The inversion of the yield curve has predicted every recession since the beginning of time, dating back a whole 6,000 years–according to my King James bible. Today’s jobs report was so fantastic, it caused a frantic circle jerking run to the upside. People are stampeding over one another to get a piece of the pie, like greedy little gluttons trapped in a house made from chocolate bars.

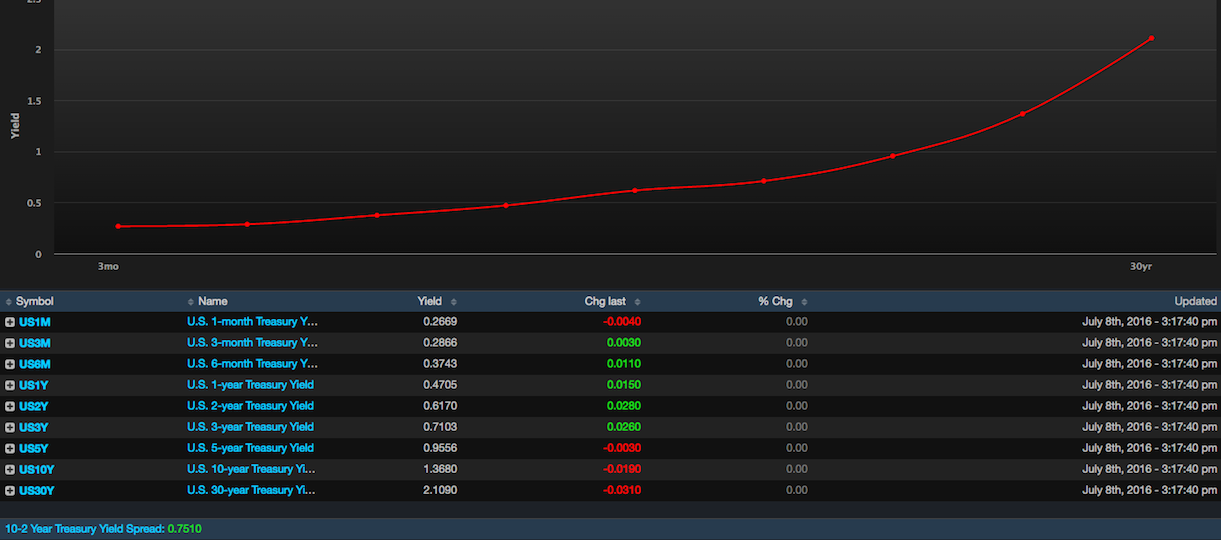

But then I swing on over to the bond page in Exodus and bear witness to our beloved yield curve, shrinking to new lows–now just 75 bps.

The smart money says otherwise. This is your Braveheart moment. Observe.

If you enjoy the content at iBankCoin, please follow us on Twitter

I do have to admit the employment number “saves the day” for the fed so many times its getting comical

Does the employment number take into account part time vs full time employment? Reason I ask is that it looks like anyone who’s anyone is about to convert all full time hourly employees to part time.

Yes, part time and temporary workers are counted as employed. The BLS typically contacts about 60k people each month to form their “sampling” statistic.

Meaning no. They are each counted as: 1.

Part-time workers are not counted in the U-3 number but are in the U-6 number which accounts for everyone 16 and over and not in jail/mental house or armed forces.

These are not normal times with so much sovereign debt now at negative yield. Might not the yield curve be driven down by a global thirst for “safe yield” rather than impending recession? Recession will come but not until the crazed rate raisers at the Fed get their way.

Yes, the yield curve might indeed be driven down by a global thirst for “safe yield” rather than impending recession. In fact, it is.

The perfect indicator of an upcoming recession is not perfect any more.

That’s the trouble with perfect indicators. At some point they cease to be perfect.

Try to think a bit deeper: why do investors flee for safety? When they think the economy is doing great, companies will expand earnings, and stocks will do well?

Before dismissing the “inverted curve” recession indicator, you should at least wait for it to fully invert and then go back to normal without a recession occuring.

Yes, perhaps we should wait before giving up on it entirely.

I was looking for some recent articles on this, and found this one here by the Cleveland Fed. Interesting.

The Yield Curve and Predicted GDP Growth, May 2016

https://www.clevelandfed.org/our-research/indicators-and-data/yield-curve-and-gdp-growth.aspx

What I find particularly interesting is the short term rates are moving up… Today 1m LIBOR hit a new 7-year high of .4758%, 3m LIBOR rose to .6671%, and 6m LIBOR rose to .9374%.

Now, 30day LIBOR at 48bps is still very low. However, it is a 7-year high. Nobody talking about this yet.

Do you have a guess as to why this is? Does you think it has to do with Brexit, or Europe in general, since it measures inter-bank borrowing costs of London banks?

Today’s trade number of the day: 17

Consecutive weeks of

O u t f l o w s

[Check your head if you

think it’s not

being propped]

So if the 10 year goes to zero or perhaps even negative next week, looks like TLT would be $200 or so.

And yet the English did take their freedom and now in the Year of Our Lord 2016 refuse to give it back when Scotland wants to join the EU.

Scotland has not had freedom since 1707. Not a good comparison.

Scotland gets no freedom buddy. Reality is, they will be more free under the Anglish than the EU overlords.

Regards

Chuck Bennett

I say God bless the United Kingdom. The voters chose freedom. Let it be so.

Dr. Fly – they’ve discovered your King James bible is missing about 20 books. http://www.ancient-origine.com/ethiopian-bible-oldest-complete-bible-earth/

Maybe inverted yield curves didn’t precede a crash or two in some of the missing verses?

It’s just the Apocrypha and the book of Enoch. No big deal. https://carm.org/why-apocrypha-not-in-bible

…not a big deal until you find out God was talking about predictive inverted yield curves in those discarded books.

lol

It’s a thing of beauty

I am short ES. Tired of seeing these signs over and over and not taking advantage of it. MY TIME IS NOW!

Me too. Long SH with half of portfolio and long gold/silver minors with the other half. Killing it so far this year.

Because you live in northern NJ, never leave your home and don’t know what’s going on in the world but what u see on CNBC or the rich dentist who lives next door (#me). You pick and chose what you post based on what people pay to click. It works, I admire your biz model, get some.

#banned. Just a prediction

You survive to give even more serious douche chills, that’s my prediction.

Is the inverted yield curve narrative possibly broken because of negative rates? Everybody knows that everybody knows that an inverted yield curve has predicted a recession since the beginning of time—until it’s no longer true. We are in uncharted waters.