack of inflation. But there’s another dynamic at play here, one that supersedes traditional laws of economics and it has to do with the Federal Reserve unwinding its balance sheet.

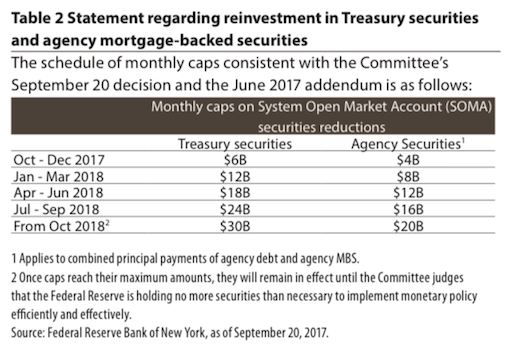

As you know, the Fed is in the process of unwinding its $4.5 trillion balance sheet, albeit slowly. But we’re going from increasing money supply from ~$50b+ per month to negative, accelerating rapidly by October of this year. This is bound to have a profound affect on markets, in ways that I am unsure — at this present time.

The Fed’s plan is to unwind its balance sheet over a period of 4-6 years, hardly reasonable considering there might be a recession or two along the way. No?

I often taken contrarian bets, but in this case I am going with the herd, following the sheeple to fade treasuries — 3X mind you, buying TMV here.

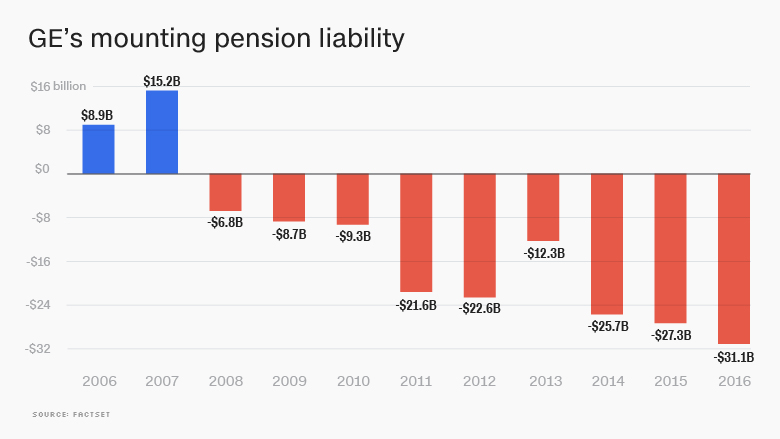

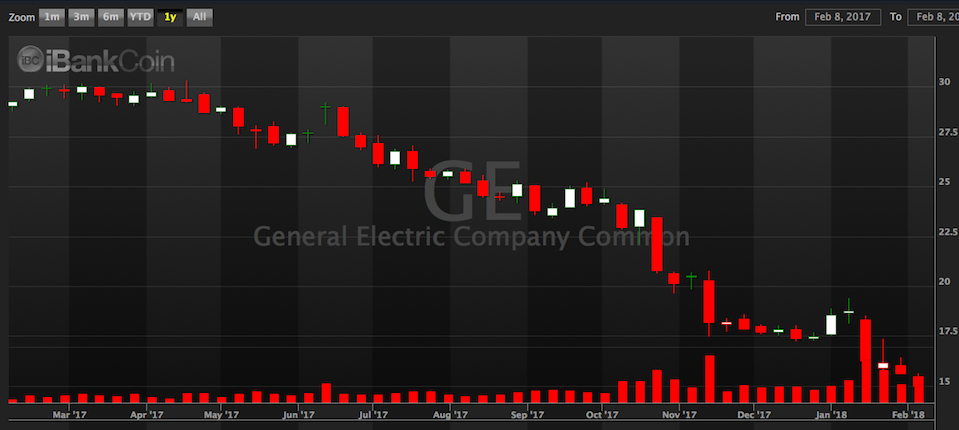

Also, watch GE for sport. The lower their share prices goes, the more dastardly their $31 billion underfunded pension becomes. It’s like a negative feedback loop that worsens with every tick lower for the stock.

Shares of GE are down a staggering 50% over the past year. Jeff Immelt REKT.

The Dow is off by 123, not really a big deal. I wouldn’t be surprised to see it down 500 or up 300.

If you enjoy the content at iBankCoin, please follow us on Twitter

Your lack of patriotism is disturbing.

Thank you.

ur gonna find urself on the wrong sidea the wall there pal

I’ll be like Kenny Powers in the Mexican baseball league.

and then the marxists will let him right back in thru the rear cuz those who bet against america are their assets

GE don’t bottom until it’s booted from the DJIA and replaced by the CIA, I mean Bezos, uh I mean AMZN

Have a look at Dunn Capital (MFTFX). Long time managed futures shop (sans the Dunn these days…) down a cool 19% this month. Non correlated to S&P500 and bonds blahblahblah…

The lows must be tested!

Get into this murder hole.

I sold that the open. Looking to book my ticket for Bogota or Cartagena now.

Be good

Regards

Chuck Bennett

Cartagena is awesome.

motherfucking chuckie was wrong,….

devil /el diablo is on his way for you in Cartagena,………..

