Since I had so much positive feedback on The Perfect Pair (which is still working, by the way), I figured I would hand the iBC readers another gem.

This one is a play on demographics and it’s a simple concept that can be summed up like this: the boomers are getting old and finally retiring, whereas the millennials are poor and hate the suburbs.

I’ve been reading a lot of Neil Howe’s work lately and he continues to make the case that healthcare will be 20% of the U.S. economy by 2020. He made that prediction a decade ago, and we’re right on track. He’s been getting more press lately and deservedly so – I think his generational research is next-level prediction making.

Anyway, old people have increasing health care costs (obvious); they won’t be moving out to the ‘burbs and into starter homes (obvious); and logic dictates they will likely sell their current McMansions and downsize – probably closer to medical care facilities.

On the other hand, young people have no money and they don’t want a McMansion and a long commute, regardless. They prefer urban living – right on top of each other – and walking or Uber’ing to and fro, the so called “shared economy”.

So basically I’m selling the suburbs and buying the urban life – as are the Boomers and the Millennials. Generation X’ers will continue to populate the burbs as their homes eventually wither and decay along with the American middle class.

I’m no financial adviser, but if you’re tired of watching daily stock market gyrations and want one investment idea to lock away a large chunk of your retirement portfolio, this is it…

Here’s the Trade:

Go Long the SPDR Select Sector Health Care ETF – XLV, and

Go Short the SPDR S&P Homebuilders ETF – XHB

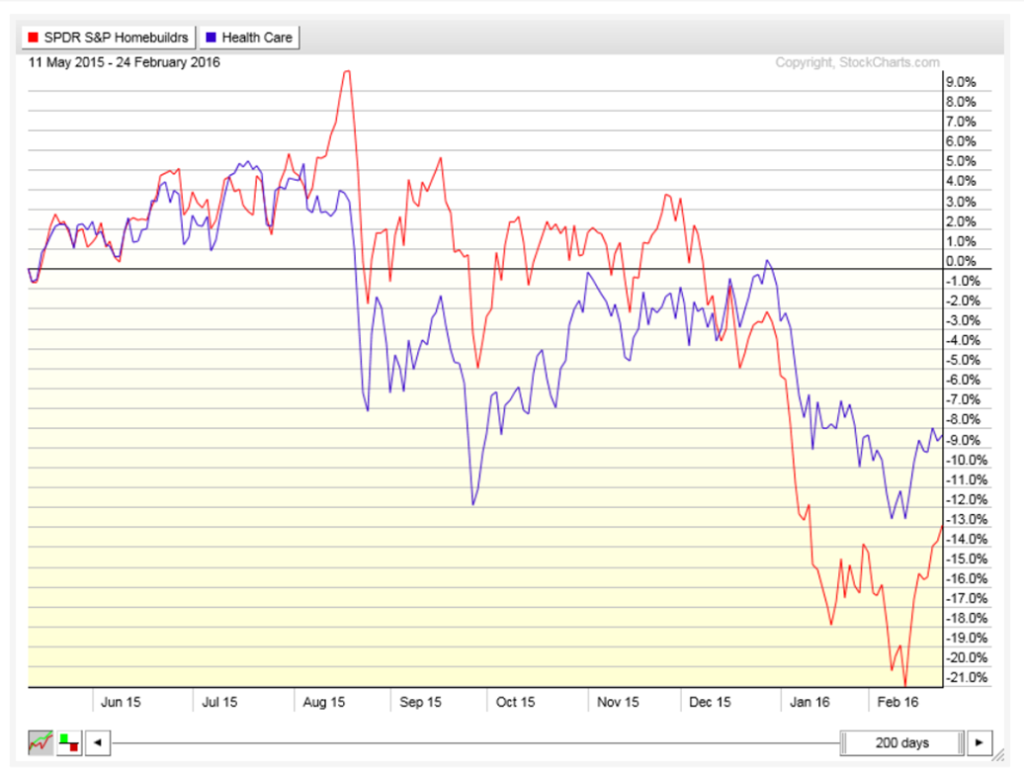

This is a paired trade, so use an equal amount of capital on both positions. By doing this you take the overall market out of the equation. If the market crashes – who cares, you’re hedged and will likely outperform. If the market rallies – fantastic, you’ll still outperform. It’s all about the spread, so let’s take a look at recent performance – because it’s often indicative of future results (did I mention I’m not a financial adviser):

That’s it. Now, put your entire life savings into this trade – in fact you should borrow for it – move to the beach, take up surfing, yoga, etc. Whatever you do, simply forget about the stock market; I just removed your exposure to stocks. Check on this spread annually over the next decade, and send me a Thank You! card every once in a while.

You’re Welcome.

Comments »