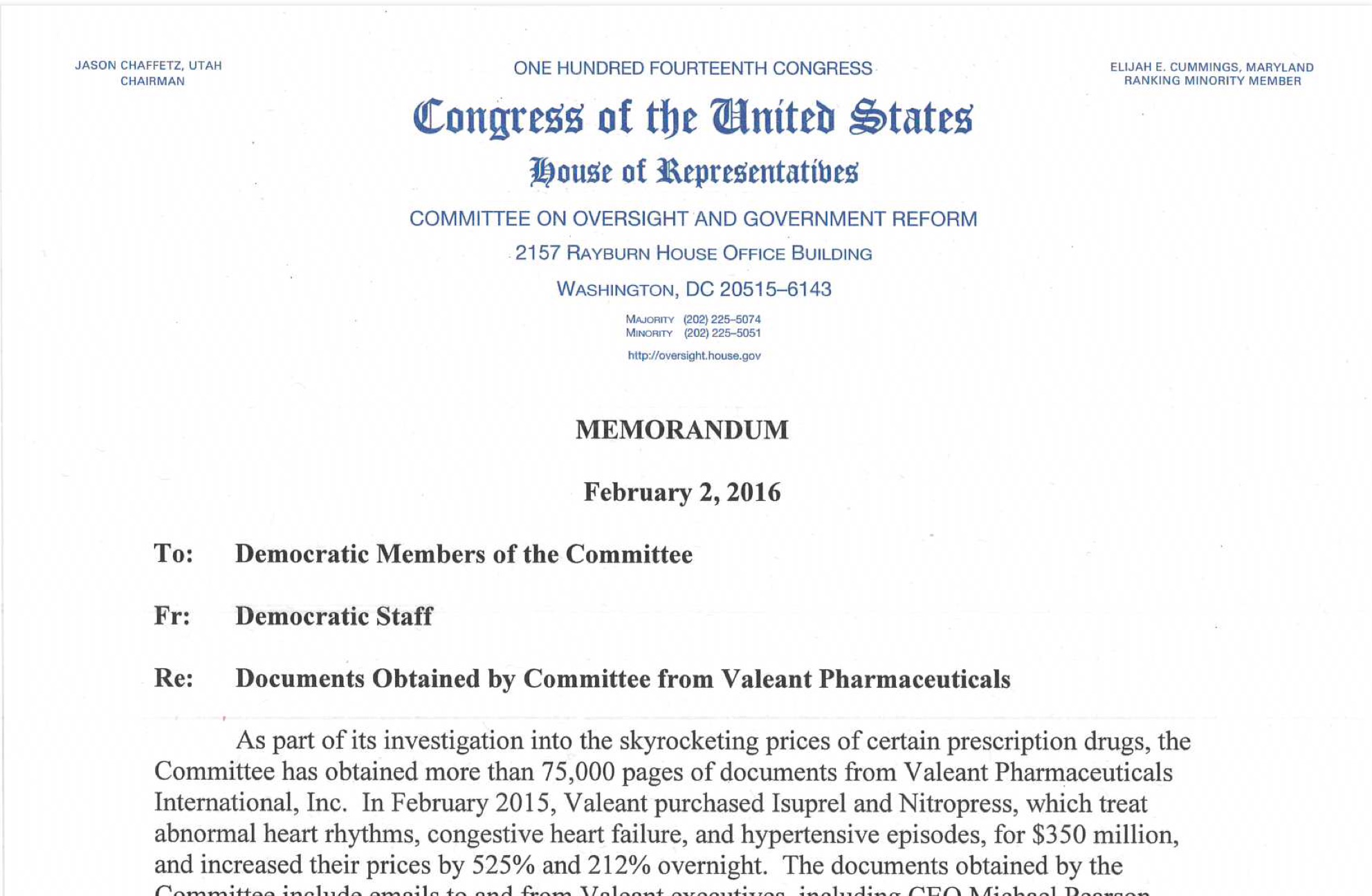

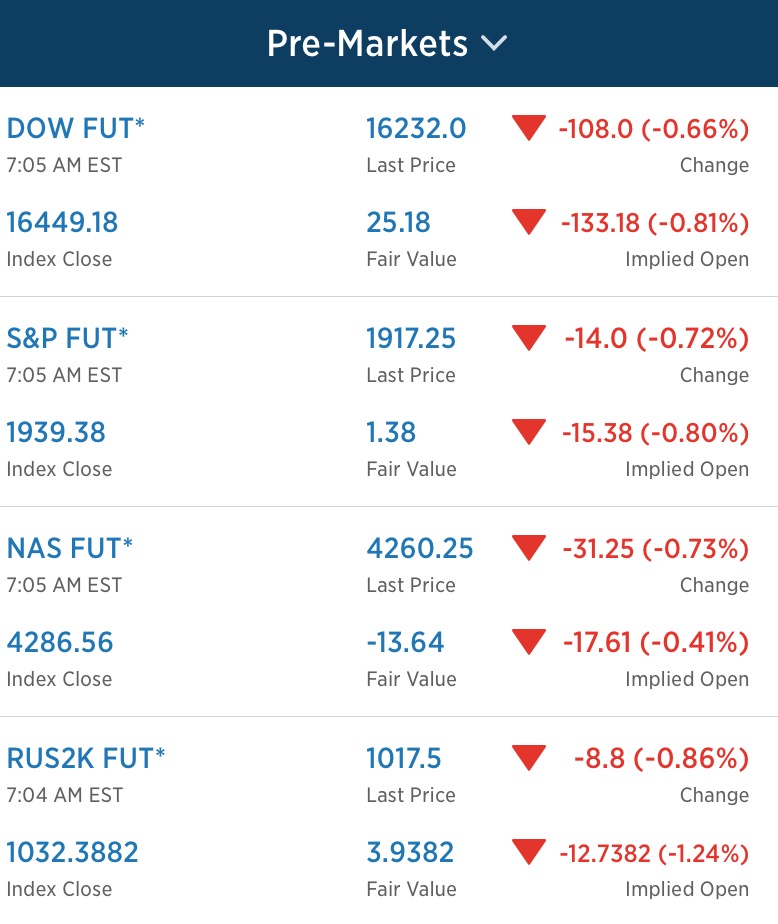

Shares of VRX are down more than $10, from an early morning surge, following a scathing memo from the Congressional Oversight Committe being released.

Access full document here.

In response to the letter, VRX is copping pleas, pointing to price cuts and all sorts of ‘good guy’ jargon.

We are also making overall changes to how we run our business. Under our recent partnership with Walgreens we will be offering 10% price reductions on some of our most popular drugs and up to 95% reductions for a large number of our branded drugs for which there is a generic alternative. Going forward, we expect our growth to be driven more by volume than by price.

When we set the price of any one drug, we do it in the overall context of our portfolio of approximately 1,800 products, including more than 200 prescription drugs in the United States, and the need to fund our robust companywide research and development programs, our expanding U.S. manufacturing base, and our patient assistance programs. In 2016, we expect to invest approximately $400 million on R&D, $484 million in expanding manufacturing in Rochester, NY, and $1 billion in our patient assistance programs that seek to ensure that out-of-pocket expenses do no prevent eligible patients from receiving medicines they need.

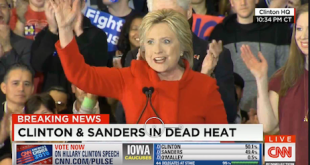

Should Bernie Sanders find his way into the White House, this stock is going to single digits.

It’s worth noting, however, the political climate has shifted mightily against big medicine in recent months. Both Trump and Clinton are supportive of healthcare reform that entails allowing government to negotiate with drug makers. This, of course, makes sense. From a drug makers point of view: the party might be ending soon.

Comments »