In last week’s Exodus recap, I talked about how an overbought condition in Exodus was actually a good thing, which typically precedes higher prices with highly impressive backtest data. If you recall, I predicted the markets would remain firm through last week and fade towards the end, when the overbought condition had worn off. Judging by Friday’s trade, that’s exactly what happened.

First things first, I was paid a dividend in my TLT position–reducing my coast basis to $119.37–putting me ahead by 11.6% for the year. That’s on a government bond lads. Pay attention.

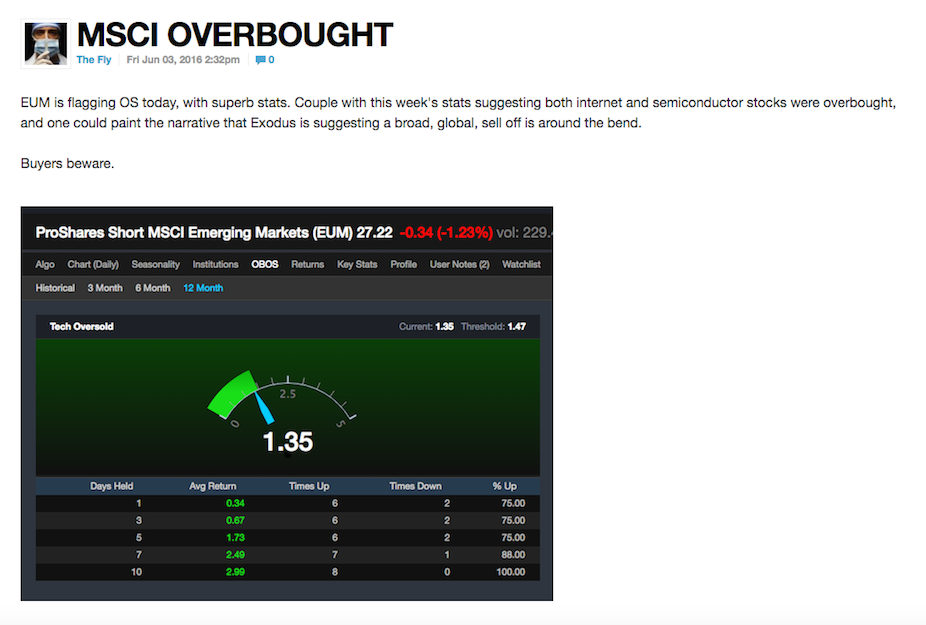

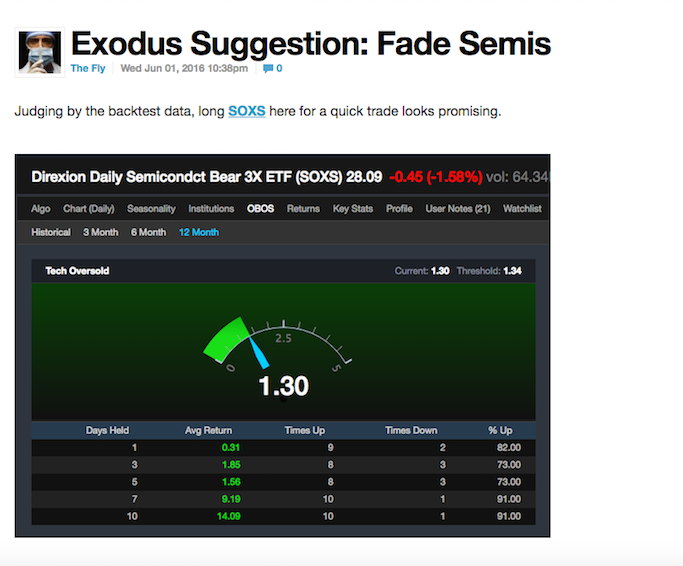

Next, the semis are showing signs of being in an overbought condition, as well as the MSCI index, which is essentially Asia, ex-Japan.

In addition to that, we’re getting OB signals in coffee, XLB, URE, IGN and EGPT, and about 25 stocks. It’s worth noting, this isn’t a vast amount of names in an overbought condition. Friday’s sell off reduced the technical rating by about 5% for all the stocks in the system.

On the oversold side, there are 55 stocks and ETFs. Most of the OS ETFs are downside bearish ones, except for TAN. Of the bearish ETFs, the most impressive and alarming of the group is QID, downside NASDAQ.

If we’re to form an opinion based on the data alone, then expect a sharp pullback in the NASDAQ to the tune of 1-1.5% early next week, followed by a rally to end the week flat. However, in almost all of the algorithms I am reading, this should be the last week of malaise, as the week after next points to be a harrowing one for those positioned long.

In short, books profits, buy the dips early this week, but get the hell out before the close on Friday.

If you enjoy the content at iBankCoin, please follow us on Twitter

11.6% this year is genius, and will be revered by election day.

I hope you are enjoying your ark sleep (whenever you do sleep), but my only negative comment – which for some reason I must express here – is that every time I see this particular Peck-as-MacArthur photo, I am taken back to my friend’s grandfather, who made it through the dustbowl but so poor that, for toilet paper, the family used dried out corn cobs instead.

Smoke ’em if you got ’em.

Very good info Dr Fly. May I ask if a water stock/etf is one of the OB in Exodus?

Wouldn’t that be some shit….the ark floats higher and water sector breaks out on fear after the Rio Olympics was announced like 4 years ago? Ha

TLT has been great for selling premium. Selling calls 30 days out at a30 delta pays about a buck on top of the dividend. Full disclosure, did get assigned on part of my position Friday.