I mean this in this post disrespectful way imaginable: no one gives a shit about Italian bond yields, till meatballs bounce. Also, the Turks have never been more fucked than they are now — and that’s a fact.

Turkey’s Lira blowing out to record lows.

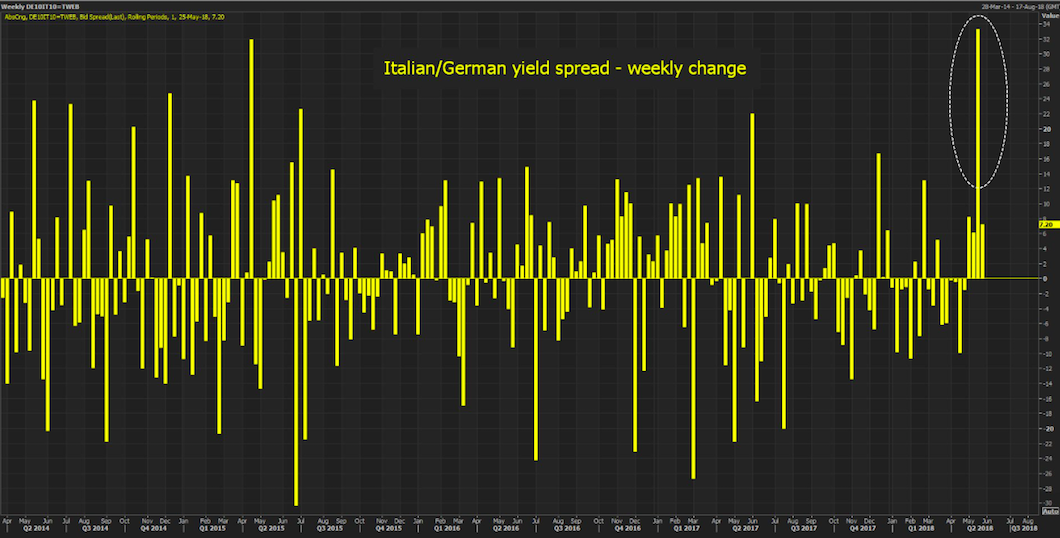

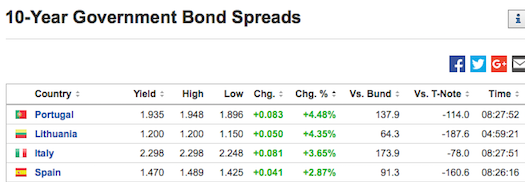

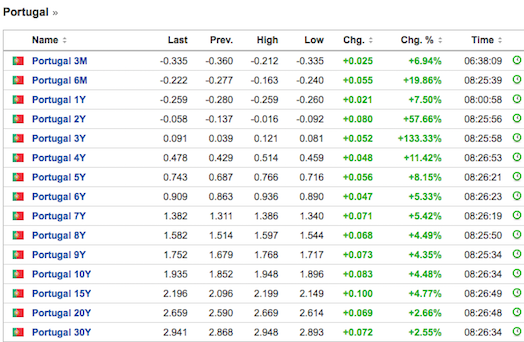

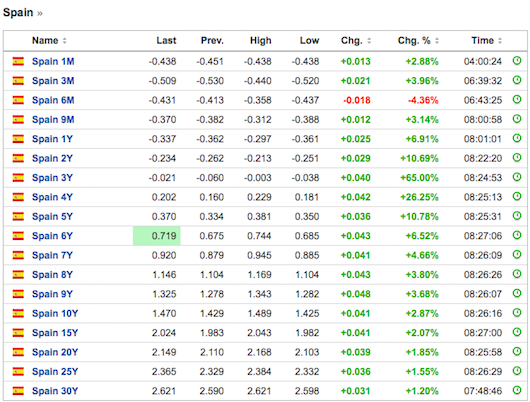

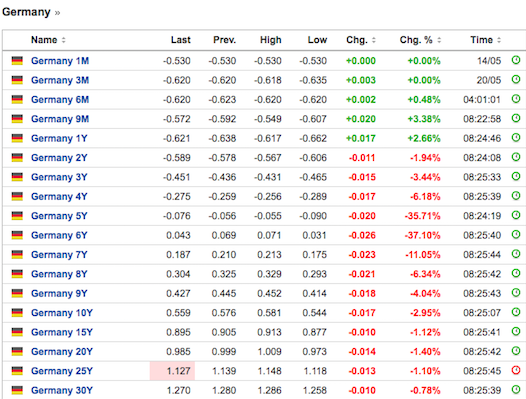

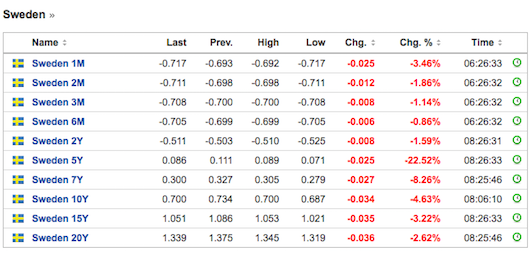

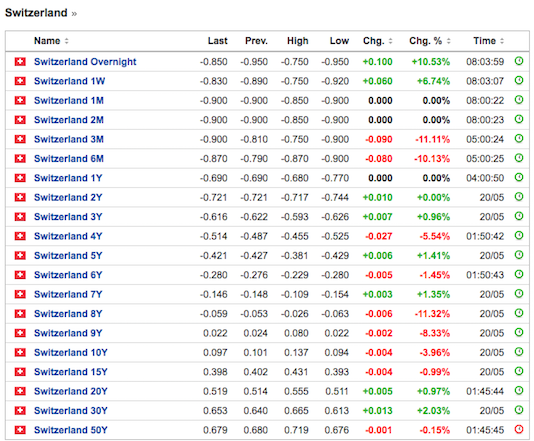

Back to Italy. Everyone is making such a big deal over the fact that Italy has the most debt in Europe, and is entirely fucked long term, and now rates are skyrocketing higher. Not only that, the German-Italian spread is bloooooowing the fuck out. Not only that, the contagion is spreading to the other PIGS, mainly Portugal, Spain and Ireland. French yields are edging higher too — ECB crisis style, amidst sharply lower yields for the good balanced sheet Eurocucks.

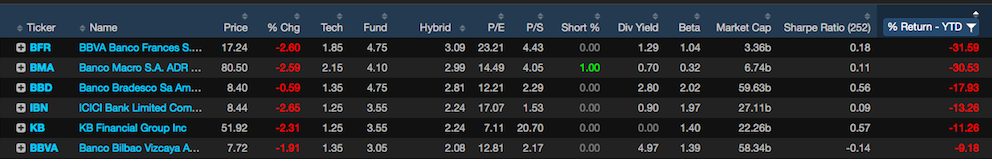

So if you look closely at the set of metrics above — it bodes poorly for the overall health of the ECB. In theory, the ECB is supposed to be this giant block of nations, all for one and one for all. But we’ve seen the balkanization of the alliance in numerous occasions, only mended together by unchecked spending and balance sheet rejiggering — subjugating the Germans to the debtFAGS represented by the PIGS (Portugal, Italy, Greece, Spain).

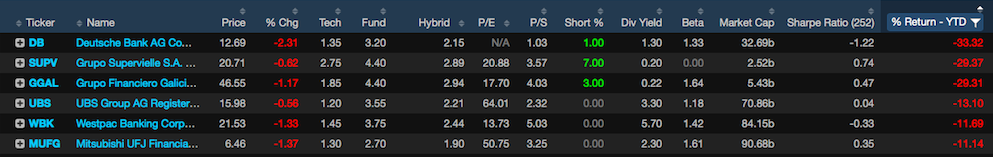

