I’ve traversed the landscape and all I see it chaos and ruin. Stocks are inexorably in a bear market and we’re gonna need a miracle to escape from a prolonged and retracted drawdown.

Just in the last the months — shares of our elite defense contractor Raytheon are down 30%. How are we supposed to finance global wars with the share price of our primary missile manufacturing struggling like this?

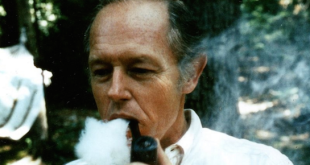

Here are some other ribald losses for you to think about whilst you smoke your estate pipes.

$NEE -34%

$SHOP-20%

$AMX -22%

$EL -28%

$TGT -21%

$F -22%

$FTNT -24%

$EW -23%

For the love of God — shares of $CHWY have collapsed to the tune of -53% in the last 3 month, threatening to deprive your beagles and hounds of the bones they so preciously adore.

I know your sentiment — “we are oversold, ergo, and this goes without saying — nothing drops like a fucking anchor to the bottom of the sea.” The thing is — we might not have a ship left to drop anchor in. We might need to escape in life rafts soon and leave the spoils for the endless hordes of migrants to punch, knife, and claw about in a meandering hellscape crafted by the demonic entities you so lovingly voted into office.

Comments »