It’s very easy to ignore the oil stocks, since they’ve been relegated to hell. But do you remember a time, not too long ago, when sharply lower equity prices in the sector meant danger for refinancing immense debt loads?

Thanks to the feverish rally in basic resources after the Trump win, investors have chilled on the idea that lower equity prices portend to some sort of danger in the bond market. We have seen zero evidence of fear in the bond market, even the junk bond market, in spite of the -35% return in the oils. This is not normal.

Since the bond market is supposed to be ‘smart’, we can conclude only two things from the recent price action.

1. Oil stocks are immensely oversold and should be bought.

2. The bond market is being artificially held up by people looking for yield and is no longer a reliable early warning system.

Which is the most probable theory? I’d say 1.

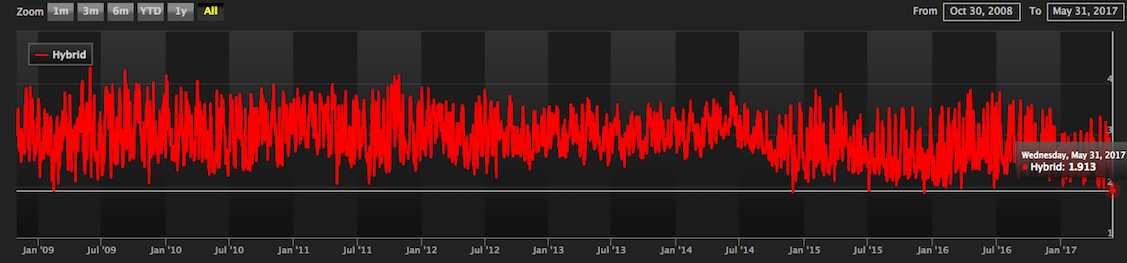

Look at the predictive mean reversion oscillator in Exodus for Major oil and gas — record oversold levels — dating back to 2009.

Assuming the sector is due to bounce, let’s examine 5 ways to play it.

1. Mega cap leadership

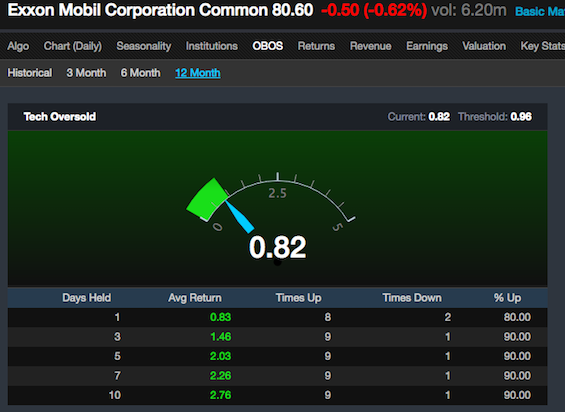

XOM, currently oversold

2. Short Squeeze

CRC, SN, CLR

3. Small cap deeply distressed YOLO trade

WTI, AREX, CRK

4. Technically strong

TELL, BCEI, GPRK, LNG

5. Strongest Fundamentals

CXO, IMO, GPOR

There are 48 stocks in the basic resource sector that are now flagged oversold in the system. The optimal holding period is 5 trading days. Although I’m not playing this sector now, because my model only accommodates mean reversion on a macro level, if I were to play it I’d buy a basket of deeply oversold stocks, first buying large cap, and then I’d work my way down the market cap ladder as performance in the industry improved.

If you enjoy the content at iBankCoin, please follow us on Twitter

I actually bought some CLF and cop today

Anyone with a functioning cerebrum?

SN… FTW…..

PE and HP

Something snapped. Fake News ack ack ack. Americana implosion into the mythical FANG bang bid from some bunker in New Zealand. Who needs energy anyway. We will all crawl on the belly begging for Top Ramen staring at a cell phone.

I “liked” because this nearly makes sense and there was no crude misogyny in it. Well done.

I saw a $7K swing yesterday in my Oil Basket within two minutes of the API report.

there is no one willing to sell oil at this level , finally , trump steps back from Paris will be the immense catalyst that will drive oil nuts .I’m 100% leveraged in oil for an immense winship . ready to wait 1 2 weeks or 1 2 months for it

the paris pact is a supreme hoax and nonsense , in a year or so we’ll have floating /vegan baloon absorbing CO2 emissions

balls baloons and whatever other tech reversing climate

which are nearly ready to be mass deployed

more then this : oil rally will be used to unroll fed balance shit & equity ( i guess they’ve bought the whole market via bond and futures )

Oil gave up half it’s May rise, normal noise here – why get so excited at this particular spot. Ohmmm.

Morgan Stanley’s Evan Calio and team, for instance, cut their “mid-cycle Bren assumption” to $65 a barrel, from $80 barrel, as a result of a “moderate-for-longer” oil-price environment. And that change results in lower price targets for oil companies across the board, though, it should be said, still upside for many of the stocks.

Still, Calio recommends favoring “quality and lowest cost U.S. producers.” He explains why:

We see potential upside in the group of 15% from current levels, hence, retain our Attractive industry view. We also expect upside in both the commodity (into the mid-to-high $50s) and equities over the summer and into fall, supported by crude inventory draws, and facilitated by reduced crude speculative length. We believe OPEC cuts will become more visible into June, corroborated by April fixture data (Middle East sailings) and coinciding with higher global refining runs as refiners exit seasonal maintenance. However, a looser expectation for 2018 S/D and producer hedging will limit perceived upside and support E&Ps that work in a $50-55/bbl world. We expect quality to continue to outperform beta with top tier Permian (Pioneer Natural Resources (PXD), Parsley Energy (PE), Diamondback Energy (FANG), Cimarex Energy (XEC), Concho Resources (CXO), RSP Permian (RSPP)) and EOG Resources (EOG) best positioned. In Marathon Oil (MRO), we see upside driven by better-than-expected DACF growth driven by the Permian and Noble Energy (NBL) as our top idiosyncratic E&P pick.

Long the commodity, gold, and some shitty gold miners (thanks Van Eck, you giant smelly asshole). Personally, not comfortable running my long only algorithm at these levels.

I like dumpster diving for trash.

T Boone Pickens? Are we still heading for Peak Oil?