The damages inflicted upon Houston will cost upwards of $50 billion. The fact that only 10 people have died from the storm is truly amazing, considering the widespread damage. Bear in mind, Houston is not a place where flooding is supposed to happen.

Unlike Katrina, where most citizens in the afflicted areas were insured, only 20% of the people hit by the flooding have flood insurance. This is going to be a GIGANTIC boon for insurance companies in the future, who will descend upon Texas like the wrath of God — scaring them into buying flood insurance. In the meantime, construction related stocks are moving higher, in anticipation of the rebuilding efforts.

You want to own Texas based companies, for obvious reasons. STRL is being gobbled up by greedy investors, up 25% over the past week.

Florida based engineering firm, NVEE, is moving higher — due to their expertise in flood related pollution.

Houston wire and cable (HWCC) has enjoyed a 17% weekly run, thanks to the vast amount of infrastructure damage done to the region.

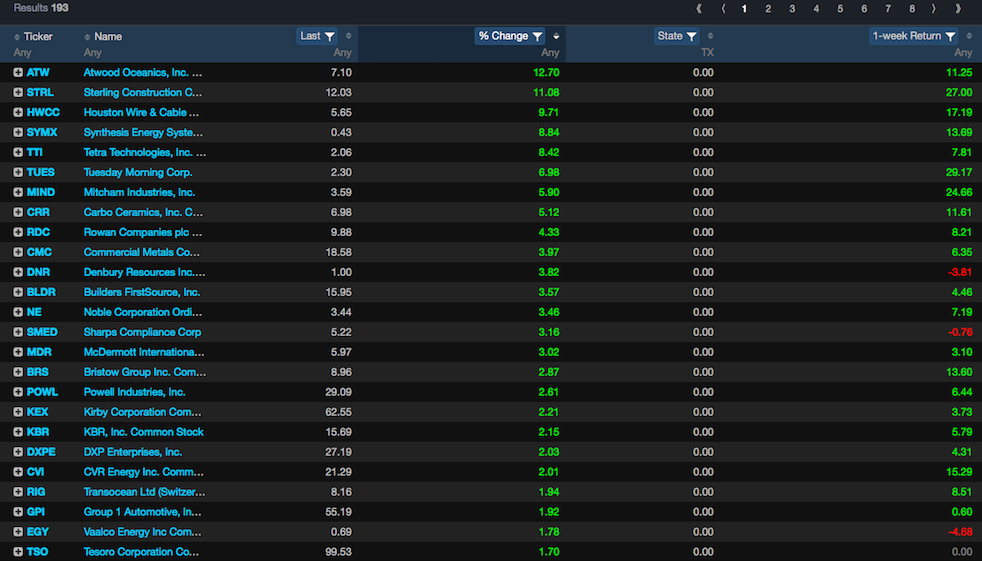

According to Exodus, there are 193 publicly traded companies based on Texas. Here are today’s top performers.

Having traded through several natural disasters, I can tell you that this hype will soon fade. The infrastructure and sheet rock story gets old fast. But what lasts are the changes made to the region, such as a brand new customer base for insurance outfits.

One should presume PGR will see more flood insurance policies thanks to Harvey, as well as TRV, MET, AIZ and ALL.

Other obvious plays are trucking companies like CVTI, ARCB, KNX and YRCW. Then you have the whole demand for steel, copper and supplies that make up the rebuilding efforts. This is what traders are looking to trade now, even if it’s the stupidest fucking trade on the planet.

If you enjoy the content at iBankCoin, please follow us on Twitter

Rebuilds will be done with PEX and empty houses will be relieved of their copper by marauding entrepreneurs pressuring copper scrap.

But is it dumber than a long term hold of UVXY?

Texas can now secede as a 3rd world nation

Fuck off

CA & TX

They are only having to boil their water in TX. Meanwhile 1200 die from floods in India and surrounding..

I look forward to watching TX politicians like Ted ” Satan” Cruz explain why the Feds should bail out TX when they said Fuck You to NY and NJ after Sandy in 2012. Maybe Mexico should help them.

We have oil, food, guns, international borders and ports. Keep your federal aid and shove it up your globalist asses.

I love tx bud Im an alex j aficionado. and fuck globalist ass

So you believe TX shouldn’t accept any federal aid including flood insurance payments, loans for rebuilding etc.?

What I’m saying is free money isn’t free. Insurance payouts for policies bought and paid for by Texans should be honored by the private companies who accepted the contract attached to those premium payments.

Federal money comes with strings attached. Apples and oranges. The Fed can shove it in my opinion. Texas sovereignty is more important than hand outs.

Amen. Moar sovereignty for Texas = less for the swamp in DC.

I hope the people in TX and elsewhere get the full support of the nation for their recovery.

But while Gekko stands tall for TX, she should recall that — on balance — TX is a ‘taker’ state:

https://www.theatlantic.com/business/archive/2014/05/which-states-are-givers-and-which-are-takers/361668/

The ‘givers’ include a lot of those bad, bad blue states. Bleeding hear libtards.

You’re an idiot. Stop watching MSNBC.

That’s directed at traderconfessions

Nation’s fourth largest city under water and N Korea taunting Prez to follow through with ‘power like the world has never seen’ and such. Markets close up.

Just think how much they’d be up if two major cities were under water and if more missiles were launched over countries we’re pledged to defend.

Some days have been and are designed, wholly or highly to enrage bears/truthtellers (meaning stock-index truthtellers or observers in general). If the controller-manipulators did not care about bears, or, cared about supporting the indexes while maintaining market&systemic integrity, it would have been a flat-to-down close. The order today, was constant rise with overexpected outcome.

Insurance is the counterintuitive buy. It’s good longer term. Premiums going up all across the board and their ain’t a damn thing we can do about it. They’ll recoup the claims payments in short order. What a racket.

Only the federal govt can sell flood insurance. And Property & Casuality co’s like TRV wouldn’t touch that shit if they could.