The S&P 500 closed at new and fresh and fantastic all time highs. Just two weeks removed from the devilish BREXIT vote, markets have, seemingly, erected itself upon a new petard and has skyrocketed in kind. All of the fear has been reduced to ash. Short sellers have been castrated and kicked into perimeter drains for all the world to see.

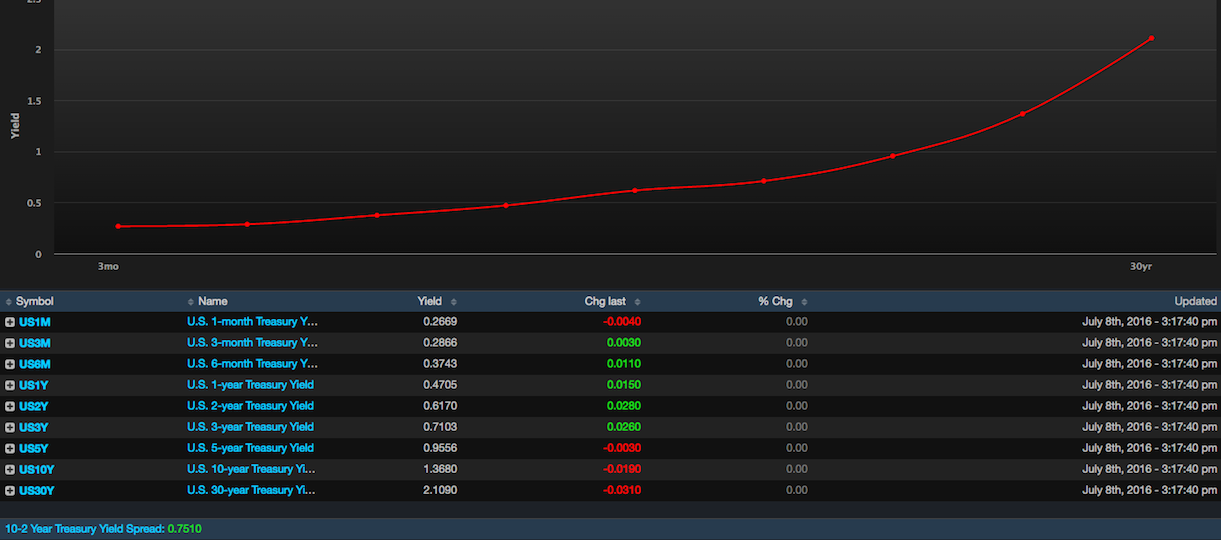

In spite of this robust American sledgehammer of an economy, the Federal Reserve remains idled, unable to move for fear of upsetting markets.

German 10yr bunds are yielding close to -0.20% and the entirety of the Swiss curve, all the way out to 50 years, is negative. All of these things are, of course, great news for equity holders.

All of the banks are mired in some sort of purgatory, eagerly awaiting for this glorious bull market to spread its tentacles to every crevice of the market.

Congrats!