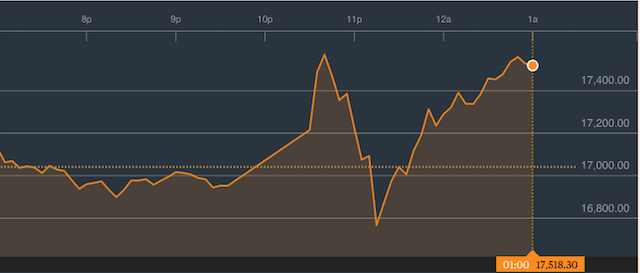

It was a solid day of short covering, on better than normal volume. Text books say we run another 2-3% before settling back in and down for a retest. Bear in mind, the currency wars aren’t done. As you enjoy the fruits of Fairy Stock Father’s labor and lavish yourselves with exorbitant gifts of degeneracy, remember the pain you felt last week–as your mind raced for ways to explain to your wife the sheer stupidity of your investment plan.

As for me, I wish I still had my 200% long SPY position. But a plan is a plan, and my sales are scheduled, etched in ancient tablets made from granite. I still have some exposure to SPY, 33% long with an additional 25% in TLT–which has done nothing but go higher. I will be selling the balance of my SPY position, as detailed in Exodus, on February 2nd.

FYI: The iBC online Boot Camp is right around the corner. Sign up now, before it’s too late!

Comments »