This isn’t exactly a bold call. Oil demand always spikes this time of year. Let’s see how this analyst feels about oil in August.

Nevertheless, this CS analyst thinks crude gets to $50 by May.

I don’t like the call for a number of reasons, the first being oil is up 50% from the lows.

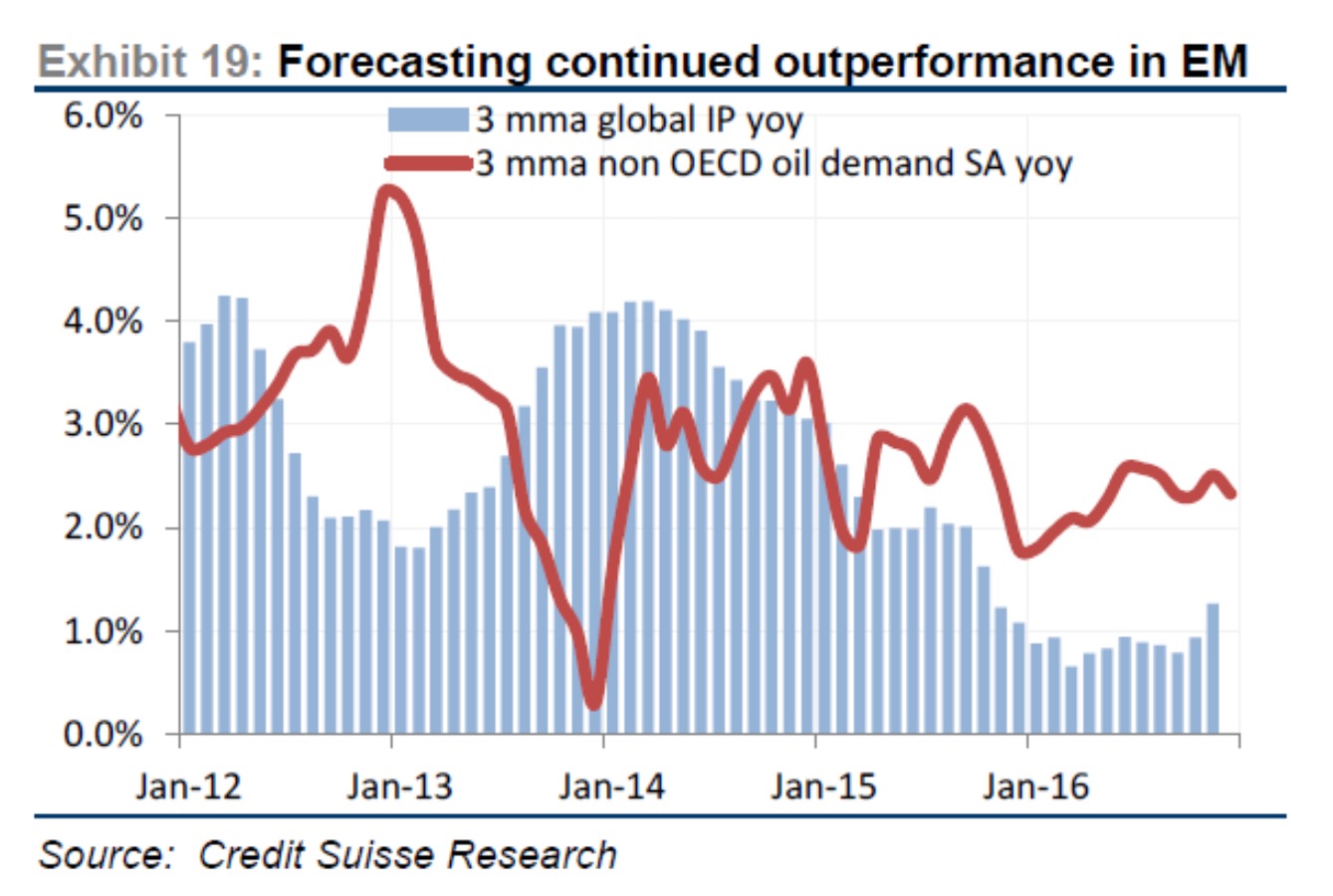

“Oil demand growth is alive and well,” he writes in a recent note. “We think that with hindsight this winter will look like a dip in an otherwise still unfolding fairly strong growth trend that is partly fueled by the ongoing economic recovery of in North America and Europe and longer standing trends across key emerging market economies.”

“While on balance oil demand growth appears relatively sluggish still in the first quarter; February data either improved on January (e.g. Brazil, the U.S.); or extended strong growth (e.g. India, South Korea), while in China demand appeared to have rebounded as well,” he writes.

“We forecast modestly re-accelerating demand growth over the course of this year, so long as a recession continues to be avoided,” asserts Stuart. “We project in fact that oil demand should continue to outperform historic correlations with industrial production.”

Since I’m short oil via XLE, I’d like to see this analyst trip and fall into a banana cream pie. Demand for crude ahead of the driving season is always robust. Like I said before, let’s see how things look in the summer.

If you enjoy the content at iBankCoin, please follow us on Twitter

Crude to $25 by May.

Can’t we all agree that analysts are morons. Now here’s something for you and Macke to do that will change investing forever.. start pushing for analyst ratings based on prior 12-month performance. Every analyst must publish his/her rating with every opinion. If we can letter rate restaurant cleanliness we can rate financial services. Your legacy awaits.

I’d love to see that. Great idea.

lol CS

Credit Suisse analysts were pimping multiple oil stocks through most of 2015. Completely worthless morons. Excellent contrarian indicators.

except

supply became ‘the factor’ last year