With crude topping $50, traders are bidding up oil stocks, like bums vying for the last bottle of Georgi vodka. The gains, quite frankly, are monumental.

I was watching an interview with the CEO of SPN earlier today. He’s indelibly bullish on crude and thinks it trades up to $60 by year end. His thesis is the same lie being shopped around Wall Street since February. Production declines will lead to an equilibrium of supply v demand. Meanwhile, back in the real world, global oil production is at new highs. Sure, many of the marginal players are folding up tent. But these are small little shits, in a vast reservoir of feces.

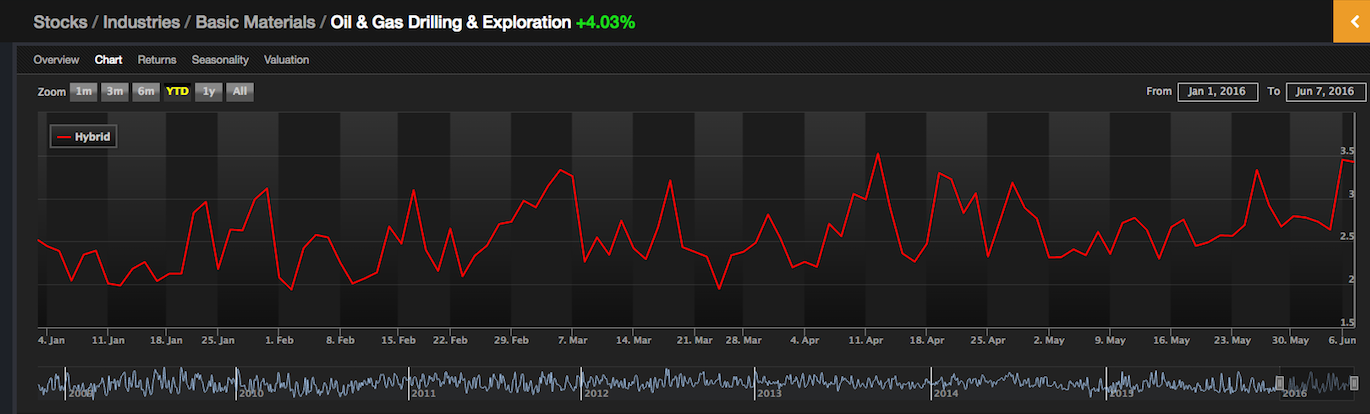

According to Exodus, the energy sector has never been this overbought. Have a look.

In fairness to the crude bulls out there, recently, overbought conditions beget more overbought conditions, as prices worked their way higher.

If you enjoy the content at iBankCoin, please follow us on Twitter

did OA borrow your time machine for this one?

life changing moves today. OA you are the greatest. Fly, thanks for lending him your time machine

OA is a great trader.

he is great and so are you. TLT is still biggest position since jan 3rd, liquidated gold last month. up over 20% ytd. best year since 12

When reading about the Nigerian pipeline disruptions by the Niger Delta Avengers, there’s a part of me that wonders whether they are funded by an outsider with the specific goal to raise oil prices. After all, the president of Nigeria said something to the extent of ‘we have trained military personnel guarding strategic pipelines and areas, yet it’s as if the Avengers know exactly when and where to strike.’ -From a WSJ article yesterday

Regardless, my mindset is aligning more and more with The Fly at this point.

Despite all the recent negative indicators (China dumping steel, today copper was dumped out of China, Chinese equity valuations far greater than we saw here in dot com bubble or ’08, weakening jobs reports, earnings driven by buy-backs, BOJ flooding the streets with yen, Brexit polls, XLU and TLT on the rise with the markets, etc.) , this market heads higher and higher.

In the past few weeks, we have seen this market dismiss all negative news, or just run right over negative news with tsunami-esque afternoon moves.

I get the sense we are all currently caught in a hedgefund squeeze.

Right now, I liken The Fly to a glacier- slow, plodding and predictable, yet, containing shear mass and power one has to respect.