Everyone makes such a big deal about the recent drop in gold. Meanwhile, the GLD is off by just 3% over the past two weeks.

In response to this tiny decline in gold, investors have pulled out their hair and jumped into the bathtub holding toasters plugged into the wall. Gold miners are off more than 13% over the past two weeks. Crazy.

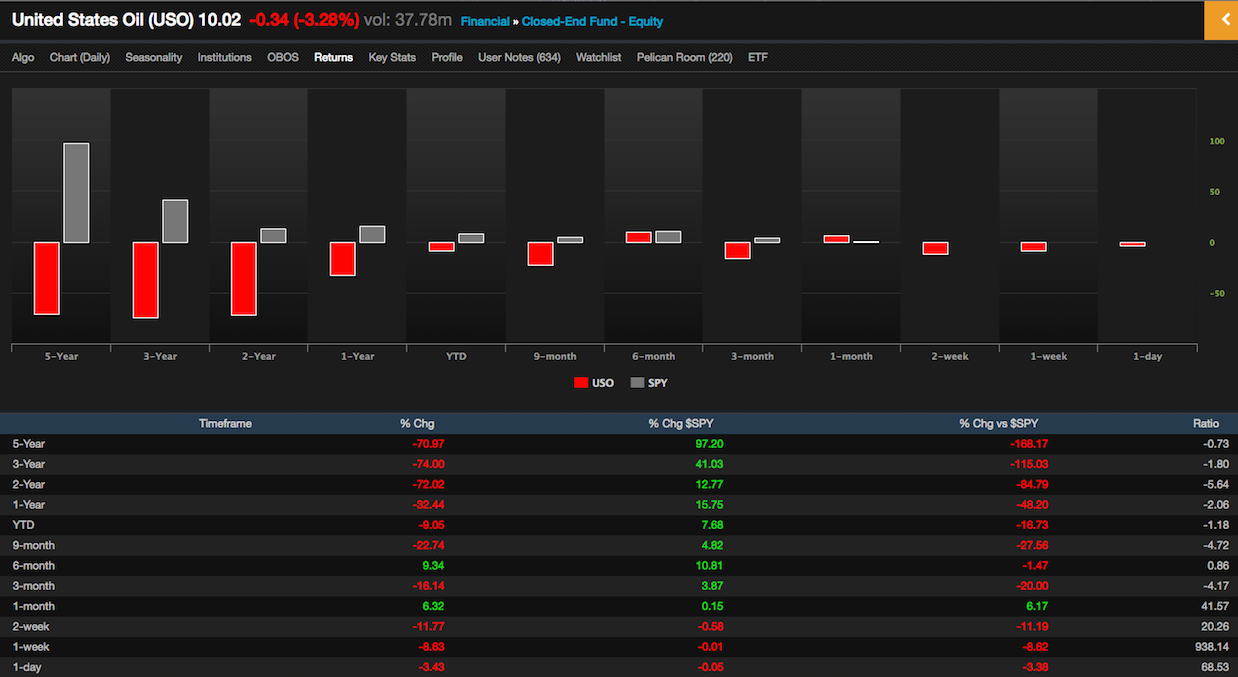

Meanwhile, the price of crude really is crashing, down more than 11% over the past two weeks–if not more. The past two days has been dreadful, with barrels of oil down more than 6%. So, what has been the market reaction to these declines?

The drillers, which is the riskiest part of the oil chain, are down 9%. Independent producers are off only 4%.

It’s worth noting, the oil and gas sector is wrought with debilitating debt loads to the tune of $600 billion that is distressed or soon to be distressed, while the gold miners have good balance sheets and have already endured years of decline.

In summary, a 3% drop in gold has equated to a 13% drop in the underlying stocks, while an 11% drop in oil has resulted in a 4-9% drop in the underlying stocks. One of these correlations are fucking retarded.

If you enjoy the content at iBankCoin, please follow us on Twitter

Oil is usable gold not, maybe wearable. But I do see your point.

Gold miners are also up 100%+ over the last 6 months. Anyway, oil is headed even lower, and gold I’m not sure about.