Comments »PARIS/FRANKFURT (Reuters) – France is prepared to switch allegiance from Spain to Luxembourg in the battle for a seat on the Executive Board of the European Central Bank, according to diplomatic sources, an appointment that would tilt the balance towards anti-inflation traditionalists.

Spain, Luxembourg and Slovenia are in a three-horse race to replace Jose Manuel Gonzalez-Paramo when the Spaniard leaves the ECB at the end of May.

Since the ECB flooded banks with cheap money for a second time last week, some of its policymakers led by Bundesbank chief Jens Weidmann have expressed alarm that the dramatic loosening of lending policy will fuel imbalances in the euro zone and stoke inflationary pressures.

The ECB hawks’ bargaining position could be further bolstered if Luxembourg’s central bank chief, Yves Mersch, wins the race.

French President Nicolas Sarkozy backed Spain to keep its seat on the ECB board before Madrid put forward the ECB’s top lawyer Antonio Sainz de Vicuna as its candidate.

Since then the veteran Mersch, who has one of the strictest anti-inflation stances among ECB policymakers, has entered the race for the post which manages the ECB’s day-to-day business.

Sources said France was now backing him rather than Sainz de Vicuna as part of a grand deal on top jobs at European institutions, which could see France bag the European Bank for Reconstruction and Development.

ECB board members are chosen by euro zone governments rather than the central bank itself. A decision may be made as soon as Monday at a meeting of euro zone finance ministers before being rubber stamped by heads of government at a later date.

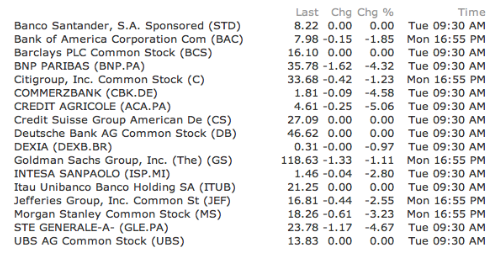

FLASH: European Banks Are Getting Crushed

GDP Shrank 0.3% in the Fourth Quarter for the Euro Zone as Exports Fall

“Europe’s economy contracted in the fourth quarter as investment declined by the most since 2009 and exports and consumer spending dropped.

Gross domestic product shrank 0.3 percent from the third quarter, the European Union’s statistics office said today, confirming an estimate published on Feb. 15. Exports fell 0.4 percent after a 1.4 percent gain in the previous three months, while household spending declined 0.4 percent and investment dropped 0.7 percent.

While Europe is facing its second recession in less than three years, the economy shows “tentative signs of stabilization,” European Central Bank President Mario Draghi has said. ECB efforts to pump cash into the economy have helped ease concern about a credit crunch and won governments time to agree on measures to contain the debt crisis.

“The region is still facing major headwinds, notably including increased fiscal tightening in many countries and markedly rising unemployment,” said Howard Archer, chief European economist at IHS Global Insight in London. “Despite some recent overall improvement in euro zone surveys and evidence that Germany is returning to growth, we doubt that the euro zone will be able to avoid further contraction in the first quarter of 2012 and very possibly the second.’”

Comments »World Markets Fall on Growth Concerns; Copper, Oil, & Spanish Bonds Lead the Way Down

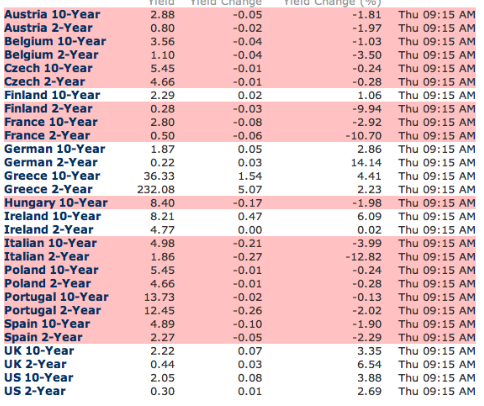

Portuguese Bond Yields Rise 2% in Less Than Two Weeks

Alternate explanations to China’s lower growth

Read here:

Comments »The news is very straightforward. China will cut its target for economic growth this year to 7.5% from the 8% goal that’s been in place since 2005, Premier Wen Jiabao told the annual meeting of the National People’s Congress today.

But what does it mean?

Financial markets have decided that a lower-growth target means China’s leadership is forecasting lower growth. That conclusion is one reason that stock markets were down around the world Monday — from a 1.4% drop in Hong Kong’s Hang Seng Index to a 0.8% decline in the German DAX to a 0.6% slide in the S&P 500 ($INX -0.39%) Monday afternoon. (China’s GDP climbed by 8.9% in the fourth quarter of 2011 and by 9.2% for the full year. That was down from the 10.4% growth in 2010.)

But I think the market’s conclusion doesn’t fit well with all the other policy statements that accompanied the setting of a lower growth target.

First, Wen did not change any of the previous language about economic and monetary policy. The government will maintain a “proactive” budget policy and a “prudent” monetary policy. Nothing there to indicate any change in course tied to the 7.5% target.

