As some of you know, I’ve been blogging, in one form or another, since 2003. I’ve always had an impetus for the written word and I’ve been at the forefront of financial blogging since 2006. Over the years, markets have undergone tumultuous pops and drops, to borrow a phrase. As the proprietor of one of the most widely read financial blogs in North America, I am privy to see, first hand, important trend shifts, such as demographics of the reader, the device from which they access the site, locality, and most importantly– if they bother to come at all.

Anyone in the digital media business will tell you that when traffic is all new highs, people are wrought with an overwhelming sense of remorse for being long equities. Hence, they visit the site all day long, in great numbers, to get insight into whatever the hell is haranguing the market that day. During periods of hedonism and excess, the idlers of the reader class are out drinking champagne over Delmonico steaks, laughing it up, throwing mashed potatoes at those professing caution.

I will have you know, during these insatiable periods of wanton ecstasy, traffic at the site plunges, causing everyone who writes here to become apathetic and to idle a bit more, just like the reader.

There is a concatenation between these two things, traffic and the direction of the market, and it is predictive.

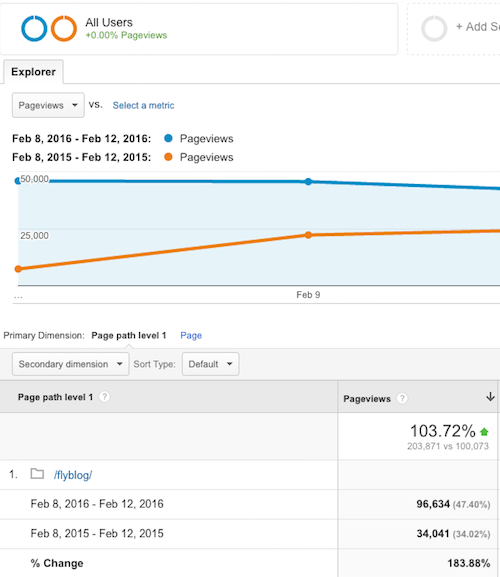

BEHOLD the traffic on iBankCoin during the week of February the 8th, 2016, also known as the recent bottom in equity and commodity prices. I compared it to the same week last year, to give you a point of reference.

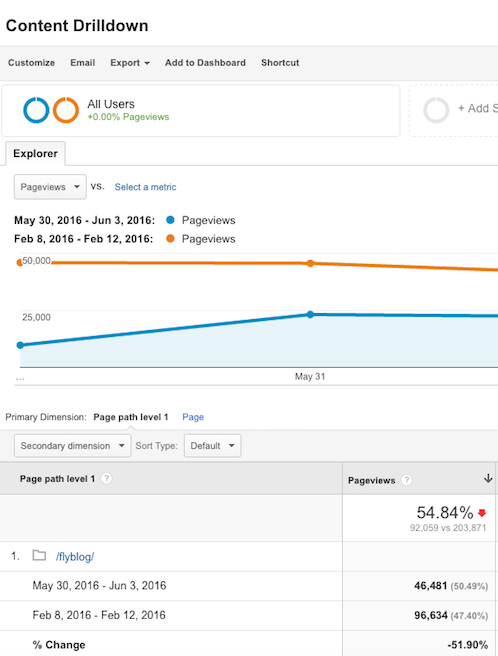

Now look at traffic from last week, the week of May the 30th, 2016.

Notice how the traffic sucked wind, in spite of the fact that yours truly brings the fire every single day? Indeud.

Now have a look at the VIX index, which measures volatility. This is a fancy way of saying when the shit hits the fan, this thing goes up. The high point of volatility correlates perfectly with web traffic, a concatenation indeud.

Now that volatility is low and markets are high, a great majority of people are, irresistibly, drawn to the market–like flies to a black light behind an electrically charged metal grid. This process will repeat itself until the end of time, with mawkish redundancies. Resist the temptation of comporting yourselves like the bipedal primates that you are.

Board the ark or get in the gold mine.

If you enjoy the content at iBankCoin, please follow us on Twitter

Interesting indeud !

How much gold can the Ark carry?

50,000 tons

Much of the general population may be thinking of 16 Tons, as in Saint Peter…

http://www.cruisemapper.com/wiki/753-cruise-ship-sizes-comparison-dimensions-length-weight-draft

When you go full zero hedge and stop investing you only get views when everyone is scared. Luckily you have OA here to still get you some non fear induced visits.

Trashman

Thanks for the emotional response that is filled with nothing but inaccuracies.

Like I said, I’ve been doing this since 2003. This isn’t anything new, even when I was trading like a mad man for the past 11 years.

trashman, don’t forget the views by “confirmation-bias” seeking bears like myself (hey, at least I recognize it…).

Like the political system, peoples are more and more AVERSE, and, PISSED, at a rigged system, (generally more cognizant that a rigging means ultimately not in their favor) IF THERE’S ANY THING MORE FUCKING OBVIOUS OVER THE LAST 7-10 TRADING DAYS, is the extent to which that is present in our stock indexes (sans since feb.) People are and are becoming more conscious of rigging and are ABANDONING.

not your idiot interpretation

Trashman, you let us down, you let humanity down, by becoming the caricature ignoramus-simpleton. You trash-simpleton.

I read the first three words of your post and the last three and just shook my head.

Hedge500 enters the trashheap of humanity as well

Younger generations get it

Step aside old farts

You’ve ruined our country and can only shake your head?Lol

Showtime sounds like a rube who got burned playing the market. Poor boi.

Nice information, thanks Fly!

Thanks. Another correlation: trading volume. It has dropped like a rock.

Market up = normal = complacency = low volatility = low volume

June 7’s VIX print (below 13!) in front of the Brexit vote and possible (but unlikely) FED action was stunning.

Lots of bears in here, including myself to some extent (everyone is always jittery at new highs). I think all that is going on is there are few places to put real money (big money) that produce decent yields so a lot of it is flowing into equities, whether it makes sense or not. Hard to get in front of that train. That being said, I don’t mind taking a little loss here though and hitching a ride on Soros and the likes by going to short the SPY over the next few days and put a tight stop in at $215. Gold is a good call but I feel like it may be a little rich here. Thoughts?

GET IN THE FUCKING GOLD MINE.

Haha, I may nibble at GDX.

I’m a contrarian by nature, mostly due to paranoia. So when all the talking heads get bullish, I cave up. When everyone’s scared and the crash is underway and it’s the end of the world, I buy. You’ve sold me on TLT. Not a big fan of gold because I don’t have an easy way to buy and store and exchange physical gold. I come almost every day even though I only agree with half of what’s written here and I am never sure which half it is.

LOL. An honest person here.

If the world was not filled with the weak. Senor Fly is in the fucking Ark. Up big ytd. The blog traffic is the ultimate IQ test. We are getting dumber. How the fuck is that possible? lol

Good one Senor! Hope you are doing well.

I have to say the VIX correlation is fascinating for a gearhead like meself.