The devious trick is getting you, the unwashed hamburger eater, believing this is going to lead to another black swan event — sending stocks tumbling lower. After all, Argentina is collapsing, foreign banks are getting hammered, and our consumer cyclicals and other old man stocks are getting blown out — all due to this new paradigm that demands higher rates because of some imaginary inflation risk.

On paper, I should be bearish. But my muscle memory over the past 10 years demands that I chalk this crisis up to more nothing — a mere way station on the path to even more hedonism and even more riches. It’s easy to get bearish — because logic demands that we should be worried about things like math and human emotion. However, at least for now and until proven otherwise, the prevailing emotion is greed through higher prices.

Plus, we got the fictitious China trade war figured out now.

“I think we’ve made very meaningful progress,” he told CNBC’s “Squawk Box.” “Now it’s up to both of us to make sure that we can implement it. We came away with a very comprehensive framework agreement that needs to be implemented, but has lots of different aspects,” he said. Asked by CNBC’s Becky Quick whether investors should view his comments over the weekend that a trade war has been put on hold as a glass half-full or half-empty scenario, Mnuchin said, “It’s completely half-full.”

Futures are +228. Happy Monday.

If you enjoy the content at iBankCoin, please follow us on Twitter

Time for Turkey to give back Constantinople.

f**** the EU-dictatorship, sideways, any ways, every which ways and then do it some more