Second, the government’s announced growth policies were actually slightly less pro-growth than expected. The money supply target was set at 14% — slightly below the median forecast of 15% among economists surveyed by Bloomberg. The growth target for fixed-asset investment was set at 16%. That’s below the 18% forecast by economists. Coming in with targets for less stimulus than forecast certainly isn’t what you’d expect if China’s leaders were indeed worried about a hard landing for the country’s economy.

Third, the heads of China’s big state-controlled banks are still talking about growth in new loans similar for 2012 to that in 2011 and about further reductions in the bank reserve ratio by the People’s Bank. Here again this is business as usual.

Maybe the big banks haven’t read the memo sent down from Beijing.

Or maybe the change in the target doesn’t mean what the markets have decided it means.

I can think of two alternative explanations.

Alternative explanation #1: Cutting the growth target to 7.5% is an insurance policy for the new leaders that will start taking over the reins in October. Hey, if after setting the growth target at 7.5%, it comes in at 8% or 8.5%, then the new leadership takes office riding a wave of economic success. Think of the new target, then, as an attempt to lower expectations.

Alternative explanation #2: The lower target has nothing to do with any actual forecast for China’s economic growth in 2012. Instead it’s a sign to local leaders that they have more leeway to implement needed economic reforms without getting a black mark on their records if growth doesn’t meet the previous 8% target.

China’s leaders — or apparently a majority of the current nine-man Politburo at least — have spent the last year talking about the need to rebalance China’s economy. The goal would be an economy less dependent on exports and spending on fixed assets such as real estate and infrastructure and more dependent on growth in the consumer sector.

The big problem with that plan — especially if you’re a local leader accustomed to being graded on hitting Beijing’s growth target — is that implementing the new plan is risky. Local leaders know how to generate numbers under the current economic model that show 8% or better growth. But hit the target while shifting to model based on growth in consumer spending? Exactly how do you do that?

By lowering the goal to 7.5%, Beijing gives local leaders more room for error — and that should encourage them, the thinking in Beijing might go, to implement the new policies.

How do investors decide which of these three explanations is correct?

I think we’ll get a good indicator when China announces consumer price inflation for February. Along with cutting the growth target for 2012 to 7.5% from 8.0%, the government also kept its inflation target for 2012 set at 4%.

On the surface, keeping that target at 4% would seem to tie the hands of the People’s Bank on further reductions in the bank-reserve ratio and a first cut in its benchmark interest rate. After all, inflation climbed back to 4.5% in January, putting a halt to months of steady decline from the July peak at 6.5%. If inflation is headed back up, or even if it’s stuck at 4.5%, the central bank won’t be able to do very much to stimulate the economy. You’d think, then, that if China’s leaders were worried about economic growth in 2012 that they’d have cut the bank some slack by raising the inflation target.

But many economists have noted that the January inflation number was distorted by the early Lunar New Year holiday. They’re expecting that the official data to be released on Friday will show that inflation has dropped back in February to 3.4% or so. That would give the People’s Bank plenty of room to stimulate the economy even with a 4% inflation target.

Of course, Beijing’s leaders already know what Friday’s announcement will say. If the inflation number comes in significantly below January’s 4.5% — and especially if it comes in below 4% — I think that’s a sign that China’s leaders think they’ve got plenty of tools for making sure that growth doesn’t slow more than they desire. And that the 7.5% target isn’t a signal of a hard landing in China but of confidence that the country’s economy has enough momentum to tackle the rebalancing that it needs for the long run.

Market slips as China revises growth downward

Comments »NEW YORK (Reuters) – Stocks fell on Monday for the second straight session and the third in the last four trading days, led lower by basic materials shares after China trimmed its growth target for 2012.

The S&P 500 index opened lower and data showing the U.S. services sector expanded in February at its fastest pace in a year did little to stem the decline.

The benchmark S&P 500 is up 8.5 percent so far this year on investor expectations for a recovery in the U.S. economy, a containment of the euro zone’s debt crisis and the belief that China will avoid a hard landing in its current economic cycle.

China, the world’s second-largest economy, lowered its 2012 growth target to an eight-year low of 7.5 percent and made expanding consumer demand its top priority, as Beijing looks to shrink the economy’s reliance on external spending and foreign capital.

“That spooked everybody this morning. It started over in Asia, flowed right to Europe and flowed right over here,” said Ken Polcari, managing director at ICAP Equities in New York.

“The fact is they are guiding a little bit lower to control their inflation. It is not necessarily the end of the world, but it gave people a reason to take some money off the table.”

Materials shares, sensitive to signs of slowing in China’s commodity-hungry economy, dropped and were the biggest drag on Wall Street. The S&P materials sector index (REU:GSPMI) fell 1.6 percent, with Freeport McMoRan Copper & Gold Inc (NYS:FCX) off 3.8 percent at $40.45.

The Dow Jones industrial average (DJI:DJI) shed 14.76 points, or 0.11 percent, to 12,962.81 at the close. The Standard & Poor’s 500 Index (MXP:SPX) dipped 5.30 points, or 0.39 percent, to 1,364.33. The Nasdaq Composite Index (NAS:COMP) lost 25.71 points, or 0.86 percent, to close at 2,950.48.

