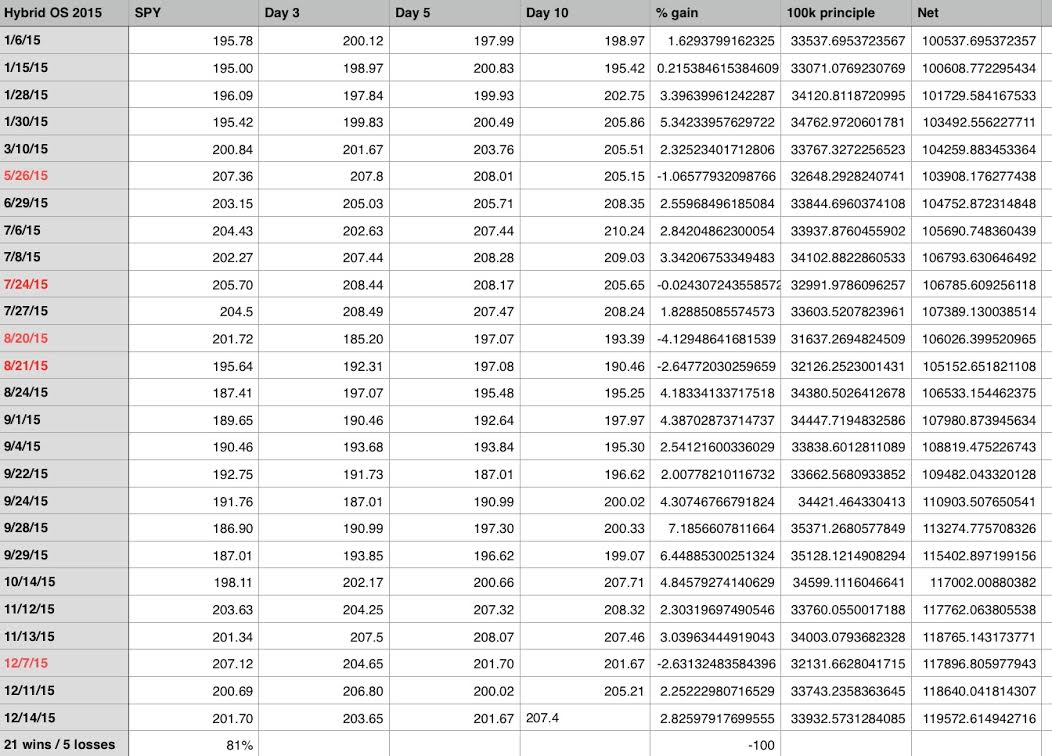

Today closed out the last 10 day holding period, in Exodus, for the last oversold signal purchase of SPY for 2015.

This investment strategy for an account worth $100k requires the investor make $33k investments upon each oversold signal. This means, in the event of signals exceeding 3 within the required 10 day holding period, that the account delve into leverage. Although the instances of levering up the account are limited, they might not be suitable for everyone.

The way it would work is like this.

OVERSOLD signal flags and an investor allocates 1/3rd of his account into SPY. Win, lose or draw, the investor must sell at the end of 10 trading days. In the event there aren’t any signals, the investor will remain in cash, limiting his exposure to equity markets. Naturally, as the account grows, so will the size of the initial investments. Hence, the power of compounding returns reigns supreme under a methodical strategy like this.

Max drawdown was -4.12%. Average drawdown was -2.09%. The win rate was 81%, 21 for 26. The investment return was upwards of 19% for the year.

I will be trading this exact strategy, exclusively, in 2016. However, I might change the index investment from SPY to QQQ or something more aggressive on occasion.

If you enjoy the content at iBankCoin, please follow us on Twitter

Tempted to sign up for Exodus and follow along.

Not that big of a monetary commitment.

From an earlier post I got the impression that you would require a limb as payment and that you were trying to hock a simple RSI study. Well, it turns out that was a lie. Bravo on Exodus’ success in 2015. It all sounds great actually.

I wonder what a typical options strategy would’ve returned. I can only imagine it to be much higher supposing one picked an appropriate strike and expiry.

