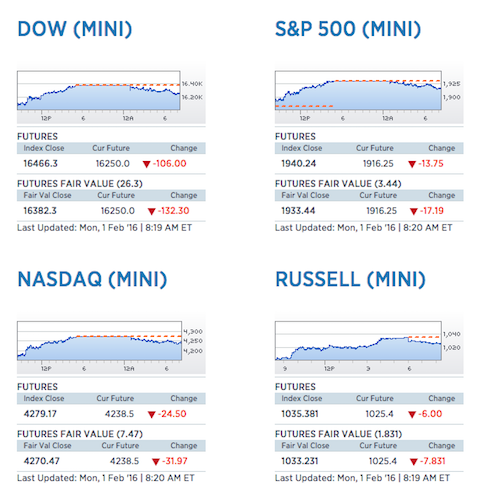

As society moves away from cash to paying for everything digitally, debt straddled governments are moving interest rates into negative territory. Essentially, this is a brazen tax being levied onto the public–to better perpetuate a false sense of stability in government balance sheets. By charging you to borrow your money, basic laws of nature and decency are are being egregiously discarded and burned at the altar of the banks. Eventually, the world spits out the crooked and the corrupt and replaces them with newer, less belligerent, forms of crooked and corrupt gentlemen. This is how the world has worked for thousands of years–yet we still have never landed on the moon.

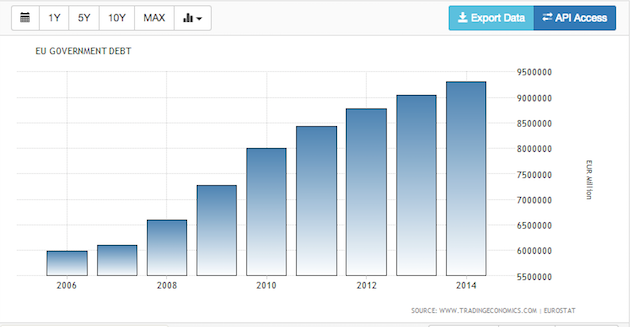

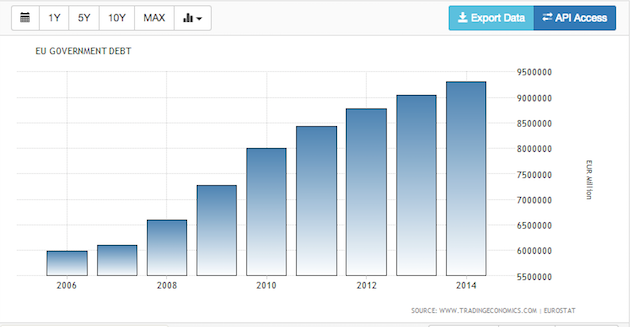

At the present, more than $5.5 trillion in government bonds are trading with a negative yield. Theoretically, the more governments borrow, the more they make!

How splendid.

This is a very depraved and sordid scandal in the making that will end up with people in the streets with kerosine lanterns and pitched forks.

Here is a list of nations with negative 2yr bond yields, as well as nations approaching negative territory.

Austria -0.41% (85% debt/gdp)

Belgium -0.39% (106% debt/gdp)

Czech -0.09% (41% debt/gdp)

Denmark -0.21% (45% debt/gdp)

Finland -0.41% (59% debt/gdp)

France -0.38% (95% debt/gdp)

Germany -0.48% (75% debt/gdp)

Ireland -0.26% (110% debt/gdp)

Italy 0.01% (132% debt/gdp)

Japan -0.11% (230% debt/gdp)

Netherlands -0.44% (69% debt/gdp)

Slovakia 0.01% (54% debt/gdp)

Spain 0.01% (98% debt/gdp)

Sweden -0.55% (44% debt/gdp)

Switzerland -0.94% (up to 15yr durations now trading with negative yields) (34% debt/gdp)

United States 0.77% (102% debt/gdp)

The only nations with government budget surpluses were Denmark and Germany, with Switzerland coming in at -0.10%. Everyone else is spending more than they’re taking in–like sailors of the drunken varietal.

Comments »