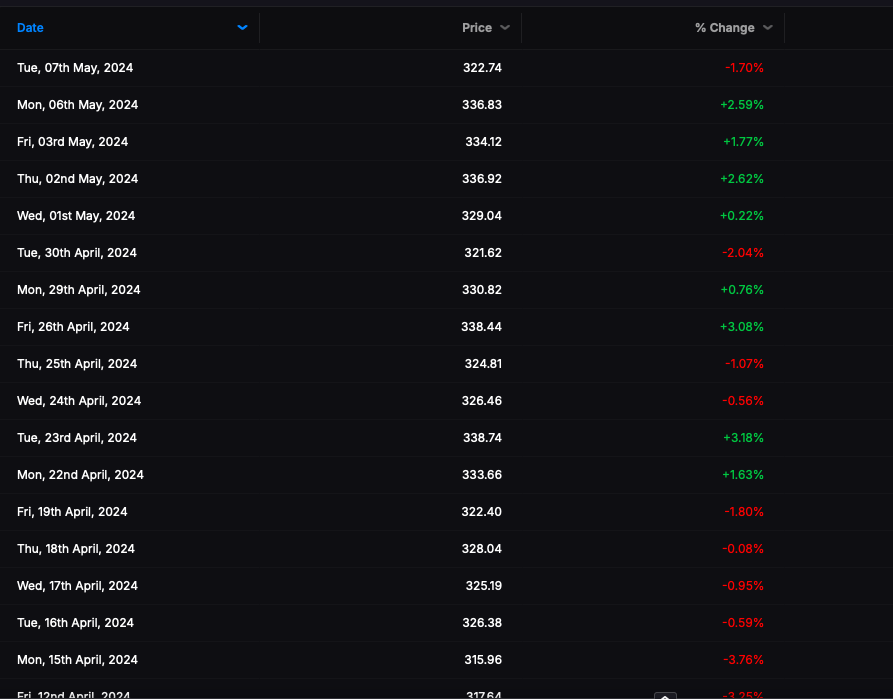

I etched out a rather mundane and constant win of +77bps today, with very little variance in my win/loss range. I am mostly allocated into gentleman in a pastoral setting type of stocks, men of industry of extreme means and measures.

I must admit to missing out on the $GME run, having sold it this morning due to it being beneath my station. In my chat room, Stocklabs, all of the plebs tripped over themselves to buy it into the afternoon, hoping to spice up their pathetic lives with some verve. I simply looked at these fools without an emotion coursing through my body thinking “what fools they are. They do not know what they do.”

I am certain a GIGANTIC dilutive secondary will fold them all like cheap tents in a wind storm, racking them with losses that will last a generation. Their premise behind the idea was to “buy into the dream”, akin to smoking opium in a Chinese whorehouse thinking about starting a Fortune 500 company.

Some people might feel a sense of FOMO when gazing into a stock soaring higher without you, especially since I was so into it just a short while ago. But you have to understand the level of professionalism that I operate on and could never lower myself to cheaply adorned denizen both gauche and depraved in a room decorated with yellow wood, zebra rugs, and leopard blankets.

At any rate, I sense that I am back and because of this, fuck you.

Good day.

Comments »