I am unsure as to the extent of the sell off. However, I do know that U.S. bonds are infinitely more attractive than Irish bonds, which are now trading with negative yields up to 5 yr durations. Because of the spread between treasuries and EU bonds, I am bullish on long dated treasuries and will hold my TLT position until the spread narrows enough to give me a calm normality about the whole damned situation.

Inside of Exodus, I’ve dedicated my trading to just playing the oversold signals. I’ve also have implemented an unprecedented transparency with my trades, in order to give members a clear view of how I use the system.

Early this morning, I closed out my final tranche in SPY, which was purchased exactly 10 trading days ago at $185 ish. Here is my Exodus blog post from this morning.

I sold my last piece of SPY at $191.80 for a profit of $864.

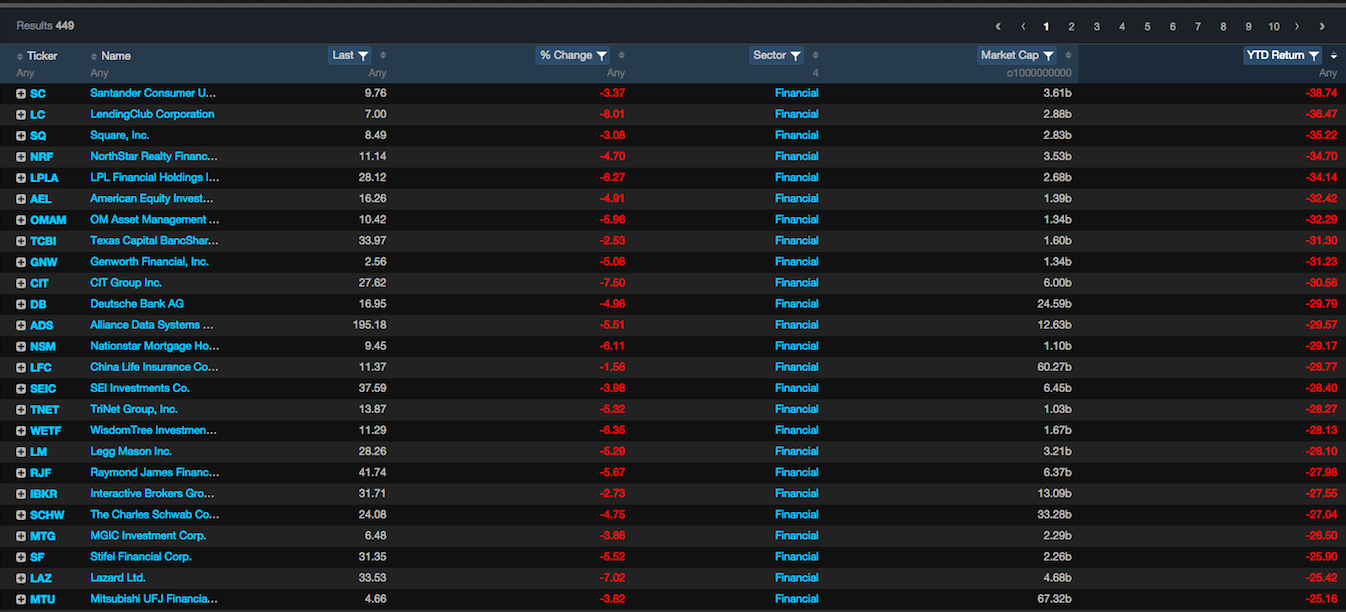

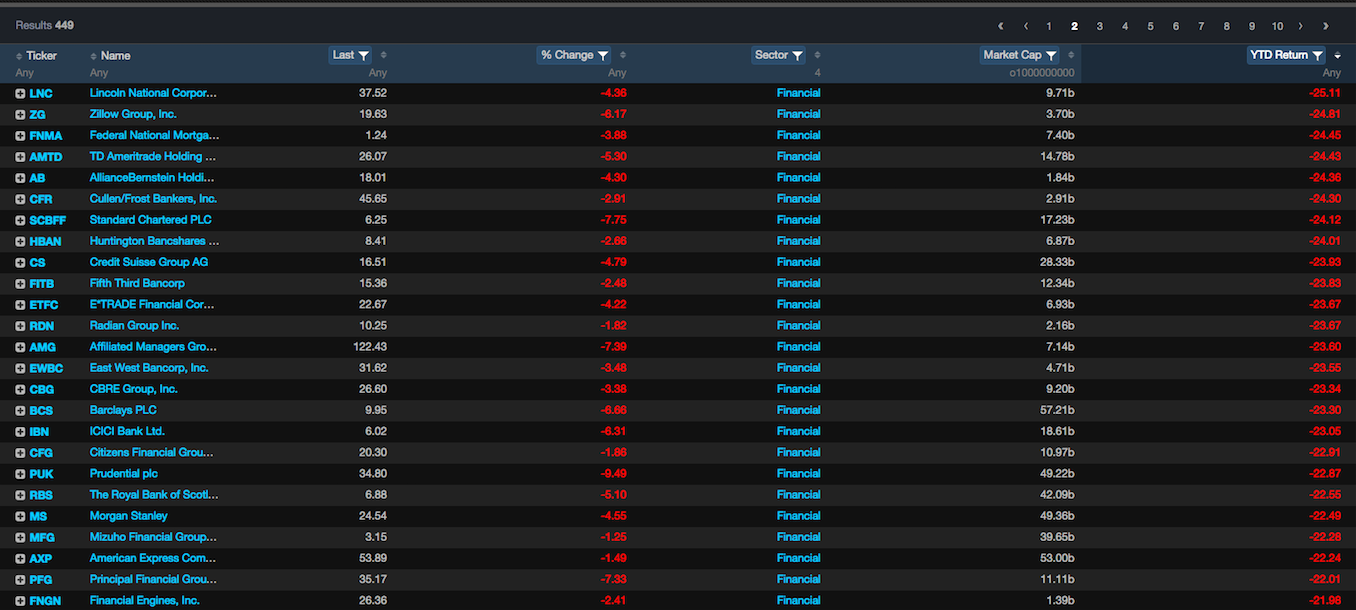

Here is my year to date update.

I am about 75% cash and 25% TLT. My SPY purchases, 6 in total, ended up losing me $4,105.67 on a theoretical $100k portfolio, or 4.1%. Remember, those losses are higher because I was 200% levered SPY at the time of my 6th purchase. To date, my TLT position (207 shares) is up $8.58 from a basis of $120.42 or 7.12%–for a monetary gain of $1,776.06 (basis adjusted for 2/1 divvy of 0.24 paid).

Year to date, my net loss is 2.32%.

Although disappointing, the -2.32% is a very easy number to make up. With Exodus armed with the new stress levels in the market, I am confident in future success trading the oversold signals. It’s important to note my choice of investment is SPY. I chose it because I was bearish on stocks and wanted something that offered a modicum of safety, when playing the long side.

Going forward

I have zero equity exposure, only long TLT, which is looking like a pretty good bet considering the current mood.

In case you’re wondering, for the sake of simplicity, I started this account with $100k and will be updating it as the year progresses.

In summary, I have zero equity exposure and think the market trades lower. I will, however, trade extreme levels and attempt to catch inflection points–using SPY. Although the recent spate of SPY purchases ended up losing me money, I am confident in the intuitive nature of our algorithms to better adjust to this tape, going forward. The very nature of the algorithms is to adjust to market environments and learn from them. For example, a few weeks ago, today’s closing level of 2.40 would’ve been considered Oversold. But the threshold is lower now and Exodus is suggesting to chill, eat sandwiches, and wait for lower prices.

That’s exactly what I intend to do.

Comments »