*** JOIN THE LEAGUE OF DISTINGUISHED GENTS, FREE FOR 7 DAYS (only email required) ***

Live by the Sharpe, die by it.

Futures are lower this evening on more good and fun trade war news.

With the extra funds raised by these taxes, I hope Trump uses them to completely destroy Asia.

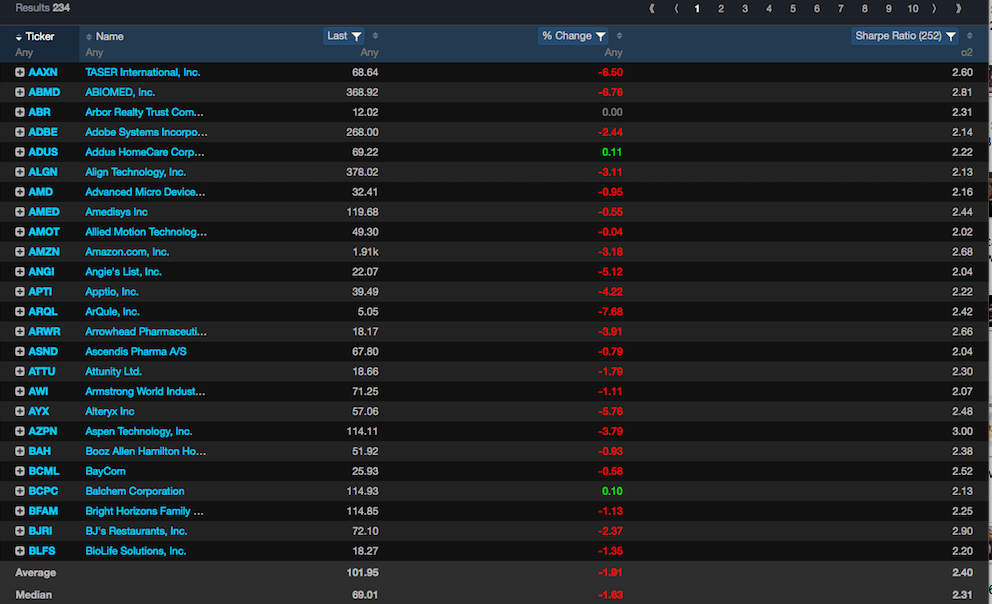

In case you’re wondering how high Sharpe stocks did today, lo and behold this fucked up fuckery.

High Sharpe’s hammered.

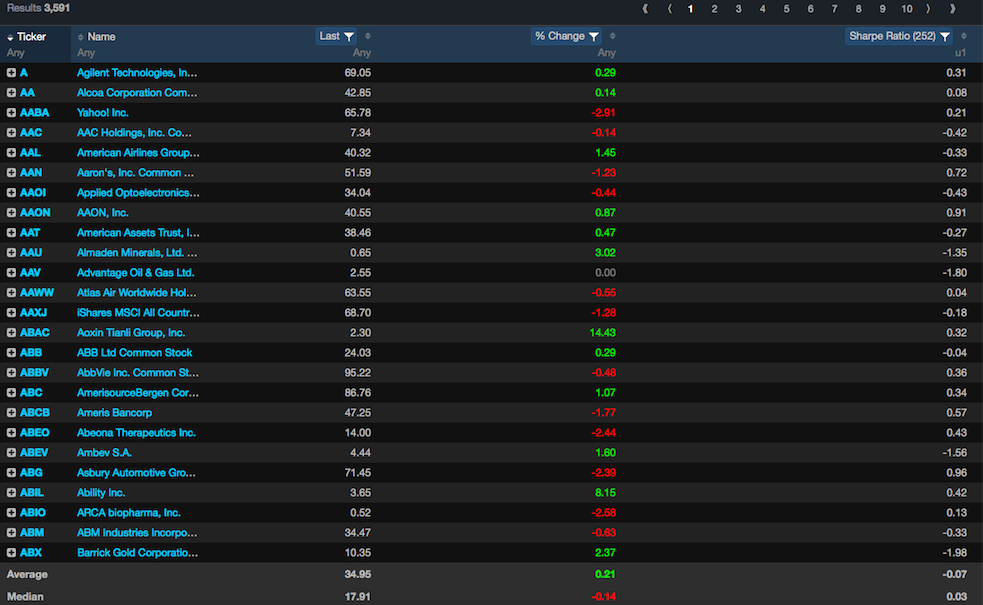

Low Sharpe’s, consisting of thousands of stocks, nothing.

Need a quick life hack to rotate out of stocks getting drilled? Low Sharpes.

If you enjoy the content at iBankCoin, please follow us on Twitter

Wow, who could have predicted that:

“To add to the previous discussion, I’ll just point out that looking at the Sharpe ratio for individual stocks is not just pointless, but actually misleading in a trending market. You might as well just look at straight performance because the two will be strongly correlated.”

– NumbersGame, April 4, 2018

http://ibankcoin.com/flyblog/2018/04/04/advisorfags-get-sharpe-ratios-added-exodus/#comment-548601

https://ibankcoin.com/flyblog/2018/07/30/advisors-btfo-stocks-highest-sharpes-getting-crushed/

This is the same reason that Index funds outperform active fund manager in a trending *bull* market: as a stock hits astronomical PE ratios, the index funds double-down on them because they have higher market caps relative to value-priced stocks with lower PEs and lower market caps.

In a non-trending market, the Sharpe ratio on individual stocks would be very useful indeed. In the longest bull market of all time with Central Banks flooding liquidity? Not so much.

Congrats on managing to write a lot of words but offer little to no value.