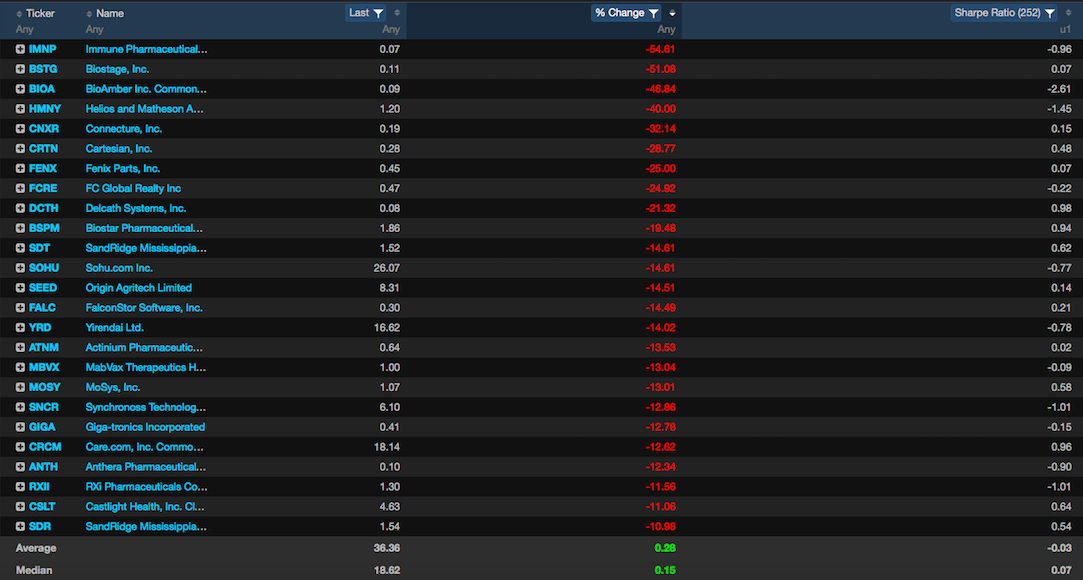

Here’s a very interesting screen that I ran in Exodus. I simply searched for intra-day returns of stocks with Sharpe ratios above 1 and under 1. For those unfamiliar, a Sharpe ratio is the risk adjusted return divided by standard deviation. In the investment advisor world, it is the crown jewel of metrics and many advisors base their entire practice around this singular data point.

Look at the divergence.

The best explanation I can offer is advisors are blowing out of positions and underowned stocks and sectors are being bought. There were a lot of crowded trades and now they’re unwinding. This is the downside to big data and everyone knowing which stocks are the best in seconds. When the trade ends or is paused, everyone tries to exit at the same time. In the past, we’d refer to these stocks as ‘hedge fund hotels’ — but now the field is dominated by series 65 retards and their reverse churning methods.

If you enjoy the content at iBankCoin, please follow us on Twitter