Make no mistake, the sheen is off the cyber-security sector, as the shares of PANW, CYBR, FEYE, FTNT, SPLK and CUDA swoon to new recent lows. Over the past 3 months, the median return for Exodus‘ internet security sector is -14%.

Today, indictments were doled out for a group of nefarious individuals who profited, mightily, off hacking the JP Morgan banking system.

U.S. prosecutors on Tuesday unveiled criminal charges against three men accused of running a sprawling computer hacking and fraud scheme that included a huge attack against JPMorgan Chase & Co and generated hundreds of millions of dollars of illegal profit.

Gery Shalon, Joshua Samuel Aaron and Ziv Orenstein, all from Israel, were charged in a 23-count indictment with alleged crimes targeting 12 companies, including nine financial services companies and media outlets including The Wall Street Journal.

Prosecutors said the enterprise dated from 2007, and caused the exposure of personal information belonging to more than 100 million people.

“By any measure, the data breaches at these firms were breathtaking in scope and in size,” and signal a “brave new world of hacking for profit,” U.S. Attorney Preet Bharara said at a press conference in Manhattan.

The alleged enterprise included pumping up stock prices, online casinos, payment processing for criminals, an illegal bitcoin exchange, and the laundering of money through at least 75 shell companies and accounts around the world.

If this news was released 6 months ago, shares of internet security stocks would’ve been off to the races. It’s somewhat disheartening to see these stocks mired in the mud of bearshit, since their growth prospects and investor appeal are second to none in the tech space.

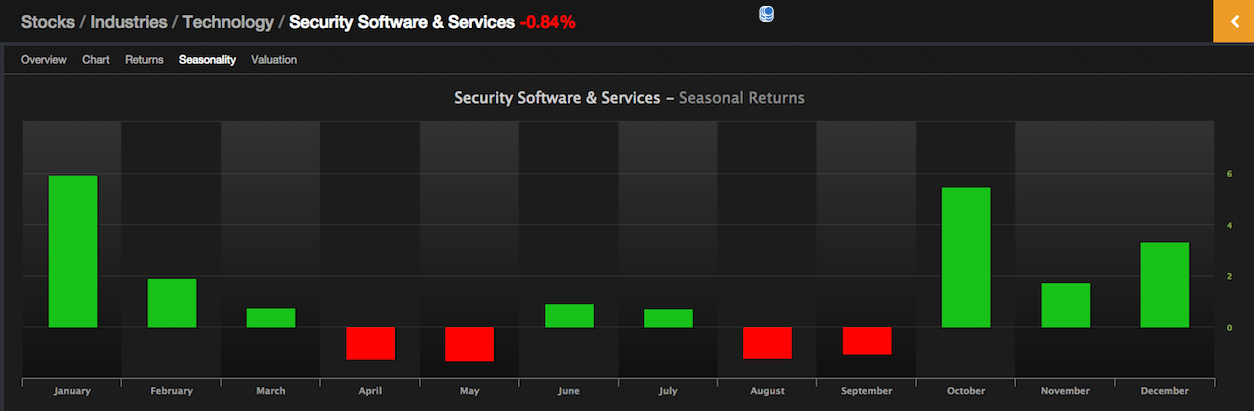

According to seasonality stats, internet security stocks perform best in the months from October-January.

I have a long term position in PANW, with a cost basis in the $80’s. It’s a wonderful company, growing revenues at 50% per annum. However, they’re unprofitable and one earnings slip up can cause the shares to drop, precipitously, effectively abandoning all hope for this sector.

Bulls will point towards an actual earnings per share, positive free cash flow as signs of a healthy company. However, if you look at the balance sheet, the company grossed a touch over $200 million in profits last quarter, but spent $191 mill in G&A. Another $50 million was spent on R&D, leaving the company with a $45 million net income loss.

This is fucking bullshit, essentially. The company is managed like a fucking iced cream truck and isn’t focused on the bottom line. This is the primary problem with these high beta software names today: they’re solely fixated on growth and market share, all the while investors get burned at the cross long their shares. Hopefully, some of these “hot shot” CEOs will be fired soon and operators will replace them, producing net income for long abused shareholders.

PANW is scheduled to report earnings on 11/23, looking for “a profit of 32 cents per share.”

If you enjoy the content at iBankCoin, please follow us on Twitter

I suggest they get off their damn walking desks and bouncing ball chairs and make some coin.

The whole basket will rise or fall on the PANW earnings. My betting is CYBR goes to 34 which is where I will buy it.

There’s no such thing as Internet security.

I complained about the same antics CRM was pulling with their spending 8 years ago and look at them now. PANW is following the same recipe apparently.