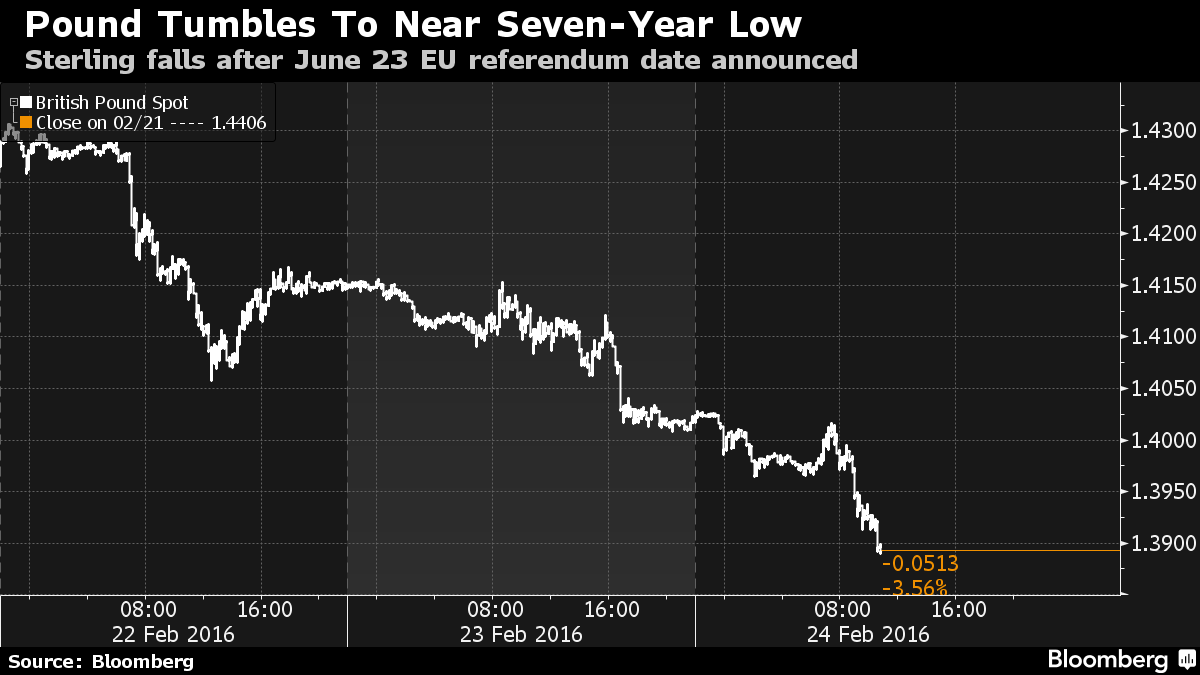

Fears of Great Britain leaving the conglomeration of broken shards called the EU are heightening this morning, which is pressing the pound sterling to 7 year lows. This is fear mongering at its best. If there’s one thing the world is exceptionally good at, it is this.

Options traders are paying the most to protect against price swings in six months’ time compared with historical volatility since Lehman Brothers Holdings Inc. collapsed during the 2008 credit crisis. Twenty-nine out of 34 economists in a Bloomberg survey said the pound will drop to $1.35 or below within a week if the U.K. votes to leave the European Union — levels last seen in 1985.

Broken elevator cable trading has resumed, world wide. S&P futures are lower by 16 handles. Over in Europe, investors are flummoxed with losses, scaling up to 2.7%, graciously accepted by the Empire of Spain.

Gold and bonds are rallying. Moreover, in Switzerland, negative bond yields persist in every duration, up to 20yrs, which will soon be dragged down under zero. Most importantly, rumors are already making way around trading desks that BREXIT will pave the way for a GREXIT, which will have a profound effect on EU banks. Once the warmer climes come, migration out of the middle east will swarm Europe, especially Greece. There will be considerable pressure applied to an already weak Greek economy, who might decide to make a clean break of it, especially after Great Britain broke precedent and left the EU, providing that should happen.

Portuguese-German spreads are at 318bps.

If you enjoy the content at iBankCoin, please follow us on Twitter