During the session, the S&P 500 briefly dipped below its 14-day moving average – a line it has held for the last 50 sessions in an impressive run.

NETANYAHU TO OBAMA: ISRAEL ‘RESERVES THE RIGHT’ TO STRIKE IRAN

Iceland Attempts to Put Forth the First Criminal Case on a World Leader Over the Financial Crisis

The IIF on a Greek Default: “It is difficult to add all these contingent liabilities up with any degree of precision, although it is hard to see how they would not exceed €1 trillion.”

It is Clear European Banks are Hoarding ECB Cash; Economy Will Suffer

Slow Cars Sales in China Mark the First Consumer Slowdown in Many Years

China Sets The Mood for Global Trade With a Negative GDP Revision

“China pared the nation’s economic growth target to 7.5 percent from an 8 percent goal in place since 2005, a signal that leaders are determined to cut reliance on exports and capital spendingin favor of consumption.

Officials will also aim for inflation of about 4 percent this year, unchanged from the 2011 goal, according to a state- of-the-nation speech that Premier Wen Jiabao delivered to about 3,000 lawmakers at the annual meeting of the National People’s Congress in Beijing today…”

Comments »BREAKING: PUTIN WINS PRESIDENCY, AGAIN

BECOMING CHINA’S BITCH: China to Boost Military Spending 11.2% This Year

By Chris Buckley

BEIJING | Sat Mar 3, 2012 11:14pm EST

(Reuters) – China will boost military spending by 11.2 percent this year, the government said on Sunday, unveiling Beijing’s first defense budget since President Barack Obama launched a “pivot” to reinforce U.S. influence across the Asia-Pacific.

The rise was announced by Li Zhaoxing, the spokesman for China’s parliament, and will bring official spending on the People’s Liberation Army to 670.2 billion yuan ($110 billion) for 2012, after a 12.7 percent increase last year and a nearly unbroken string of double-digit rises across over two decades.

“China is committed to the path of peaceful development and follows a defensive national defense policy,” Li told a news conference ahead of the annual session of the National People’s Congress, the Communist Party-controlled parliament that will approve the budget.

“China has 1.3 billion people, we have a large territory and a long coast line but our defense spending is relatively low compared with other major countries,” he added, in comments carried live on state television.

Beijing’s public budget is widely thought to undercount real spending on its rapid military modernization, which has unnerved Asian neighbors and drawn repeated calls from Washington for China to share more about its intentions.

The Pentagon’s budget, however, still far exceeds the PLA’s, something China likes to point out.

“China’s defense spending as a share of GDP in 2011 was only 1.28 percent. For the United States, Britain and other countries the figures all exceeded two percent,” Li said.

“China’s limited military strength is aimed at safeguarding sovereignty, national security and territorial integrity. It will not pose a threat at all to other countries.”

Obama has sought to reassure Asian allies that the United States will stay a key player in the area, and the Pentagon has said it will “rebalance toward the Asia-Pacific region.”

China has sought to balance long-standing wariness about U.S. moves with a desire for steady relations with Washington, especially as both governments focus on domestic politics this year, when Obama faces a re-election fight and China’s ruling Communist Party undergoes a leadership handover.

Comments »The 9th Wonder of the World: Central Banks to Invest Currency Reserves In U.S. Equities

The Euro Finance Minister Approves EFSF Bailout for Greece

“Euro-area finance ministers authorized the European Financial Stability Facility to issue bonds for the Greek debt swap.

“Ministers authorize the issuance by EFSF of bonds to finance the euro area’s contribution to the PSI exercise and the repayment of accrued interest on Greek government bonds,” Luxembourg’s Jean-Claude Juncker, who leads the group of euro- area finance ministers, said today in a statement.”

Comments »FLASH: Both Spanish and Italian Sovereign Bond Yields are BELOW 5%

Eurozone Manufacturing Contracts for a Seventh Consecutive Month

“(Reuters) – The euro zone’s manufacturing sector contracted for the seventh straight month in February, with factories in the bloc’s struggling indebted states facing some of the toughest conditions on record, a business survey showed on Thursday.

It looks increasingly possible that the 17-member euro zone is stuck in a mild recession, as new orders continued to fall and backlogs of work dry up, even in the region’s most healthy economy Germany.

Markit’s Eurozone Manufacturing Purchasing Managers’ Index (PMI) rose to 49.0 last month from January’s 48.8, in line with a flash reading but has now been below the 50 mark that divides growth from contraction since July.

“Whether the euro zone will sink back into recession in the first quarter remains highly uncertain. The periphery remains the major concern,” said Chris Williamson, chief economist at data provider Markit.

The data comes a day after the European Central Bank’s latest half-trillion euro cash injection into the euro zone’s banks.

The funds have helped stabilize sovereign bond markets in countries such as Italy and Spain but accompanying austerity programs appear to have delivered a further blow to growth….”

Comments »