This is good because it means that their central bank, the Federal Reserve, will hold off on hiking rates.

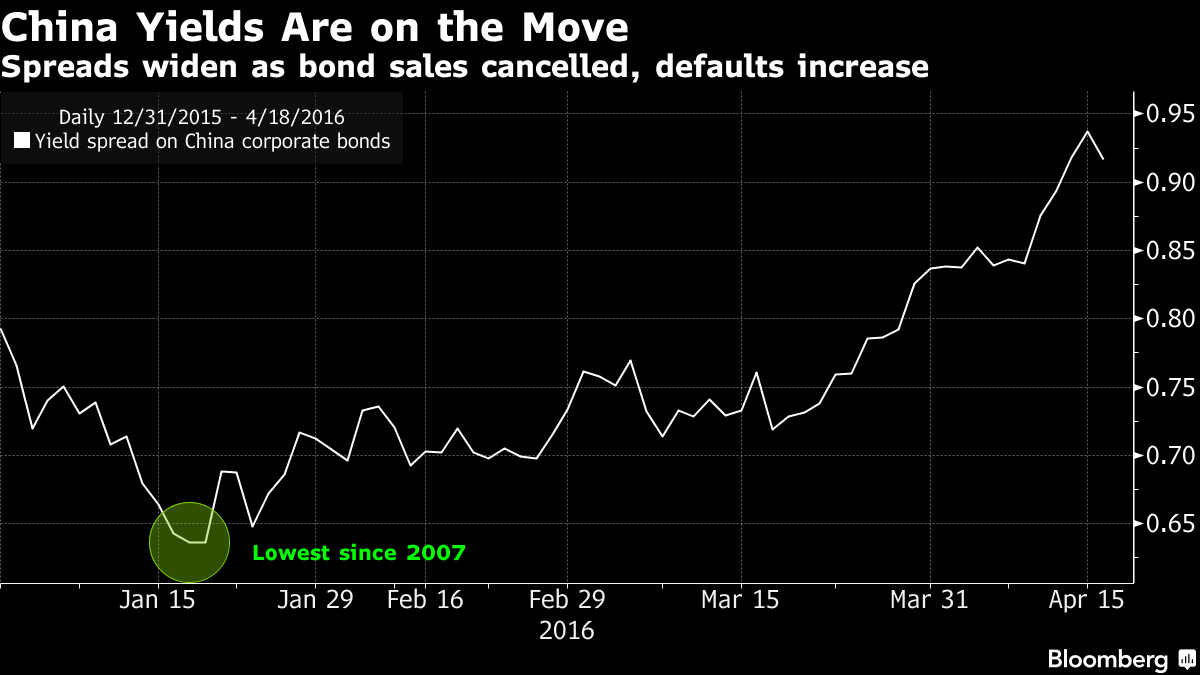

Junk debt in China is acting junky as of late, with spreads widening and yields rising in 9 of the last 10 trading days. Credit agencies are slashing the ratings of these nefarious firms and issuers are canceling bond sales at a frantic pace. More than $9 billion in bond sales have been canceled in April alone.

The numbers suggest more pain ahead: Listed firms’ ability to service their debt has dropped to the lowest since at least 1992, while analysts are cutting profit forecasts for Shanghai Composite Index companies by the most since the global financial crisis.

“The spreading of credit risks is only at its early stage in China,” said Qiu Xinhong, a Shenzhen-based money manager at First State Cinda Fund Management Co. “Many people have turned bearish.”

“To Chinese investors at the moment, default risks are high almost everywhere,” said Shi Lei, the head of fixed-income research at Ping An Securities Co. The yield premium on corporate bonds will probably rise by 30 to 50 basis points over the next several months, Shi said.

Sixty two companies have canceled bond payments this month. To put that into perspective, that’s six times the normal average.

“As more and more issuers default, lenders and investors will reassess their portfolio and lending, and that will cause yields to rise,” said Christopher Lee, chief ratings officer for Greater China at Standard & Poor’s in Hong Kong. “If the onshore market has any dislocation, that will have a spillover effect in the offshore market.”

Corporate debt to GDP in China stands at a record 165% of GDP. Again, this is good news for markets because…

If you enjoy the content at iBankCoin, please follow us on Twitter

Back to school shopping must be the reason. For otherwise dragging forces on indexes to be up triple digit. Mustve kicked in

ho hum another multi win day. raising cash up to nearly 20%. my super cruddy ark trade TVIX is threatening my TWTR to become my biggest position loser. oh, and my azz is fleek.

It’s good news because, by the time bad news finally creeps out from the opaque land of China, then China is already near a bottom and ready to start back up soon?

Or maybe it is good news for markets that are not in China?