Exodus combines both technical and fundamentals of stocks, so to compare it to an RSI is ridiculous.

If the market trends downward in 2016, how will Exodus respond? Will it start spitting out more overbought signals and fewer oversold ones?

Last year was pretty rough. Exodus is intuitive. Today’s OS scores might not be tomorrow’s. It identifies ranges in the market. So I suspect the amount of signals will be the same.

Your planned strategy, with Macke thrown in for January, is tempting me out of retirement.

Unless I am misreading the spreadsheet, you can squeeze a little more out. Rather than 33% of 100K, use 33% of the account value at the time of purchase. Compound!

Correct. I figured there was unaccounted expenses that would incur, such as commissions and in some cases margin expense. +19.5% is rough estimate, with a rounding error from 1-3%.

It all sounds very sensible, but not much fun.

You know what’s not fun?

Trading this market blindly.

This is actually perfect for a $3K to $100K options challenge using a reverse Dalembert bet sizing. (Bet 1 unit then up on wins to 1 unit, 2, 3, 5, 8, 13, 21, 34, 55 units and scale down to the appropriate bet size after a loss; example if you lose at the 8 unit level scale down to 5 units on the next bet (or lower if your bankroll at the time does not allow you to bet 5 units; it’s up to you to put this into excel sheet and bet appropriately).

I’d have to research further, but off the top of my head you grab at least 2 weeks of time and go near the money.

Just as an example right now the $SPY is at $207.40. The January 207.5 calls are trading at about $2.48. A 2% gain in $SPY would increase the value of the calls to about $5.30, depending on how long it took to get there. Even if it took the full 10 days your intrinsic value would be roughly $4. 5.3/2.48= a return of 113.71%.

The median gain looks like it’s around 2-3%. So a strategy in the challenge might be to take half your gain as soon as you get to a 2% gain in $SPY and let the other half run to try for the 6-7% gainer, which would mean huge gains in your options.

Now if you come up a winner 10 times in a row and assuming you double your money each time using the above bet sizing, $1,000 turns into $143,000. If you start with $3,000 you allow yourself 3 losses right off the bat before the challenge goes bust. Since some of the time you will be winning much more than 100%, it becomes very hard to blow up the challenge account if you stick to the rules and scale the unit size up and down the Dalembert chain as you win and lose.

This just might be gold.

I like where your head is at, QCI

I am seeing alot of overlapping signals. Do your results ignore those if already invested 33% or are you increasing exposure? In two cases there appears to be 4 signals inside of 10 trading days.

Much like the approach I plan to use in 2016. Stripping out risk from individual equities is huge in this market. I don’t need my trading account banged when a CEO gets pneumonia. Like TQQQ and sometimes LABU (for Q1) for this strategy.

hardest part of a system like this is discipline. Will only work if you stick to the rules. Very few people have this ability IMO and then mistakes in other areas will affect how you trade the system. I’m interested to see how people do.

Would love to see the OB results as well.

OB results not as stellar I bet

I’d imagine you’re correct. could be beneficial for sell signals however, even if not going short.

question – is the purchase of SPY made at the end of the trading day if OS is flagged, or at the time during the day when OS is flagged…or does it matter really ?

thank you in advance..

These are closing prices, so there is opportunity for improvement or slippage.

Fly, question… I just recently joined Exodus today. I use reversion to the mean models to trade my account and would like to pile Exodus on as well. I have always loved the site. Here is an example, GLD being over sold at 1.20, with the threshold at 1.20. Is that what your OBOS model suggest, executing the trade when the current oversold number is the same as the threshold? I only trade IWM, SPY, and some times the leveraged ones.

Just curious if that what your 10 day hold model suggests.

Thank you.

Executing when the threshold is met or broken. The stock should say oversold on it, to be sure. Stats are available per stock

Perfect, Thank you. Keep up the good work. You’re the only financial site that’s worth a damn. Hell I don’t even watch CNBC anymore. Rocky is on AMC TV in office as we speak.

Correction, Spike TV.

Surely this is a stupid question, but this same data back to 2008 can be seen by members of exodus? Would love to see how this has performed in the past.