Europe intends to liberalize their QE program to switch from buying bonds in the largest economy to the most indebted. This would switch much of the $90 bill or so in monthly appropriations to Italy and Spain and away from Germany.

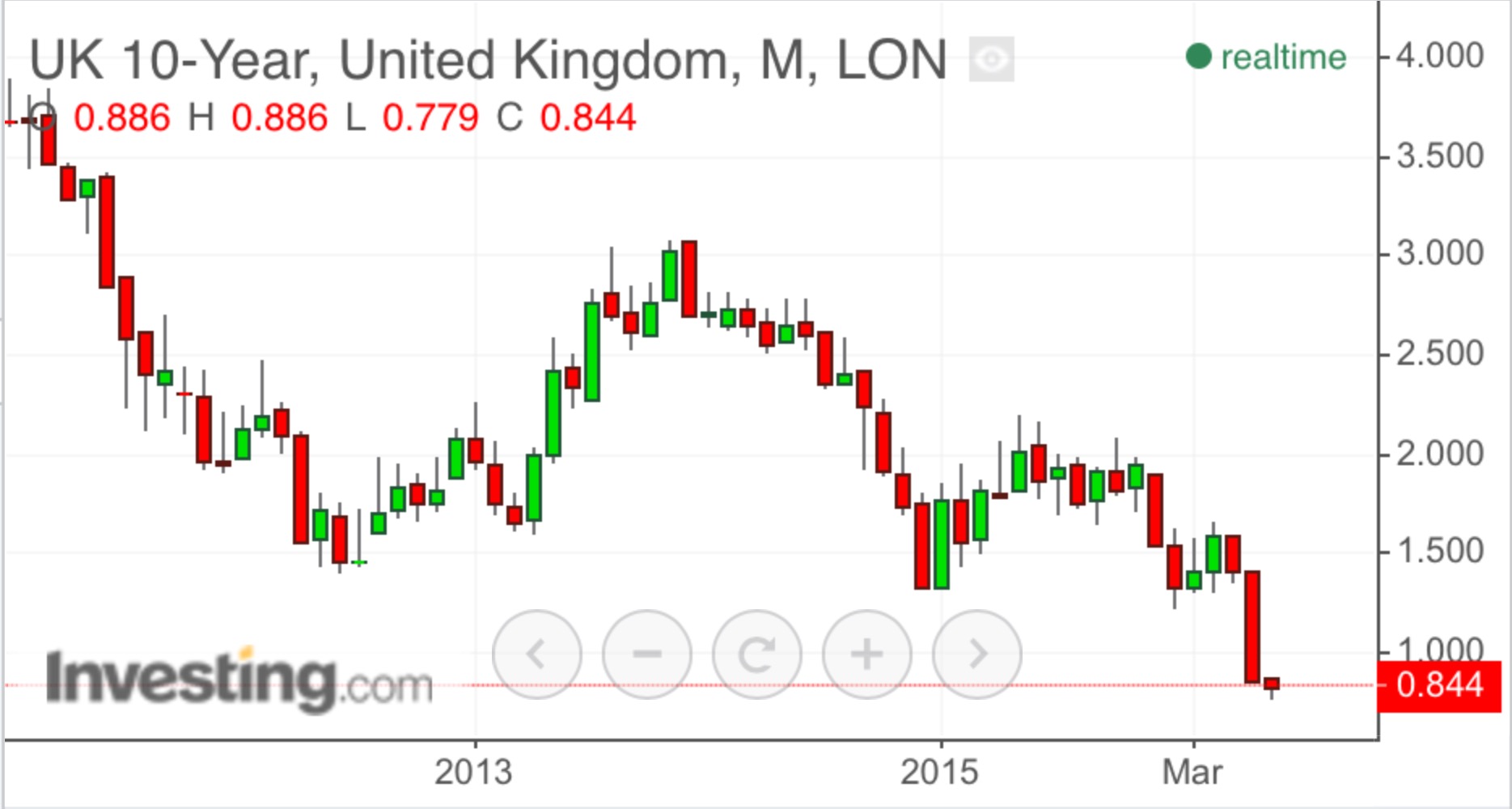

The second quarter ended. But we’re getting more of the same, large swaths of money chasing yield. I equate these people to zombies, because there’s no rationale behind buying a 1% Spanish or Italian bond, let along a negative yielding Japanese or German. Out of all the western nations, America has the highest yielding government bonds, which is why I am long TLT in size.

These are all record low yields, all due to the creation of money, out of thin air, which is then tossed into the bond market like zombies running after people for their brains.

In case some of you are new to this investing game, let me describe QE in simple terms. Europe has a lot of expenses, so they issue bonds to people, offering a yield to lure them into the fold, sort of like when you took out a mortgage for your home. But instead of waiting for someone to buy their bonds, they create money, out of thin air, and buy the bonds themselves. Yes, they’re literally financing their own debt. This intervention in the bond market is the reason why yields keep plunging, as ordinary investors front run scheduled monthly purchases of debt by central banks.

This is the definition of perversion of economics, a Frankenstonian experiment destined to blow up in our faces.

If you enjoy the content at iBankCoin, please follow us on Twitter

Great call Fly.

How long can this go on? Will negative rates come to the U.S.? Then what.

US will soon go negative as economics in EU worsen and CB’s continue to foster the supply demand imbalance through policy and regulations. Great call on TLT by Fly.

So when this all blows up in our faces, won’t it be best to be owing physical assets and/or cash?

Yes.

People fail to question why TLT and ZROZ continue to rally in the face of stocks rallying off of Brexit. Either the stock market is making the right call for continuing growth or the bond market has it right about more pain coming.