As commodities continue to crash and pundits continue picking bottoms, you will do well by paying special attention to currencies. If you haven’t noticed by now, everything is correlated to currencies at the moment. Since we’re all currency traders now, it’s important to understand what is happening, and what the possibilities of it continuing to happen are.

First of all, if you haven’t read my article Fed Trade School, do it now. I described what’s happening, and provided a strategy that continues to work (it’s not too late to put it on, or add to it, by the way).

Now, we are approaching a big binary event – an inflection point if you will: Fed Day, Dec. 16. The market will read it one of two ways, in my view:

- “One and Done”; the Fed raises rates and then attempts to reverse the narrative of additional rate increases.

- “Fed 2% Target”; the Fed raises rates and then provides some narrative on how they will approach their 2% rate target.

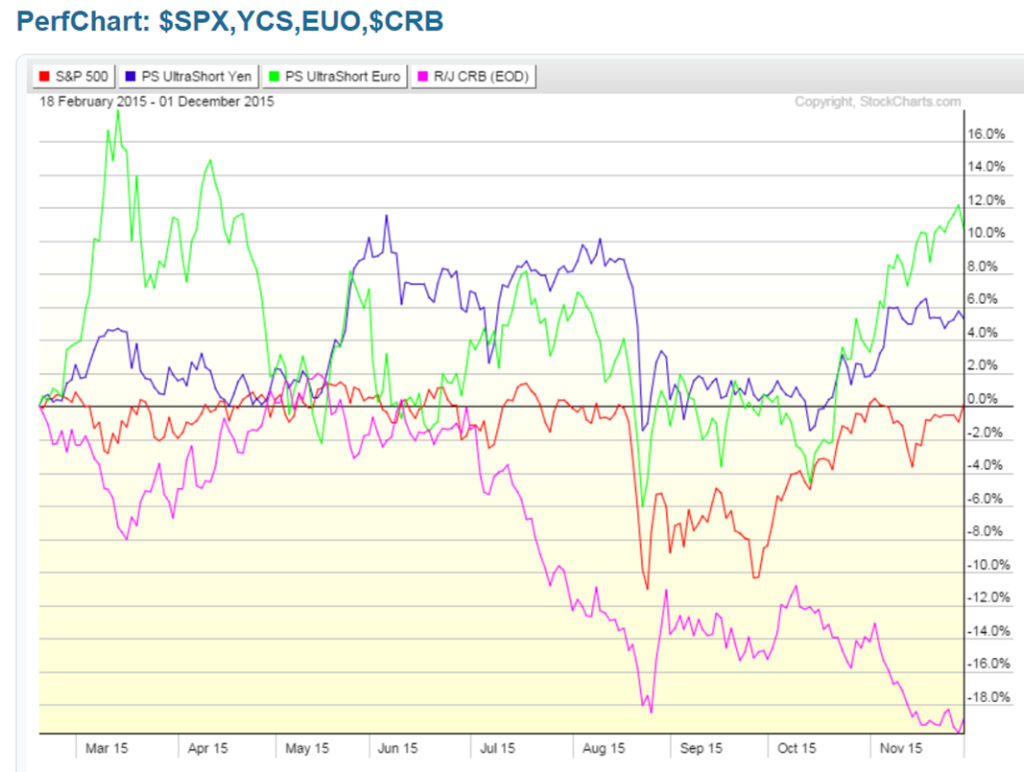

After today’s speech, the odds favor the “Fed 2% Target” outcome, which will result in more of the same. Meaning, the US Dollar will continue to outperform global currencies, and I will continue yell laughing at commodities as they crash, see below:

Most big research firms have suggested that equities are only in for modest single digit gains in 2016. As you can see in the chart above, the S&P 500 is stuck in the middle of what’s happening to currencies and commodities worldwide. Therefore, if you plan on outperforming in 2016 – I think you need more currency exposure.

So Here’s the Trade:

Part 1: If the Fed narrative is hawkish and they lay out their path to a 2% target, go long the following currency ETF’s:

- ProShares UltraShort Yen (YCS)

- ProShares UltraShort Euro (EUO)

Part 2: Go short your favorite commodity exposed countries via some of the following ETF’s:

- Russia (RSX)

- India (INDY)

- Canada (EWC)

- S. Africa (EZA)

- Chile (ECH)

- Brazil (EWZ)

- China (FXI)

Part 1 or Part 2 will work on it’s own, but both parts paired together will work very well – especially if worldwide growth continues to slow down throughout 2016.

If you’d prefer more direct commodity exposure, I have recommended shorting ConocoPhillips (COP), and Anadarko Petroleum (APC), here and here. I still like those ideas and for full disclosure I am still in those positions.

If you enjoy the content at iBankCoin, please follow us on Twitter

Really good work

Great post

More great insight and investment advice. At what level on the USD do you think the Fed attempts to “talk it down”?

I don’t think they are targeting a specific US dollar level per se. It’s complicated, the game of jawboning and confidence is more art that science. They’ve communicated for months now of a rate hike and they have to go through with it (or we will lose confidence in their messaging).

To answer your question, I don’t think they will talk it down. However, there is a risk that their hawkish policy will lead to (or it’s unavoidable to begin with) economic deceleration – in which case, the dollar should weaken. At that point though, every central bank on the planet will probably have easy money policies and it’ll be a race to the bottom. At that point it’s anyone’s guess who the relative winner will be (probably gold).

Best thing I have read this week!