Good luck, but this will go UP if market really cracks. It may be a late short unless you plan on holding for a long time.

Meaning TLT will go up if market really tanks

I know. TMV works under a truly grim scenario.

For ordinary downside I am long SOXS

Your thesis is substantially correct, but it argues for long, not short, 10-30y treasuries. You think the fed is going to raise into a meltdown? They’ll cut, faithfully following the 90 day tbill, as always. $IRX isn’t going down much yet, but it will.

I hope and pray that piece of shit binance blows up and disappears, sort of like XIV

All margined up in OSTK @ 54.6. Bought more Ethereum @ $796

The Fed bought bonds from the banks and paid for them with reserves, which exist only in the interbank system. They have nothing to do with the real economy. The Fed will now sell bonds, and the cash received will be given to banks in exchange for the reserves used to buy the bonds in the first place.

There was and will be no net effect on private sector liquidity. QE and it’s unwinding are a simple asset swap. Almost a non-issue.

Prepare for the downvotes and fake news!

I’ve gone down this road here before. No one wants to hear such truths.

Screaming into a black hole I tell ya’

I’m used to it.

only conspiracy cranks know that’s the reality behind the window dressing

Good move on TMV.

In 2019, many savers will be thrilled they can buy a CD at 4%.

I always thought we’d still be at 0% when the next recession rolled around. Got that one wrong.

I’m so bored with the Fed’s balance sheet. It grows, it shrinks, blah blah blah. When are they gonna grow a pair and do something fun, like peg the 30 year to -5%.

I’m concerned with the 2% inflation target which is being viewed like Gospel. To make matters worse, I doubt that this administration is capable of managing interest rates based on inflation targeting, or any other aspect of our economy.

They say they care about these things, but do they? I can’t find the exact figures, but the Fed has basically never achieved their dual mandate. Based on the data, you’d have to conclude they either:

1. don’t care

2. are incompetent

3. it’s impossible using currently available methods.

4. some combo of 1-3

All the Fed was designed for was handling interbank payments, but Congress decided to impose the dual mandate. Not a bad idea entirely, but the Fed appears to have much less power than some give it credit for. But the mandate does give Congress something to hide behind. Just blame the Fed!

Smart fiscal policy would help. However.

that’s the window dressing we’re supposed to look at and criticize; not look behind it

A 2% inflation target is a cruel, slow torture on the wage-earnign class. The asset owning class doesn’t feel it, because their assets go up in price to mattch inflation.

As much as the FED expresses concern fo the wealth gap, their inflation targeting helps creates it.

Question: Did you buy TMV before or after you read the PROSPECTUS?

Awesome comment.

It’s here: http://direxioninvestments.onlineprospectus.net/DirexionInvestments//TMV/index.html?open=Statutory%20Prospectus

It’s 498 pages, but most concern other funds. Probabl

I skimmed it and didn’t notice an early termination clause. I did notice that it is NOT an ETN: this fund invests inactaul assets (aminly interest rate swaps). I would feel okay investing in this product – if I believed in the trade…

Awesome comment.

It’s here: http://direxioninvestments.onlineprospectus.net/DirexionInvestments//TMV/index.html?open=Statutory%20Prospectus

It’s 498 pages, but most concern other funds. I skimmed it and didn’t notice an early termination clause. I did notice that it is NOT an ETN: this fund invests in actual assets (mainly interest rate swaps). I would feel okay investing in this product for a short time (or its bullish sister, TMF), if I believed in the trade…

I made the mistake several years ago in making some trades in some commodity ETF/ETN.

Then I found out via their tax documents that they are actually structured as a limited partnership and they sent K-1s with some gains as long term, some short term, and some ordinary income. I traded it in and out a number of times with a few wash sales.

Never again!

Kind of late on betting against bonds. At some point, it will be a flght-to-safety trade. That said, the market is learning to live with the reality of higher rates (which is what this correction is about). I think we see a 15% correction across the indices before this is over.

taking out 4.5 Trillion out of the stellar economy we have going. cant be bad no. Im opitmistic. at least stocks will be cheap again.

It’s interesting that I’ve been thinking about the FED the last few days as well. In particular, I was wondering about the muted (or actually positively correlated) Treasury reaction to the stock market correction. If the FED wants to sell Treasuries, the last few days would have been an ideal time. At 4:30pm, I’ll have that answer.

I like your idea, but i think you are late to the punch bowl. Treasuries have already had several alrge downward moves recently. Alos, the market has already been spooked, so I think that will put a floor on them.

I don’t think it is reasonable to expect Treasury rates to go up because people like stocks that much more – we’re too high in the market and late in the cycle for that. Treasury rates will only go up if inflation expectations rise. However, if we actually get inlfation, then stocks will sell off, increasing bond demand. Look at inflation in 07-08. Also, remember that Tresury curves primarily flatten because long rates drop, not because short rate rise.

I want to see waht the FED’s been up to this last week, to see what their real plan is.

Yeah–this sell-off is good. Gets rid of all the degenerates that have flooded into the market.