I’d Rather Die Than Trade Bad

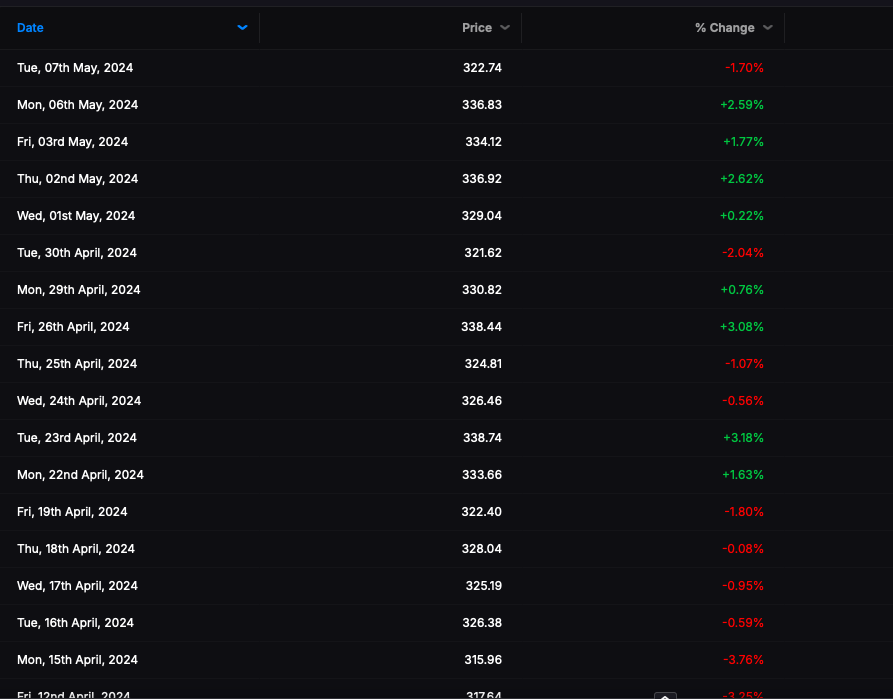

Another session and another closed at my session lows, down 57bps. This is getting sort of ridiculous, as I grasp in desperation for anything to rescue me for whatever fucking stupidity I am trapped in. I see no matrix, no lines of code. This must be how you people feel all of the time and it’s horrible. If markets were like this all the time I’d never trade. I’d rather die a horrible death than come to work and have to endure this. Seriously, death would be a reward over drawing down 57bps in a flat and slow tape.

My last loss was in a fucking African stock, lost $2k in 30mins in $JMIA. My bags were literally stolen by African savages into the bell, looted.

I even bought $GME back, only to see it immediately trade lower. It’s almost as if a dark fucking cloud filled with nothing but lightening bolts is following me around and whenever I make a move, it strikes down at me. I’ve been hit with so many bolts the past week, I feel like my fucking brains are cooked.

I finished another day fully long and eagerly await another GAP LOWER in the morning. I had driven my losses from down 55bps at the open to green and then watched it slowly drip lower, 5bps here, 10bps there, into a down 20bps close to cap off my day.

It really is the worst. It’s hard for me to express my feelings, other than to compare me losing like this to let’s say Babe Ruth going to bat and striking out 30 times in a row without a single homer. I am not accustomed to mediocrity and always took pride in the fact that I was exceptional when it came to this. I could fuck up any number of things but if you placed me in front of a trading turret I’d crush. And now even that is gone.

I swear to fucking everything holy, things better change around here soon.

Comments »